Following two consecutive quarters of remarkable profit growth compared to the same period last year, Mobile World Investment Corporation (coded MWG) is expected to continue its upward trajectory with positive prospects. This is attributed to the recovery of The Gioi Di Dong/Dien May Xanh (TGDĐ/ĐMX) stores from a low base and the expansion of Bach Hoa Xanh (BHX) stores after breaking even.

KBSV Securities forecasts a slight recovery in the ICT&CE sector for MWG in the second half, bringing the total revenue of the TGDĐ/ĐMX chain in 2024 to VND 87,111 billion, up 3.5% year-on-year. This growth is driven by: (1) PMI surpassing 50 in Q2 2024; (2) Improved consumer spending due to minimum wage increases; and (3) The return of the replacement cycle for phones, laptops, and tablets towards the end of 2024.

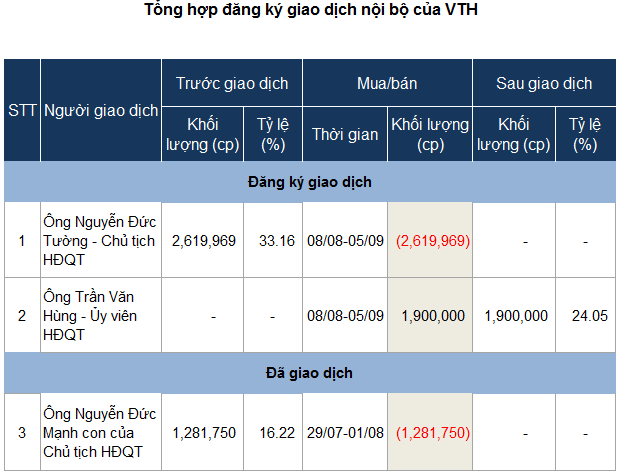

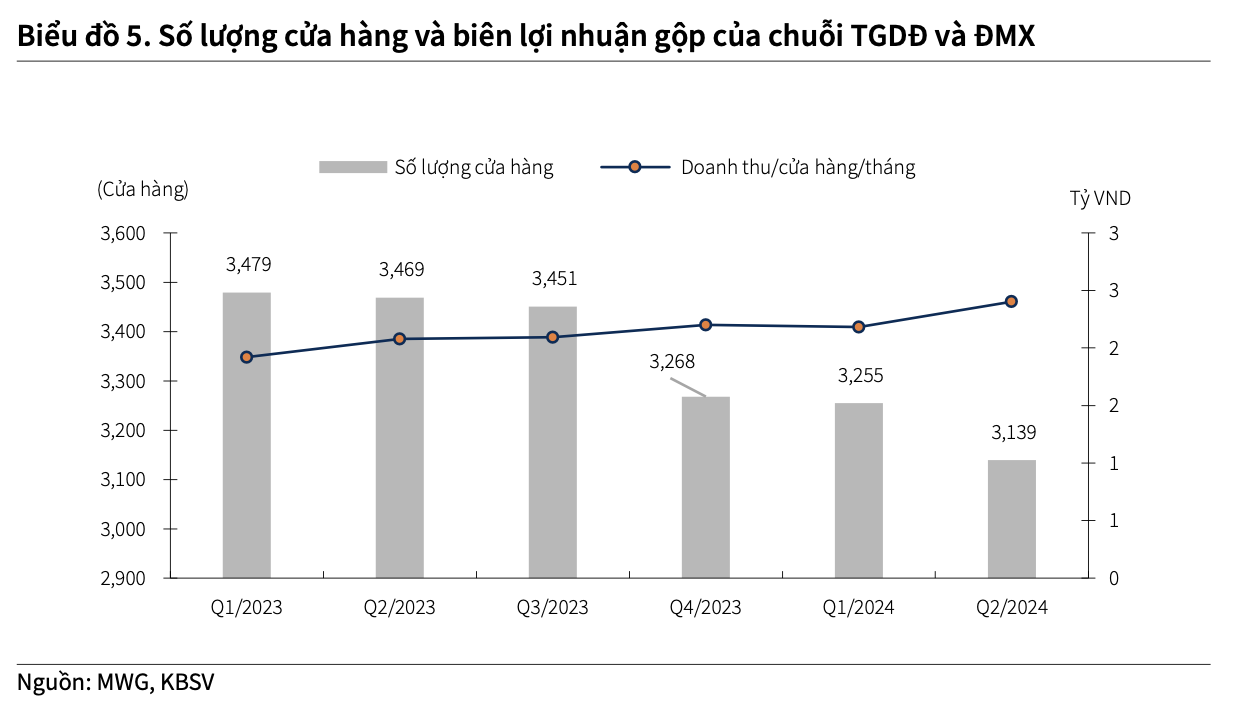

In the first seven months, TGDĐ closed 43 stores, while ĐMX shut down 150 stores. During the Q2 2024 investor meeting, MWG’s leadership stated that the company had essentially completed the closure of unprofitable TGDĐ and ĐMX stores. As a result, the average revenue per store per month for TGDĐ/ĐMX reached approximately VND 2.4 billion, a 20% increase compared to the same period last year.

