At the recent 2024 Annual General Meeting of Thanglong GTC Joint Stock Company (ThanglongGTC), Mr. Nguyen Van Dung, representing the state-owned shareholder Hanoi Tourism Corporation (Hanoitourist), raised several outstanding issues for the Board of Management of Thanglong GTC to address this year. This included a proposal for the Company to divest its entire investment in the project’s owner at 15-17 Ngoc Khanh, Hanoi.

According to the state capital representative, the 15-17 Ngoc Khanh project has been stagnant for many years, with the electrical station constructed in violation of the planning regulations. Ba Dinh District has requested its dismantlement, but the issue remains unresolved. To safeguard and enhance the effectiveness of the Company’s capital utilization, Hanoitourist proposed a complete divestment of Thanglong GTC’s capital contribution in Pacific Thang Long Limited Company, the project’s owner at 15-17 Ngoc Khanh, in accordance with legal provisions and the resolutions of the Annual General Meeting.

The representative of Thanglong GTC’s Board of Directors expressed their willingness to accept Hanoitourist’s suggestions and assured that they would direct the Company’s Board of Management to resolve the pending tasks and issues.

A “diamond” land project stagnant for over a decade

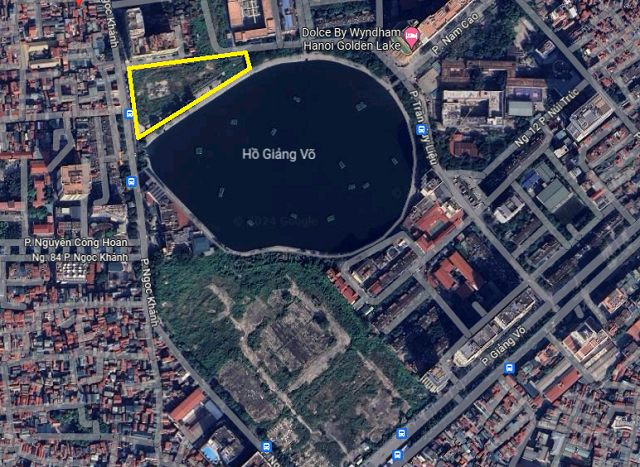

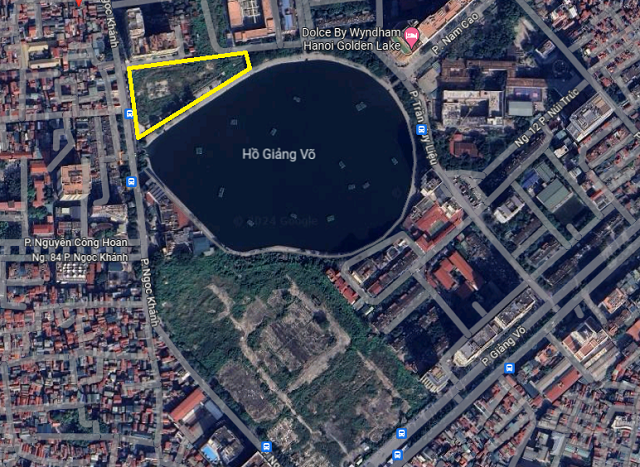

The 15-17 Ngoc Khanh project, also known as the Giang Vo Complex, is located by the Giang Vo lake, and is considered one of the “diamond” land lots in Ba Dinh District. It was licensed in 2007 with an initial investment scale of 70 million USD. Pacific Thang Long Limited Company, a joint venture established in the same year to implement the project, had Thanglong GTC contributing 29%, equivalent to 4.93 million USD (approximately over 93.3 billion VND), while Janakpup Limited (Ireland) contributed 71%, equivalent to 246 billion VND.

