The VN-Index struggled to stay afloat today, despite a boost in global stock markets following the Fed’s interest rate hike. While other markets rallied, the VN-Index faced a selling onslaught, closing 5.30 points lower at 1,280 points with 259 declining stocks outweighing 148 gainers.

The financial sector shone today, fueled by anticipated regulatory reforms that could elevate Vietnam’s market status according to FTSE. Real estate also rose by 0.48%, led by VIN Group’s VHM, VIC, and VRE, collectively propping up the index by nearly 2 points.

On the flip side, residential real estate took a hit, along with banking, insurance, materials, and telecommunications sectors. Heavyweights like VNM, MSN, FPT, VCB, PNJ, CTG, and BID dragged the market lower.

A surge in selling pressure late in the session pushed total trading value across the three exchanges to nearly VND 20,000 billion. Foreign investors offloaded VND 419.2 billion net, with a net sell of VND 374.5 billion in matched transactions.

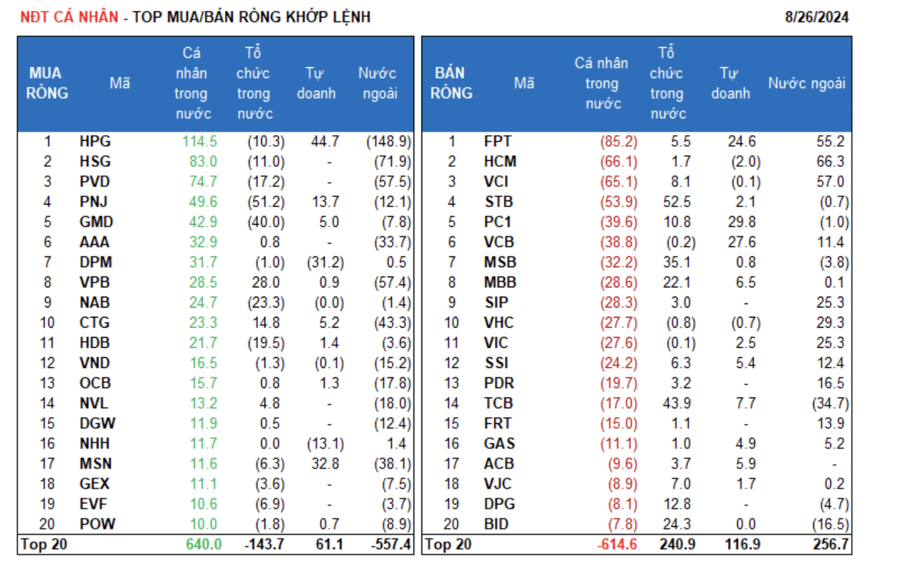

Financial services and information technology attracted foreign interest, with HCM, VCI, FPT, FUEVFVND, VHC, SIP, VIC, PDR, and FRT among the top buys. On the other hand, they sold basic resources stocks, including HPG, HSG, PVD, VPB, CTG, TCB, AAA, and VHM.

Individual investors bought a net VND 78.9 billion, with a net buy of VND 137.6 billion in matched transactions. They focused on basic resources, with HPG, HSG, PVD, PNJ, GMD, AAA, and DPM among their top purchases. On the selling side, they offloaded financial services and information technology stocks, including FPT, HCM, VCI, STB, and PC1.

Proprietary trading accounts bought a net VND 208.8 billion, with a net buy of VND 200 billion in matched transactions. These accounts targeted banking and food & beverage sectors, buying heavyweights like HPG, MSN, PC1, VCB, FPT, and VNM. They sold chemical stocks, with DPM, NHH, and FUEVFVND among their top sells.

Domestic institutions bought a net VND 102.3 billion, with a net buy of VND 36.9 billion in matched transactions. They sold consumer goods stocks, including PNJ, GMD, and FUEVFVND. On the buying side, they targeted banking stocks like STB, TCB, and MSB.

Block trading today amounted to VND 1,918.1 billion, a 29.8% decrease from the previous Friday, contributing 9.5% of the total trading value. Notable transactions included domestic individuals trading in banking stocks (MSB, TCB, NAB) and VIC, MSN, and KOS.

Looking at matched transactions, money flow allocation increased for large-cap stocks in the VN30 index but decreased for mid-cap (VNMID) and small-cap (VNSML) stocks.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.