The market showed some improvement today with bottom-fishing driving prices up in the afternoon. While propping up blue chips may not be ideal at this point as it could create a negative impression, it hasn’t disrupted the sideways trend of the VNI. It’s important to keep an eye on the adjustment levels of individual stocks to make informed decisions.

Intraday fluctuations over the past few days have seen higher volumes on the downside and lower volumes on the recovery. The index is being supported, giving the impression of a calm market, but many stocks have already adjusted significantly. If there is bottom-fishing to cover positions, there is a chance to stabilize prices.

However, the money flow remains weak. A clear adjustment phase with declining volumes would indicate exhausted selling pressure. Currently, it’s possible that positions are being held as fluctuations haven’t been too negative, and the opportunity to reach or surpass the 1300 level still exists. As a result, investors haven’t sold off extensively. In such a scenario, maintaining a balanced portfolio is advisable to stay agile.

The strong trading of VIC and VHM today was a crucial factor in preventing a major sell-off. If more indices had shown red, it would have been challenging to maintain market sentiment. While propping up or rotating blue chips isn’t necessarily bad, it can be beneficial as long as it stabilizes the market and allows other blue chips to adjust to levels with demand. The potential for resonance among these stocks could then push the VNI higher.

The current narrow fluctuation pattern won’t persist and will eventually shift in some direction. Declining volumes suggest that money flow is waiting for signals before taking action. There’s a possibility of a few resonant sessions among blue chips to break through the psychological barrier of 1300, triggering the waiting money flow and providing a clearer trend.

With the upcoming extended holiday, there’s an opportunity to stimulate market sentiment before and after the break.

I maintain my view that a rising market is preferable, but a decline wouldn’t be detrimental. A balanced position allows for proactiveness. Even in the worst-case scenario of a market correction, it would be a balancing accumulation phase and an opportunity to cover positions. The market has numerous supportive factors in the medium to long term, and the 1300 peak isn’t a critical concern. Many stocks show promising prospects with positive business cycles.

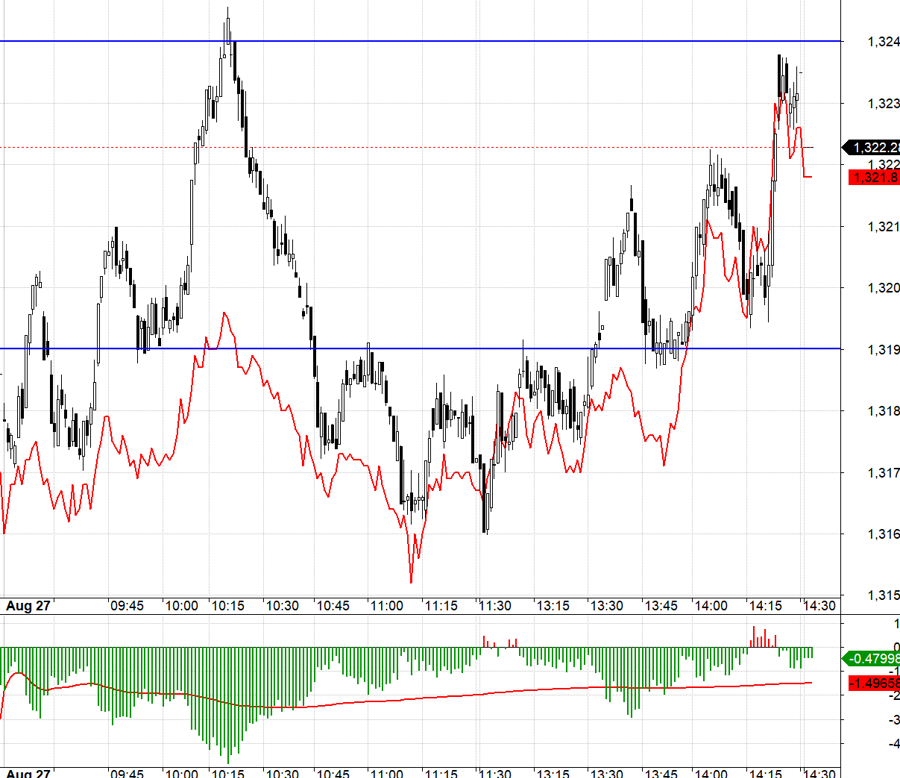

Today’s derivatives market was untradeable, with a narrow basis and index fluctuation. F1 mostly struggled below 1319.xx, while VN30 failed to reach 1311.xx on dips below 1319.xx. Fluctuations between 1319.xx and 1324.xx resulted in basis contraction. It’s best to stay on the sidelines when things get too challenging.

VN30 closed today at 1322.28. Tomorrow’s resistances are 1325, 1332, 1338, 1345, 1349, and 1355. Supports are at 1319, 1311, 1307, 1300, 1290, and 1285.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, interpretations, and opinions expressed herein are those of the author with respect to the stock market and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the opinions and interpretations expressed herein.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.