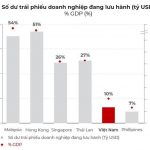

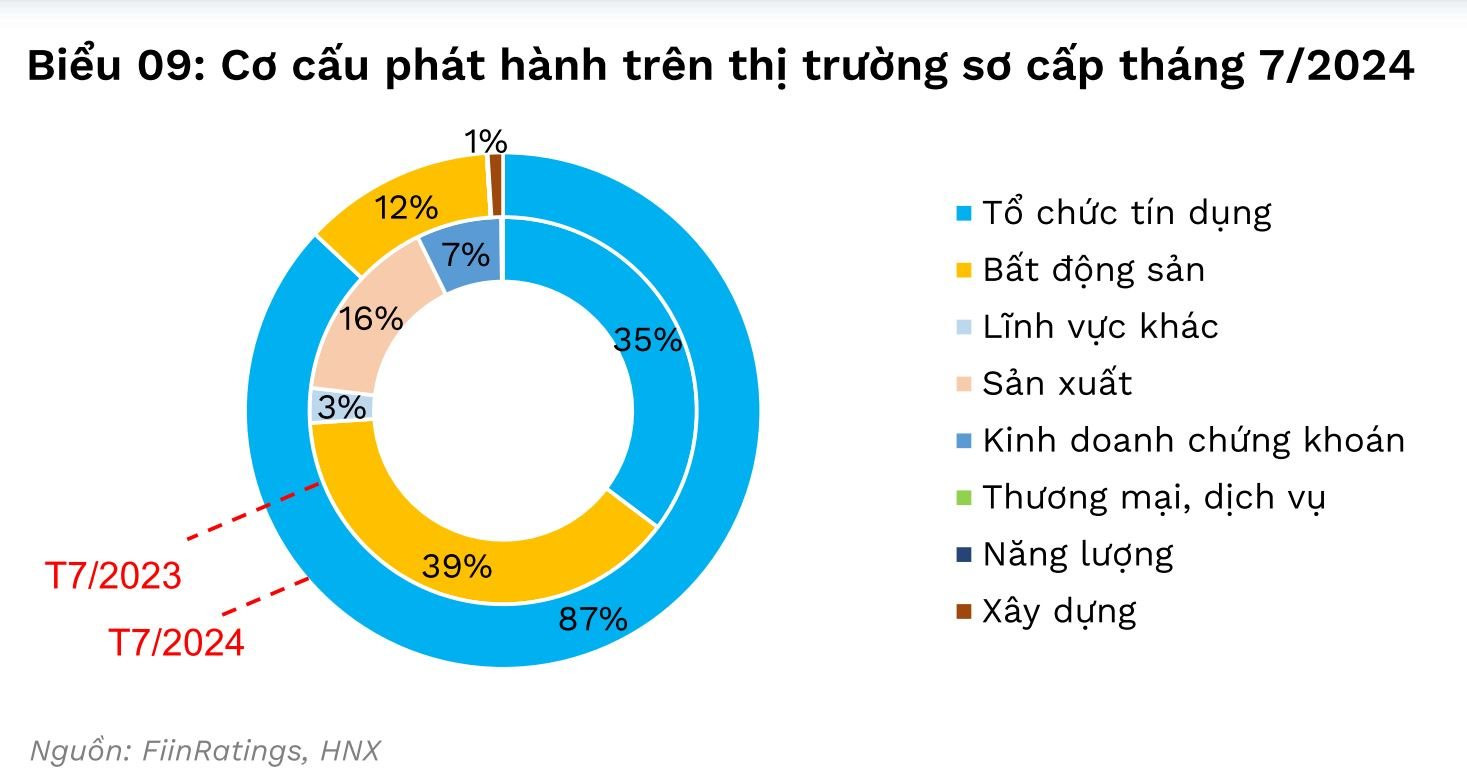

The latest report on the bond market by the enterprise credit rating agency FiinRatings reveals that commercial banks dominated the primary market with an issuance value of over VND 27 trillion in July 2024, accounting for 87% of the total value.

