In a recent announcement, QHW revealed that its upcoming dividend payout will be distributed at a rate of 12%, meaning that shareholders will receive VND 1,200 per share. With nearly 8 million shares currently in circulation, QHW is estimated to disburse approximately VND 9.6 billion for this dividend round. The ex-dividend date is set for September 6, 2024, and payments are expected to be made on September 20, 2024.

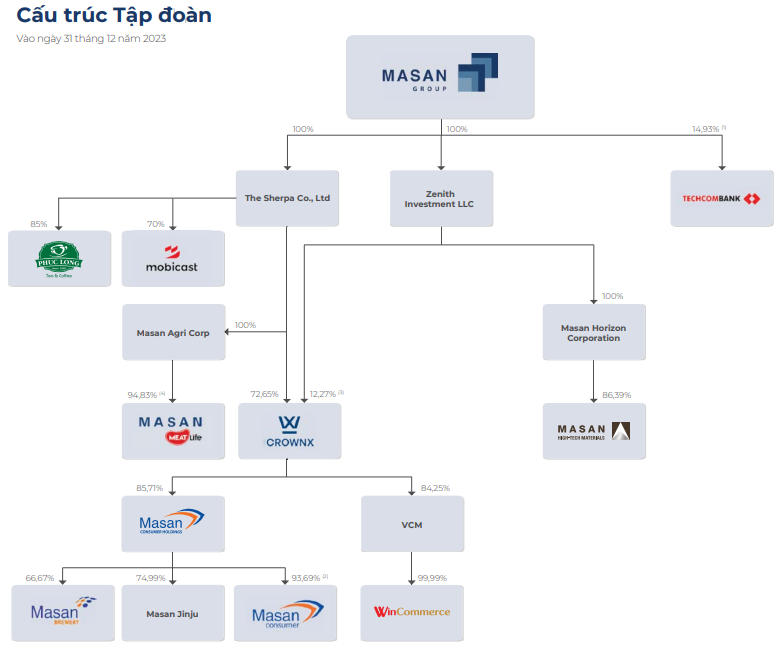

QHW is known for its strong association with the Masan ecosystem. Specifically, Masan Beverage Company Limited is the direct parent company of QHW, holding 65.85% of its capital, and is therefore poised to collect approximately VND 6.3 billion in dividends from QHW.

Going further up the hierarchy, Masan Beverage is wholly owned by Masan Consumer Holdings (MCH), a key member of the Masan Group ecosystem.

Source: 2023 Annual Report of Masan Group

|

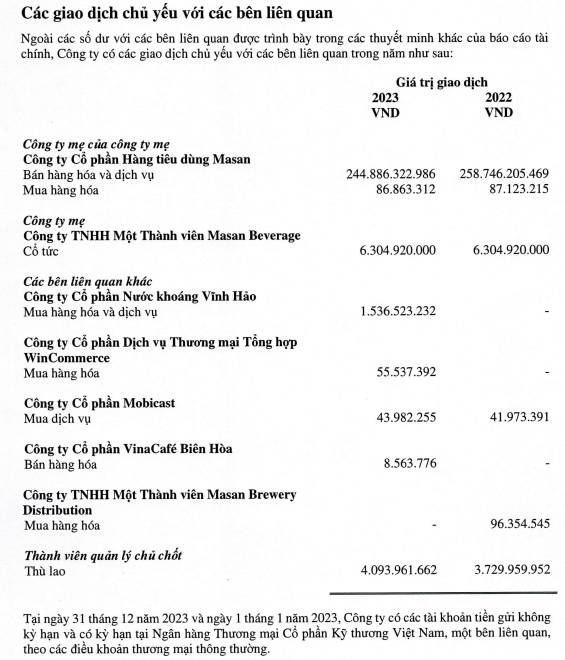

In recent years, QHW has consistently paid out annual dividends of VND 1,200 per share. Additionally, QHW has engaged in numerous transactions with companies within the Masan ecosystem, mostly involving sales of goods to Masan Consumer and dividends to Masan Beverage.

|

QHW’s consistent annual dividend of VND 1,200 per share

Source: VietstockFinance

|

Source: QHW’s 2023 Audited Financial Statements

|

With its investments spread across multiple companies listed on the stock exchange, the Masan ecosystem enjoys regular income streams from these dividend payouts.

Also on September 20, the Masan Group, in its role as an indirect parent company, will receive nearly VND 447 billion in dividends, corresponding to its 67.3% ownership stake in Vinacafé Bien Hoa Joint Stock Company (HOSE: VCF).

Many banks announce shareholder meetings and reveal dividend distribution plans

Up to this point, 10 banks have announced their annual general meeting plans for 2024 and dividend distribution plans, which have attracted the interest of shareholders.