The Giang Vo Complex covers an area of 19,942m2. Zone 1 has an area of 5,800m2 and comprises three apartment buildings with residents. Zone 2 spans 14,143m2, including 360m2 designated for the electrical station and generators of the apartment complex, and the remaining area is adjacent to the Giang Vo lake (with a 2,077m2 lakeside walkway) intended for phase 2 constructions.

Location of the Giang Vo Complex. Image: Google Maps

|

Three apartment buildings in Zone 1 of the project and the surrounding wall in Zone 2. Image: Tienphong

|

Thanglong GTC shared that at the time of equitization (2015), the Company had contributed capital to the joint venture based on the value of the “special right to exploit 12,066m2 of land and the cost of compensating assets on the land” of this “diamond” project. The assessed value of the investment at equitization was nearly VND 105 billion, an increase of VND 11.4 billion compared to the initial value, meaning that each square meter of land and assets thereon cost less than VND 8.7 million/m2. However, with the skyrocketing land prices nowadays, the land use rights of the project are surely worth several times more than the value at the time of equitization a decade ago.

According to the 2024 land use plan of Ba Dinh District, the project has been granted Decision No. 5340/QD-UBND dated December 29, 2022, on the extension of land use for 24 months.

Thanglong GTC has a charter capital of VND 1,228 billion. Hanoitourist holds 45.19%, Thung Lung Vua Joint Stock Company holds 27.03%, and Commercial and Tourism Corporation Ngoc Anh (in the same ecosystem as Thung Lung Vua) holds 27.445%, while the remaining 0.34% is held by other shareholders. The company’s chairwoman is Ms. Nguyen Thi Nga, who is also the chairwoman of BRG Group.

In 2023, Thanglong GTC achieved revenue from sales of over VND 32 billion, mainly from real estate leasing. Financial revenue exceeded VND 104 billion, including interest income of over VND 21.4 billion, dividend income of nearly VND 79 billion, and revenue from BigC Thang Long of VND 3.6 billion. Post-tax profit stood at VND 102.5 billion. For 2024, the company set a total revenue target of over VND 32 billion.

Giang Vo Complex Project Perspective

|

What sets the foreign director of Pacific Thang Long apart?

Mr. Ole Bollingtoft, the Danish-born General Director of Pacific Thang Long, is a millionaire. He also serves as the General Director of Hon Thi Stone Mining Joint Stock Company (with 81% foreign ownership) and Pacific Land Vietnam Joint Stock Company (wholly foreign-owned).

Pacific Land Vietnam is the investor in the billion-dollar HaBiotech project in the high-tech biological zone in Hanoi’s Bac Tu Liem District. The projected investment is 250 million USD for technical infrastructure and a number of service constructions, high-rise apartments, and dormitories (without housing for families), and 800 million USD for specialized equipment such as laboratory, center, research institute, and university facilities…

Last August, the People’s Committee of Bac Tu Liem District had a working session with Pacific Land Vietnam regarding the promotion of the project’s implementation. Mr. Ole Bollingtoft shared that the project was facing difficulties and obstacles that required coordination with central ministries, sectors, and the city and district authorities. The company hoped to continue receiving support from the district in legal assistance to facilitate the project’s early implementation.

HaBiotech is a key project for Hanoi, with the People’s Committee of Bac Tu Liem District as the investor in charge of creating a clean land fund for project implementation using the state budget. To establish the construction land fund, the project involved site clearance of approximately 200 hectares in Lien Mac, Tay Tuu, Minh Khai, Co Nhue 2, and Thuy Phuong wards, as per Decision No. 4918/QD-UBND dated December 10, 2007, of the Hanoi People’s Committee.

The HaBiotech project received its investment certificate in 2008 but had to undergo planning adjustments following the merger of Ha Tay province and Hanoi and changes in planning laws. As a result, the investment preparation procedures remain incomplete, and site clearance faces challenges due to the large budget requirement and prolonged process.

Mr. Ole Bollingtoft. Image: People’s Committee of Bac Tu Liem District, Hanoi

|

Thu Minh