New bond issuances remain concentrated in the 3-year and over-5-year tenors to bolster the medium to long-term capital of banks that have not been able to increase their charter capital.

Meanwhile, the real estate sector’s bond issuance activities remained subdued, with only 3 issuances recorded in July 2024, totaling VND 3.8 trillion.

For the first 7 months of 2024, the total issuance value reached VND 178.5 trillion, a 57% increase compared to the same period last year. However, the value of non-bank bonds decreased by 32%.

Bond buyback activities in July 2024 reached nearly VND 32.1 trillion (up 26.1% from the previous month). Banks continued to be the main buyers, accounting for 90% of the value in the month.

According to FiinRatings, many banks have approved bond issuance plans to supplement Tier 2 capital in the second half of 2024 and the first half of 2025.

In the secondary market, in July 2024, the trading value of private placement bonds reached VND 89.1 trillion, a decrease of over 15% from the previous month due to higher liquidity in the bank bond group in June. The real estate and banking sectors still accounted for the majority of transactions, with trading values decreasing by 55% and 17%, respectively.

In terms of trading yields in the secondary market, bank bond yields remained stable at 5-8%, while non-bank enterprise bond yields ranged from 7-13%.

For the first 7 months of 2024, the total issuance value reached VND 178.5 trillion, a 57% increase year-on-year. However, the value of non-bank bonds decreased by 32%. In terms of issuance structure by industry, credit institutions remained the main issuers, accounting for 87% of the total value. Notable issuers among large banks in the past month include MBBank (VND 10 trillion), Vietinbank (VND 5 trillion), and SHB (VND 3 trillion).

The tenors of the bonds issued by credit institutions were concentrated in the 3-year tenor for private banks and over 5 years for state-owned banks. To meet the credit growth that accelerated in June while charter capital remained unchanged, credit institutions need to continue strengthening medium to long-term capital sources by issuing bonds with tenors of over 3 years.

Meanwhile, the real estate sector’s bond issuance activities remained subdued, with only 3 issuances recorded in July, totaling VND 3.8 trillion, the lowest since March. The largest real estate bond issuer was Hai Dang Real Estate Company, with a 1.5-year bond valued at nearly VND 3 trillion.

Positive Prospects Driven by Macroeconomic Factors

According to FiinRatings, the acceleration of credit growth in June signals an improvement in capital absorption by the economy. In June alone, credit outstanding increased by 3.6%, higher than the growth rate of the previous five months combined.

