Two leading stocks, VIC and VHM, attempted to hold their ground to support the VN-Index this afternoon, but they couldn’t compensate for the weakness of the majority. Additionally, sharp declines in many large-cap stocks increased pressure on the index, forcing the VN-Index to post its most significant loss since the explosive trading session on August 16.

The HoSE’s representative index closed near the day’s low, shedding 5.3 points or 0.41%. This was partly salvaged by VHM’s 1.89% gain and VIC’s 1.44% increase, which together buoyed the index by nearly 1.4 points. VIC inched up slightly in the afternoon session compared to its morning close, while VHM remained unchanged.

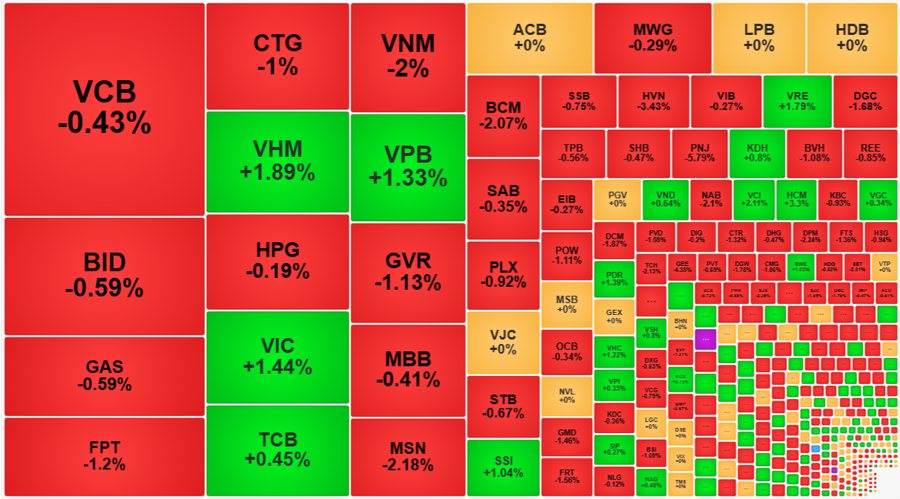

Apart from VIC, only HDB, SSB, and SSI showed improvement in the VN30 basket, with the rest declining compared to the morning session. The lower price level pulled the VN30-Index down by 0.19%, with a breadth of 6 gainers and 21 losers, a complete reversal from the morning session. Among the ten largest stocks by market capitalization, FPT fell by 1.2%, CTG by 1%, and VNM by 2%. This basket witnessed eight stocks erasing over 1% in value, with the deepest losses in MSN, which dropped by 2.18%, and BCM, which fell by 2.07%.

Not only blue-chips but also the overall price level of the HoSE weakened noticeably this afternoon. Firstly, in terms of breadth, while the index was in the red during the morning session, the number of gainers still outnumbered the losers. However, in the afternoon, decliners dominated with 259 losers versus 148 gainers (compared to 188 losers and 196 gainers in the morning). Secondly, there were only 52 stocks that fell by over 1% in the morning, but this number climbed to 104 in the afternoon. Thirdly, among the stocks that declined the most, many had high liquidity, and the total trading value of this group accounted for 31.1% of the exchange’s transactions.

These stocks experienced intense selling pressure, including blue-chips. MSN tumbled by 1.55% compared to its morning close, eventually closing 2.18% lower than its reference price. MSN also had the highest liquidity in the market during the afternoon session, with a trading value of 443.9 billion VND. Foreign investors offloaded this stock significantly, with net outflows reaching 38 billion VND, mostly in the afternoon session. PNJ also drew attention, falling by 2.66% at the morning close and ending the day down 5.79%, with substantial liquidity of 272.1 billion VND. A list of stocks that declined by over 2% with transactions of hundreds of billions of VND includes DPM, down 2.24% with a trading value of 152.5 billion; AAA, down 3.38% with 124.1 billion; TCH, down 2.13% with 118.3 billion; and CSV, down 2.3% with 105.9 billion.

The blue-chips’ inability to provide adequate support was one of the factors influencing the overall trading sentiment. Small- and mid-cap stocks, which had been performing the best recently, had already been facing profit-taking pressure. When the VN-Index started to fall more sharply due to the lack of support, these stocks encountered even greater pressure. While the market was weak today and there weren’t many stocks hitting the daily limit-down, nearly 50 stocks still fell by over 2%, and they all belonged to the small- and mid-cap category. During bullish or range-bound periods, low-liquidity stocks tend to benefit from easier price manipulation, but when the market weakens, this group also loses buying interest rapidly.

Today’s gainers included some strong performers, mainly driven by individual stock flows. The securities sector is a prime example, as the entire group exhibited mixed performance, with many stocks falling by over 1%. However, some securities stocks demonstrated resilience, such as HCM, which rose by 3.3%, VCI by 2.11%, SSI by 1.04%, TVS by 3.37%, CSI by 2.24%, and ORS by 1.53%. The real estate sector followed a similar pattern, with VIC, VHM, VRE, OCH, QCG, PDR, and KHG unable to represent the entire group, as the number of decliners outnumbered the gainers, and stocks falling by 2% to 4% were also quite common.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”