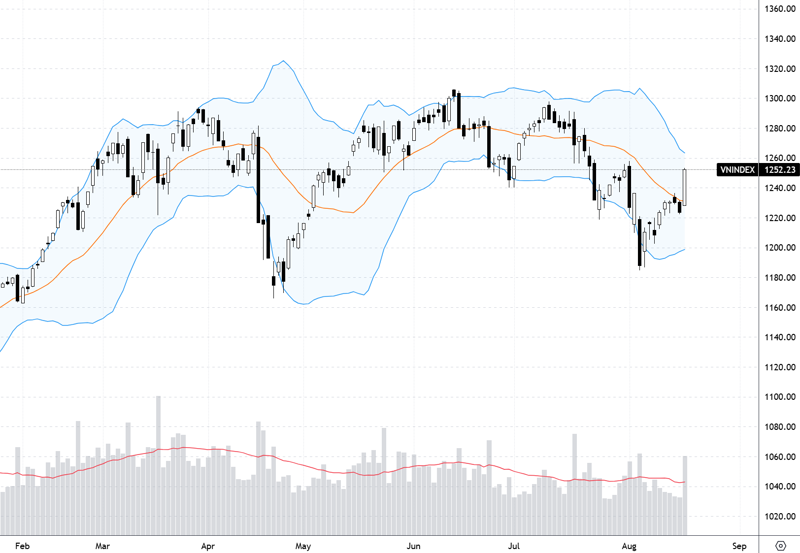

The rapid pace of the market after VN-Index surpassed the MA20 threshold pushed the index closer to the historic peak of 1,300 points. The last two sessions of the week saw a slower increase, more fluctuations, and a higher number of stocks in the red compared to those in the green, along with a significant drop in trading volume.

The polarization in the market aligns with the differing opinions among experts interviewed by VnEconomy. There are currently two contrasting viewpoints. One side believes that the market has reached a short-term peak in the current recovery and is likely to adjust and accumulate within a 30-50 point range. The other perspective suggests that the market is experiencing short-term profit-taking without a strong downward trend, as if waiting for supportive information, and is merely taking a brief break before the next breakthrough. The change in pre-funding margin requirements is considered a positive factor at this time.

It is deemed normal for the market to face increased selling pressure around the 1,300-point peak and a decrease in proactive buying interest. Bottom-fishing investors with good profits will be inclined to sell, but the pressure only slightly increased over the last two days of the week, and the final session even managed to recover towards the end. The decline in stock prices is mainly attributed to weakening buying power.

Although there is a divergence of opinions on whether the market has peaked, the experts unanimously suggest that investors should restructure their portfolios at this sensitive juncture. Short-term stocks that have surged can be sold to lock in profits, while long-term holdings can be maintained for observation, and additional purchases can be considered during price dips.

Nguyen Hoang – VnEconomy

The strong gains last week pushed the VN-Index towards the historic peak of around 1,300 points. However, as the index climbed higher, liquidity weakened, trading volume dropped significantly, and more stocks underwent adjustments. In your opinion, does this indicate a lack of market strength, or is it merely a consequence of typical short-term profit-taking?

I assess that there is a high probability the VN-Index will form a short-term peak in this recovery phase at the current level, and the market is likely to undergo an adjustment of 30-50 points.

Nguyen Viet Quang

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In this recovery phase, the VN-Index has rebounded by over 100 points from the bottom without any distinct corrective sessions (only one corrective session so far) and has entered a strong resistance zone around 1,295 points (a selling pressure zone as many investors still hold stocks in this range). Therefore, as the index reaches this level, there will be a lack of proactive buying interest from investors, coupled with profit-taking selling pressure from investors who bought at lower price levels, causing the VN-Index to stall.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The market continued to gain positively last week, with only minor adjustments in the last two sessions but quickly recovered thereafter. Looking at the chart, it is evident that as the index climbed higher, liquidity gradually decreased, which is understandable as the market has recovered rapidly in a V-shape without any clear corrective phases. As the index approaches the previous peak, buying interest at higher prices will be cautious, leading to a decline in trading volume, while profit-taking pressure will gradually emerge, causing the market to stall in this zone.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

I believe that the market slowdown and the increased occurrence of fluctuating sessions as it approaches the 1,300-point peak are largely influenced by short-term profit-taking sentiments. The market’s liquidity has somewhat decreased as the index rises into higher zones, reflecting investors’ prudence in the absence of supportive news. However, I don’t think we can conclude that the market is lacking in buying power, as liquidity remains around the 20-session average, and capital is rotating among sectors, supporting the overall index.

Le Duc Khanh – Analysis Director, VPS Securities

Trading at previous peak zones often involves a more cautious buying sentiment, while selling pressure increases for some stocks that have risen significantly during the strong recovery week. Technical adjustments when the VN-Index returns to the old peak zone of around 1,280-1,290 points are understandable. Such fluctuations may occur early next week before the VN-Index rises to around the 1,300-point mark. The trading week also witnessed a positive recovery for many key stock groups, such as the finance-banking group and the VN30 stocks.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

Since breaking through the 1,200-point threshold in early August, the VN-Index has regained its upward momentum impressively, approaching the 1,300-point level in 3 weeks. The positive semi-annual business results of domestic enterprises have significantly supported this recovery. However, as the VN-Index nears the 1,300-point mark, investors tend to secure profits and become cautious when the market enters an information trough, with the season for announcing business results ending and shareholder meetings concluding…

Nguyen Hoang – VnEconomy

The banking stocks that led the VN-Index’s upward trend last week proved unsustainable, performing worse towards the week’s end. Other large-cap stocks like VHM, VIC, HPG, FPT, and GAS are also facing challenges. Is this the short-term peak of the current recovery?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The index’s positive increase last week was largely contributed by the banking group. From my observations, there has been gradual polarization as mid-cap stocks started to show signs of adjustment, while the banking group and large-cap stocks continued to rise, supporting the index points. As large-cap stocks encounter pressure, the market is likely to undergo a short-term adjustment. Investors should pay attention to this possibility as the index approaches the resistance zone around the previous peak of 1,300 points.

