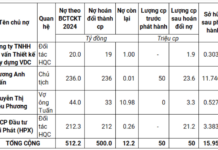

The first debt belongs to Ms. Vu Thi Lien, with a book value of nearly VND 9 billion by the end of May 2024, including nearly VND 3 billion in interest. The collateral is an apartment with a floor area of nearly 141 sq. m, bought and sold under a contract signed in December 2011 between Hoang Quan Industrial Park Real Estate Trading Services Joint Stock Company and Ms. Pham Thi Duyen. The starting price for this debt is VND 5.9 billion.

The second debt belongs to Ms. Pham Thi Huyen, with a book value of nearly VND 3.4 billion, including over VND 1.3 billion in interest. The collateral is an apartment with a floor area of 116.1 sq. m (the bank only has a photocopy of the apartment purchase contract, not the original). The starting price for this debt is VND 2 billion.

The third debt is owed by Ms. Nguyen Thi Thuy An, with a book value of VND 3.1 billion, of which over VND 1.1 billion is interest. The collateral is an apartment with a floor area of 140.6 sq. m. The starting price for this debt is nearly VND 2.2 billion.

The fourth debt is owed by Ms. Mai Thi Hong Thinh, with a book value of over VND 3.7 billion, including more than VND 1.4 billion in interest. The collateral is an apartment with a floor area of 140.6 sq. m. The starting price for this debt is nearly VND 2.4 billion.

The fifth debt is owed by Mr. Le Van Son, with a book value of over VND 3.9 billion, including nearly VND 1.5 billion in interest. The collateral is an apartment with a floor area of 140.6 sq. m (the bank only has a photocopy of the apartment purchase contract, not the original). The starting price for this debt is nearly VND 2.5 billion.

The sixth debt is owed by Ms. Bui Thi Hong Gam, with a book value of nearly VND 2.8 billion, including over VND 1.1 billion in interest. The collateral is an apartment with a floor area of 140.6 sq. m. The apartment purchase contract was signed in July 2013 between An Tam Construction Investment Company Limited and Ms. Bui Thi Hong Gam. The starting price for this debt is VND 2.1 billion.

Agribank stated that these debts have been overdue for many days and have been classified as non-performing due to the borrowers’ violation of their repayment obligations. The collateral for the debts has not been legally completed (still in the stage of sales contracts, ownership certificates have not been granted, and the assets have not been handed over to the buyers due to the project being constructed illegally and not yet completed).

Cherry Apartment project illustration. (Source: Hoang Quan Real Estate)

Previously, in July, Agribank Saigon Central Branch also announced the auction of collateral comprising 28 apartments in the Cherry Apartment project of An Tam Investment and Construction Company Limited. These apartments were purchased by An Tam from the project’s investor, Hoang Quan Real Estate Trading Services Joint Stock Company, in 2011.

The starting price for this auction was nearly VND 62 billion. Agribank stated that this debt has also been overdue for many days and has been classified as non-performing due to a violation of repayment obligations. The collateral has not been legally completed (still in the stage of sales contracts, ownership certificates have not been granted, and the assets have not been handed over to the buyers due to the project being constructed illegally and not yet completed)

According to our understanding, the Cherry Apartment project, developed by Hoang Quan Real Estate, comprises a 12-story apartment building with 99 units ranging from 76 sq. m to 140 sq. m in area. The total floor area is over 19,000 sq. m, and the total investment is VND 203 billion.

The project commenced construction of the foundation and basement in May 2010 and was expected to be handed over to customers in 2013. However, after nearly completing the structure, the project was halted, leading many customers to terminate their contracts.

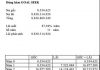

Vietnam Airlines sees promising results in its quest for financial balance

By the end of 2023, this business has incurred a total loss of over 5.8 trillion VND despite a 30% increase in revenue.