KBSV predicts that the average revenue per store per month for the TGDĐ/ĐMX chains will remain at around VND 2.3 billion, with gross profit reaching VND 16,989 billion in 2024, representing a 20.9% year-on-year increase. This improvement is attributed to the effective restructuring strategy, with the phone segment expected to recover better than the appliance segment, which performed well in the first half.

Proven Success Formula for Bach Hoa Xanh

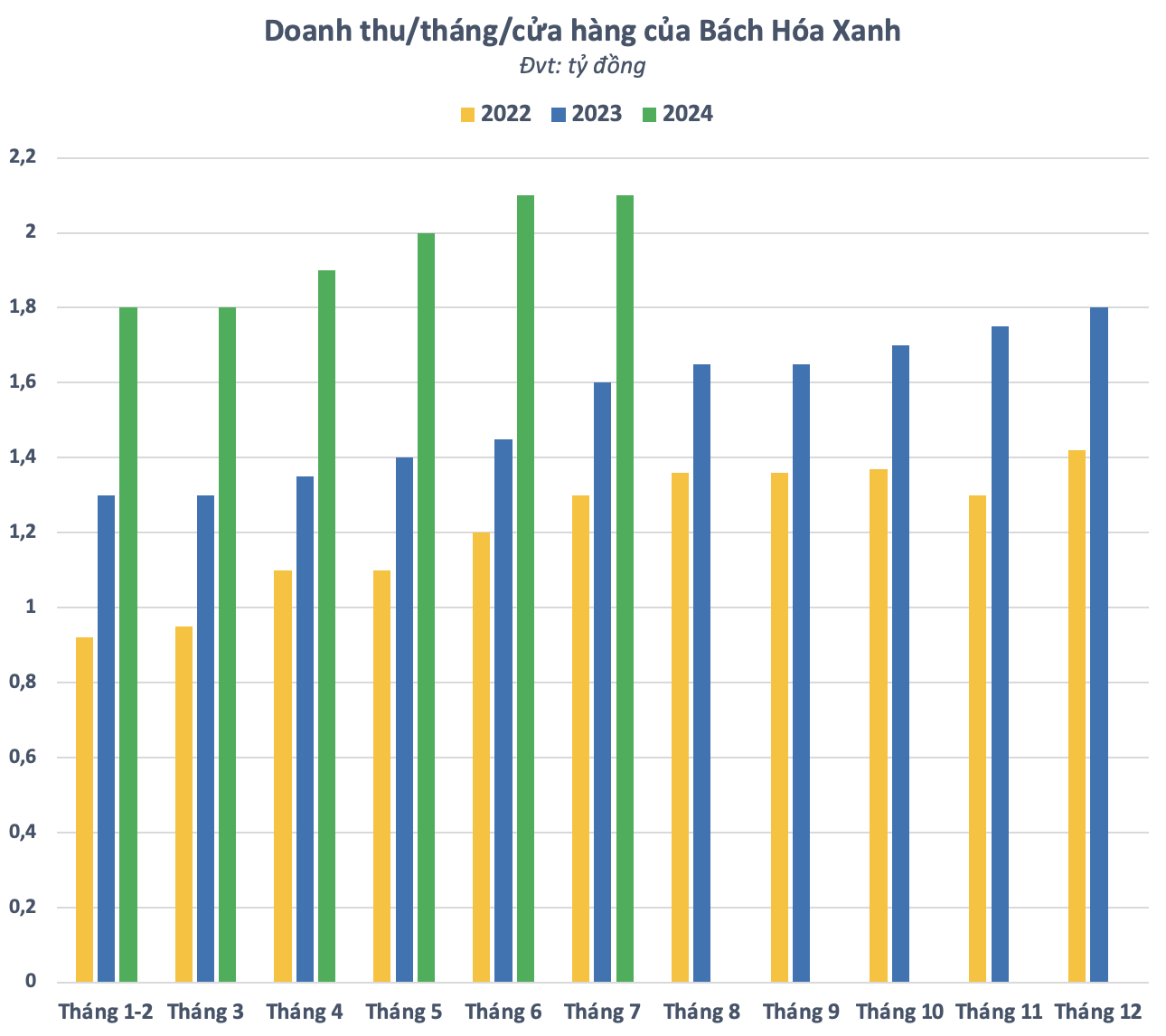

As the ICT&CE sector recovers, MWG receives good news as BHX turns a profit of nearly VND 7 billion in Q2. The average revenue per store reached VND 2.1 billion in June, a 44.8% increase compared to the same period in 2023, driven mainly by the fresh produce and FMCG categories. This positive trend continued into July.

