Vietnam credit rating agency, VIS Rating, has recently conducted seminars to share insights on its published bank credit ratings, outlook on the banking sector, and the application of credit ratings in bond investment activities.

VIS Rating’s seminars focused on providing in-depth analysis and insights into the factors influencing bank credit ratings, the outlook for the banking sector, and the practical applications of credit ratings in bond investment decisions.

Key Factors Driving the Credit Ratings

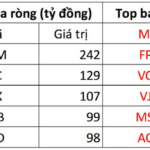

In the first half of 2024, VIS Rating assigned long-term issuer credit ratings to three mid-sized private banks in Vietnam: Tien Phong Commercial Joint Stock Bank (TPBank) (AA-), Orient Commercial Joint Stock Bank (OCB) (A+), and Loc Phat Commercial Joint Stock Bank (LPBank) (A+). All ratings were given with a stable outlook.

According to VIS Rating, TPBank demonstrated stronger standalone capacity compared to the other two banks, underpinned by its robust capital structure and profitability. TPBank’s successful adoption of digital transformation has expanded its customer base and core deposits, resulting in lower funding costs and higher return on average assets than the industry average. OCB’s strong capital position serves as a partial offset to its riskier asset profile.

The ratings of these three banks also reflect VIS Rating’s expectation of moderate government support, if needed. Government support is a unique factor considered in bank ratings compared to non-bank financial institutions and private corporations, given the critical role of banks in Vietnam’s economy and the potential systemic impact on the financial market and the broader economy in case of a bank failure.

Risks in the Banking Sector

One of the key risks highlighted in the seminars is governance and liquidity risk. This was evident in the mass deposit withdrawals and liquidity stress experienced by Saigon Commercial Joint Stock Bank (SCB) in 2022. Governance risk arises when individuals holding influential positions in the bank or its parent conglomerate exert control over the bank’s operations for personal gain.

These close linkages create operational risks and make the bank more vulnerable to problems within the larger conglomerate, impacting market sentiment and triggering mass deposit withdrawals. Additionally, Vietnamese banks rely heavily on short-term market funding, and their liquidity buffers are still limited in the face of liquidity shocks.

Domestic Credit Ratings for Determining Credit Risk Weights

Domestic bond market regulations in Vietnam require domestic credit ratings for all domestic bond transactions. The domestic credit rating scale offers a more nuanced assessment of credit quality with 21 rating levels, compared to less than 10 levels on the international scale after applying the sovereign rating cap for Vietnam. Current regulations allow banks to use domestic credit ratings to determine credit risk weights for claims on and debt securities issued by other credit institutions.

Bond Ratings Provide In-depth Information

Are issuer ratings sufficient for assessing bond investment risk? Issuer ratings reflect VIS Rating’s assessment of the issuer’s ability to meet its financial obligations. Bond investors are exposed to risks associated with the issuer as well as the specific bond they invest in. Bond ratings, which are assigned to individual bonds, take into account the risks associated with the bond’s structural features, such as third-party payment guarantees and the order of priority for bondholders in the event of default. Compared to issuer ratings, bond ratings provide more detailed information to investors for evaluating investment risks and pricing bonds accordingly.