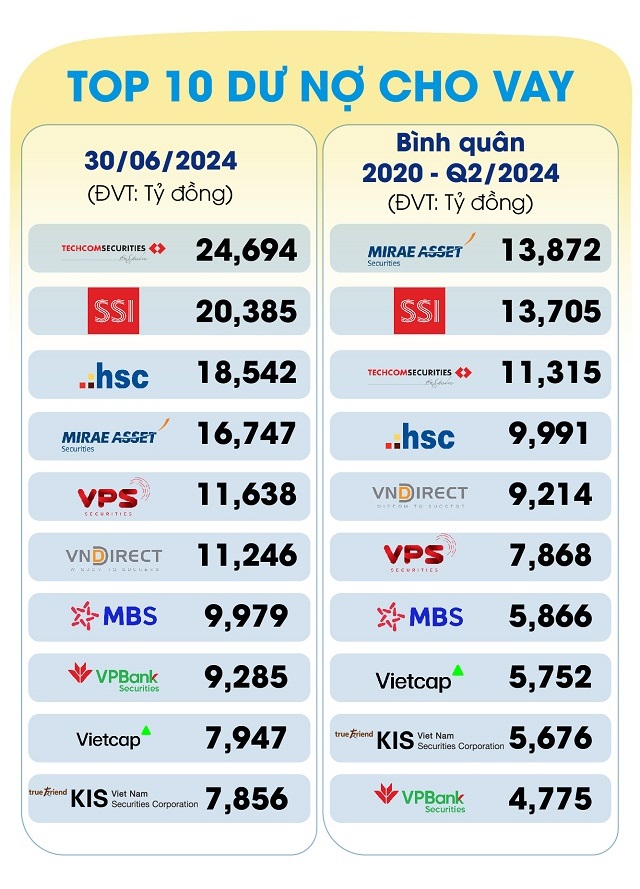

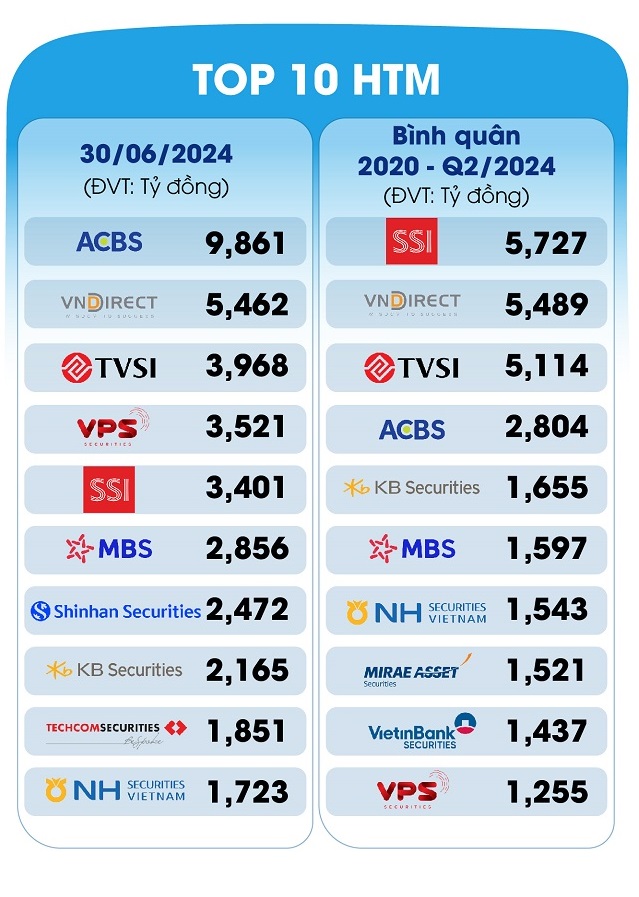

Diving into the specifics, financial assets (FVTPL, HTM, AFS), loans, and cash and cash equivalents make up the majority of securities companies’ asset structures due to the focus of this group on securities brokerage, margin lending, and proprietary stock trading. This proportion has been maintained at around 90% from 2022 to Q2 2024.

From a broader perspective, securities companies maintain a safe capital structure with a nearly 1:1 ratio of equity to debt.

Design: Tuan Tran