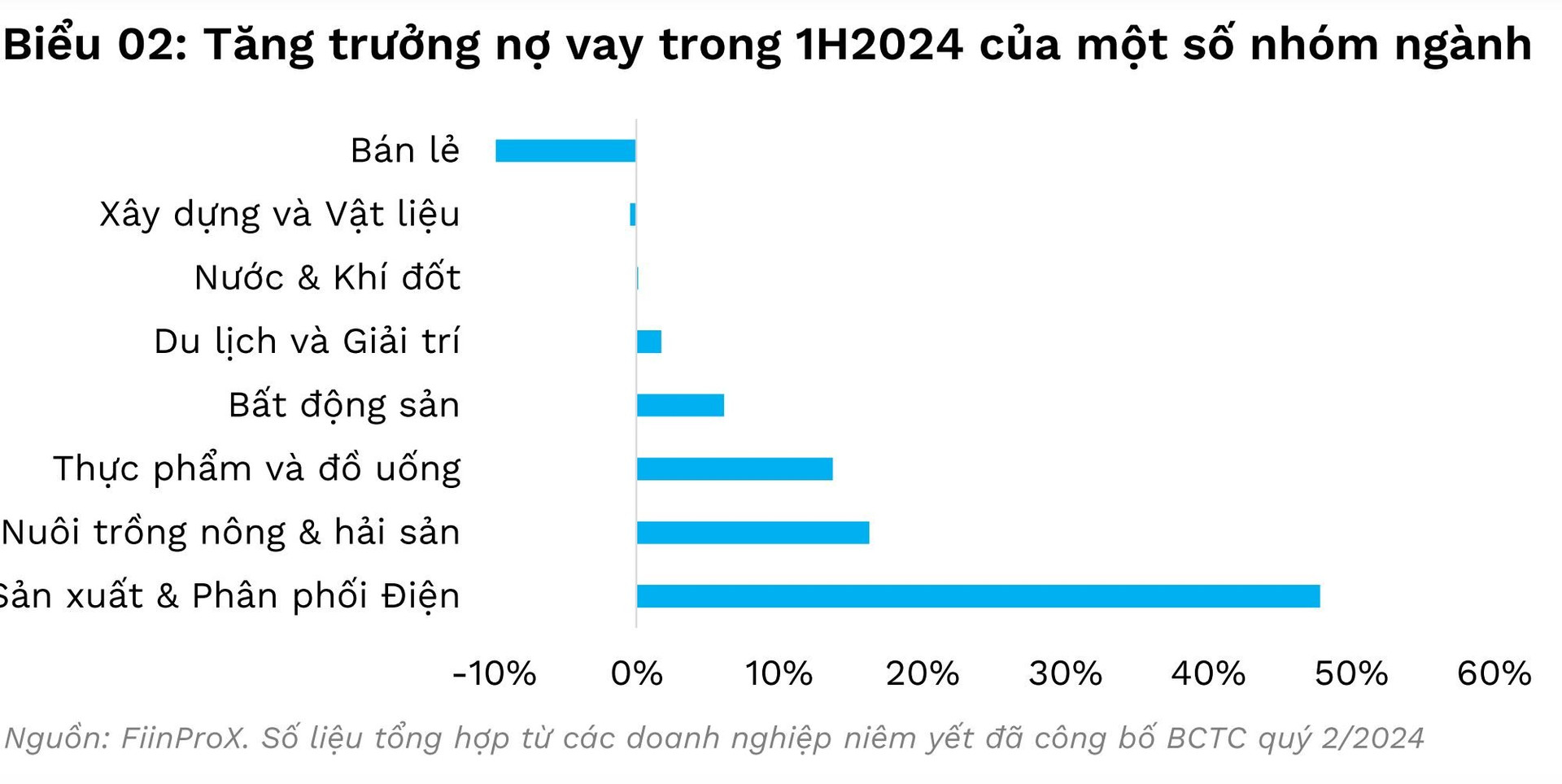

Financial data as of the end of Q2 2024 for listed companies showed significant debt growth in the real estate, aquaculture, and manufacturing sectors. In contrast, debt levels in service sectors such as retail and tourism remained unchanged or decreased slightly compared to the end of last year.

FiinRatings assessed that the SBV’s move to “warn” commercial banks about transferring credit growth quotas from banks that are not performing well to those with higher growth potential also contributed to the acceleration of credit growth in recent times. Additionally, the end of Q2 is the period when credit institutions accelerate disbursements to meet certain safety ratios set by the SBV.

The SBV’s coordination of credit growth quotas will make banks more proactive in finding customers and disbursing loans, creating momentum for credit growth in the coming months.

While the Q2 financial statements of banks showed that the balance of corporate bonds held continued to decrease due to the sluggish corporate bond market, the credit growth momentum will motivate banks to diversify their credit channels into the corporate bond market in the future. At the end of Q2 2024, corporate bonds accounted for only 1.3% of total credit outstanding at 29 commercial banks (compared to 2.2% at the end of 2022).

However, according to FiinRatings, as capital absorption by enterprises improves in the coming months, corporate bond investment activities will be more active as enterprises fully utilize their loan limits at commercial banks, thereby boosting the corporate bond market.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.