This initially affirms the correctness of BHX’s restructuring strategy to transition to a mini-market model. KBSV estimates that BHX’s revenue in 2024 will grow by 31.8% year-on-year to VND 41,952 billion, with a net profit of VND 521 billion. This strategy prioritizes cost optimization per store and expanding the number of stores after achieving profitability.

In fact, BHX has ambitious expansion plans, aiming to open seven new stores in four provinces and cities: Ho Chi Minh City (3 stores), Long An (1 store), Binh Duong (1 store), and Dong Nai (2 stores) in the near future.

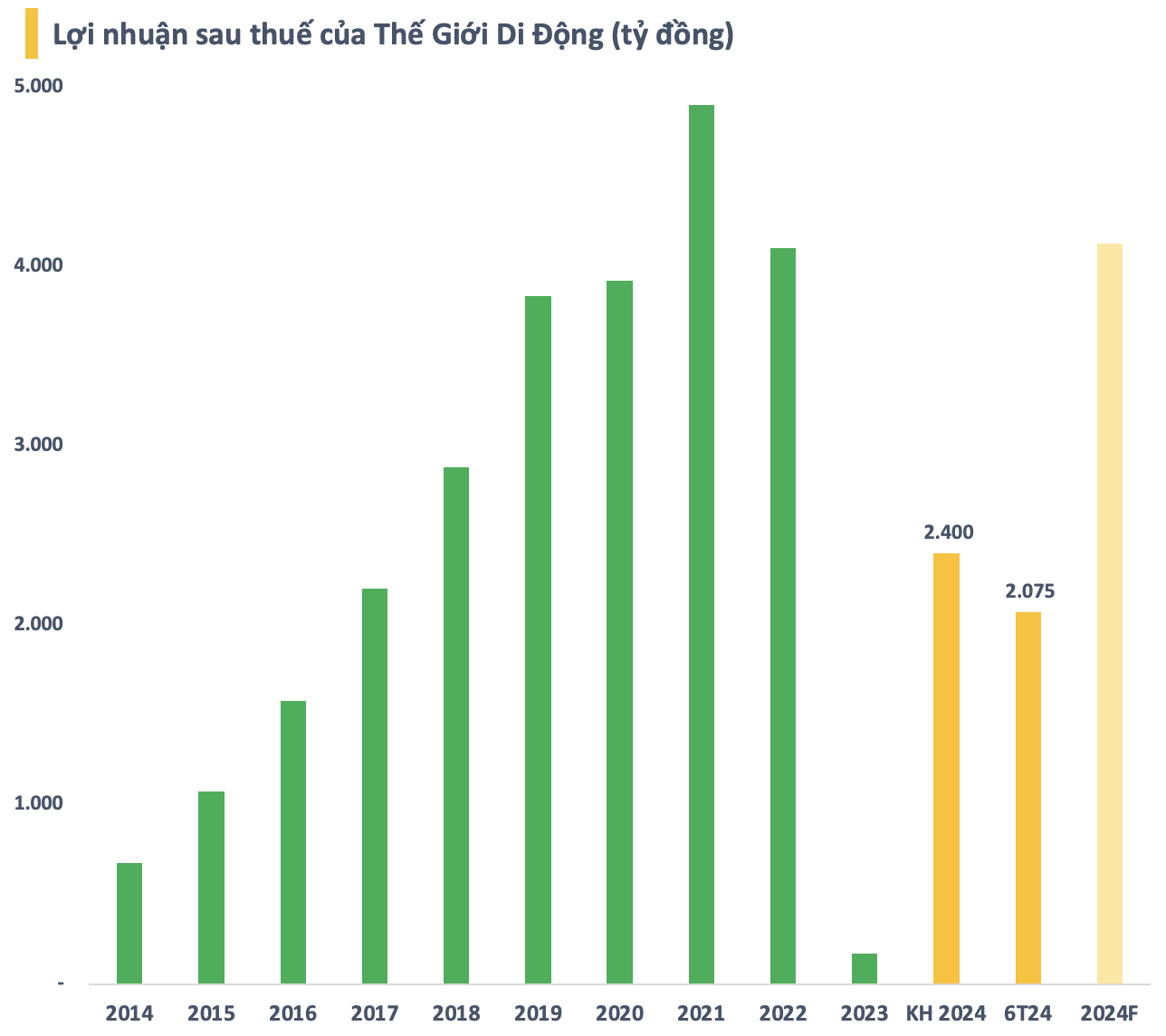

With BHX’s expansion and the recovery of the ICT&CE segment, KBSV projects MWG’s net revenue for 2024 to reach VND 133,964 billion, a 12.4% increase year-on-year. The net profit is estimated at VND 4,128 billion, a significant surge of 2,360% compared to 2023. While this figure is much higher than MWG’s plan, it is plausible considering the company has nearly completed its annual plan in the first half.

KBSV’s projected profit for MWG in 2024 is significantly higher than the company’s plan

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.