Le Duc Khanh – Analysis Director, VPS Securities

After consecutive recoveries, the market will need some “rest” sessions, including fluctuating sessions. I think the opportunity for the VN-Index to return to the old peak and break through will occur from next week to early September. Large-cap stocks will attract capital and perform well in the coming period as the upward trend is still being confirmed.

I don’t think we can conclude that the market is lacking in buying power, as liquidity remains around the 20-session average, and capital is rotating among sectors, supporting the overall index.

Nghiem Sy Tien

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

The market’s and stocks’ recovery pace has been rapid and strong, with most stocks rebounding to strong resistance zones. Therefore, it is understandable that the upward momentum has stalled or adjusted. Given the current market conditions, I assess a high probability that the VN-Index will form a short-term peak in this recovery phase and that the market is likely to undergo an adjustment of 30-50 points.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

As the VN-Index approached the 1,300-point mark, investors’ capital disbursement slowed, but the selling pressure was not strong enough to force a decisive sell-off. The hesitation on both sides indicates market expectations that there won’t be a significant drop when reaching the historical peak and that investors are awaiting supportive information rather than selling decisively. In my opinion, this level could be the short-term peak of the current recovery, but the VN-Index is likely to accumulate and strive to conquer the 1,300-point mark.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my view, it is too early to conclude that the VN-Index has formed a short-term peak in this recovery phase, especially since the index had one trading session with a long lower shadow candle accompanied by maintained liquidity in the final session. Capital remains in the market, rotating among sectors and supporting the overall market condition. In a stable macroeconomic context, this trend may continue in the coming period until a leading stock group emerges, propelling the index to break through the current resistance level.

Nguyen Hoang – VnEconomy

Securities stocks started to increase towards the end of last week, anticipating the removal of the prefunding hurdle. What impact do you foresee if new regulations are issued? Will it immediately boost foreign capital liquidity, and will the market react strongly to this supportive information?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In my opinion, the news about removing the prefunding hurdle will not immediately increase foreign capital liquidity. This regulation makes the Vietnamese market more attractive to foreign investors and will boost investment in the long run. As this information has been mentioned multiple times, I assess that the market will not react strongly, as evident in the final session, where, despite the news, only a few securities stocks rose by nearly 3%, while most stocks showed slight gains, and the number of declining stocks still dominated.

I think the index could be the short-term peak of the current recovery, but the VN-Index is likely to accumulate and strive to conquer the 1,300-point mark.

Le Minh Nguyen

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The prefunding requirement is a critical factor in the Vietnamese stock market’s upgrade process. In an optimistic scenario, if the prefunding issue is resolved soon and acknowledged by FTSE in the upcoming review in late September, the Vietnamese stock market will be notified of the upgrade. The official upgrade process will occur a year later, in the September 2025 review. We believe that foreign capital will actively flow into the Vietnamese stock market in anticipation of the upgrade amid easing pressure on exchange rates.

However, it is essential to note that foreign investors will consider various other factors besides the upgrade story, especially profit prospects, foreign ownership limits, and policy rate developments in their home countries. Additionally, as foreign investors have consistently sold for over a year, their proportion in the Vietnamese market has significantly decreased. Therefore, PHS believes that the main driver for market growth will still depend on domestic capital, and in the short term, information related to prefunding regulation amendments will positively impact investor sentiment.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

The news about removing the prefunding hurdle has invigorated the market, and the rise in securities stocks has boosted the overall market sentiment, rescuing the VN-Index from a declining final session. While we cannot affirm that this information will immediately drive the market up, it is likely to warm up market liquidity if the regulations are approved.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

I assess that the news about removing the prefunding hurdle will significantly impact investors’ expectations, especially for the securities group, which is expected to benefit the most from the market upgrade. Regarding expectations, the new regulations may positively impact foreign capital flow. However, it will take time to test the implementation and evaluate the actual results, so the initial scale may not be large enough to immediately affect the foreign capital flow trend.

In an optimistic scenario, if the prefunding issue is resolved soon and acknowledged by FTSE in the upcoming review in late September, the Vietnamese stock market will be notified of the upgrade.

Nguyen Thi My Lien

Le Duc Khanh – Analysis Director, VPS Securities

I think foreign capital may be activated in the last two weeks of September, coinciding with the “review” period for ETF portfolios. Improved investor sentiment may make September the first month of net buying by foreign investors after consecutive months of net selling.

Nguyen Hoang – VnEconomy

Last week, you also opined that the market would struggle to break through the peak in the short term. So, what should investors do now? Should they take profits and wait for a price drop to buy again, or should they continue to hold? Have you reduced your stock holdings yet?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

In the current phase, investors holding stocks that have rebounded to strong resistance zones should consider reducing their positions by around 30% (depending on individual risk appetite) to prepare for buying opportunities during corrective dips. For stocks with new capital inflows that have not reached strong resistance zones, investors can continue to hold. Last week, I proactively reduced my positions in stocks that hit strong resistance to have buying power if the market undergoes adjustments.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

At this point, I think investors should maintain a balanced portfolio. If they hold many stocks and use leverage, they can partially take profits to bring their portfolio to a moderate level and alleviate psychological pressure when fluctuations occur as the index approaches the old peak of 1,300 points.

For portfolios with reasonable positions and positive expectations for the current holdings, investors can continue to hold and await the upcoming trend. Regarding my personal portfolio, I still hold 50% in stocks and await further market developments.