Real Estate Remains a Profitable Investment Avenue

As of 2024, the economy has witnessed a positive rebound following a period of fluctuations. According to statistics from the General Statistics Office of Vietnam, the GDP growth rate for the first half of 2024 reached 6.42%, a significant improvement compared to the same period in 2023.

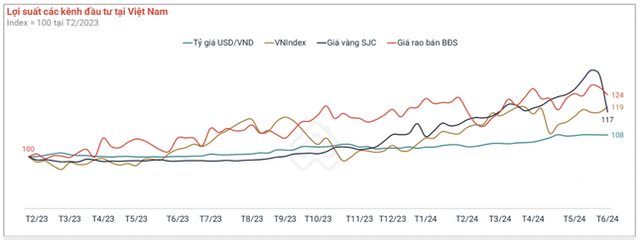

With the economy on an upward trajectory, the investment market has also regained its vibrancy, and a clear differentiation can be observed across various investment channels.

Bank savings, traditionally considered a safe haven, have lost their appeal due to declining interest rates that fail to keep up with inflation. As a result, investors are withdrawing their funds from banks and seeking more lucrative investment avenues.

According to Batdongsan.com.vn, most investment channels have shown positive signs compared to 2023. Stock prices have increased by 19%, SJC gold prices have gone up by 17%, and the USD exchange rate has risen by 8%. Notably, real estate stands out as the leading investment channel, with average asking prices in the first half of 2024 surging by 24% compared to the beginning of 2023.

Real estate leads in investment returns (Source: Batdongsan.com.vn)

In the second quarter alone, new real estate supply and market transactions increased threefold and 2.4 times, respectively, compared to the first quarter. This not only highlights the appeal of real estate as a strong investment channel but also reflects the market’s demand for quality projects.

Favorable Conditions Boost the Real Estate Market

Additionally, the Land Law 2024, Housing Law 2023, and Real Estate Business Law 2023, which came into effect on August 1st, are expected to have a significant impact on the real estate market, ensuring its healthy development.

By clearly defining the stages of a project, from preparation to completion and operation, these laws enhance transparency and provide a clear framework for real estate projects.

Notably, these laws are expected to address the market’s “hot button” issue of legal complications. In 2023, more than 1,200 projects faced legal hurdles, according to the Ministry of Construction. The new laws are anticipated to resolve these issues and boost the market by unlocking new supply.

Effective solutions for the real estate market

The combined effect of these three new laws and the positive growth momentum in the real estate sector has bolstered investor confidence in the market’s promising outlook.

Quality Products Emerge as the Preferred Choice

Given the favorable conditions, now is an opportune time to invest. However, as the market enters a new growth cycle, it has also undergone a rigorous selection process, setting new standards for identifying reputable, high-quality, and valuable projects.

Phu Quoc, a dynamic and resilient real estate market known for its rapid recovery from fluctuations, serves as an excellent example of the discerning nature of investment capital.

The Phu Quoc real estate market exhibits a noticeable imbalance between the supply of vacation properties and residential homes. While the market introduces 2,000-3,000 new vacation properties each year, leading to oversaturation, there is a scarcity of residential projects with long-term ownership potential due to the limited allocation of urban land (only 8%) and the dwindling supply of vacant land.

Limited supply of long-term residential properties in Phu Quoc

Furthermore, Phu Quoc’s vision to develop as a sustainable and livable city, rather than solely focusing on tourism, has shifted the investment landscape. The island’s rapidly growing population, both organically and through migration, is expected to reach 680,000 by 2040, creating a substantial demand for residential properties. Consequently, long-term residential real estate has become the primary target for savvy investors in this “Pearl Island.”

Across other markets in the country, analyzing the supply-demand dynamics, along with legal compliance, location, and developer reputation, remains crucial in identifying worthwhile investment opportunities that offer liquidity and potential for future profits.

EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses…

Prime Minister: State-owned enterprises holding substantial resources need to be profitable

On the morning of February 5th, Prime Minister Pham Minh Chinh emphasized the importance of profitable operations and increased contributions to GDP growth and the state budget by working with 19 conglomerates and state-owned enterprises. These businesses possess significant resources and must strive to generate more profits.