The stock market traded relatively sluggishly on the first day of the week, August 26. However, some stocks stood out, defying the overall trend. Notably, two stocks, VCF of Vinacafe Bien Hoa and HLB of Ha Long Beer, surged to the maximum allowed limit. VCF rose 7% to 233,200 VND per share, while HLB skyrocketed 15% to 293,800 VND per share.

What caught attention was that VCF and HLB are among the top four most expensive stocks on the exchange (only after VNZ and WCS). Therefore, the increase in absolute value was relatively large, with each VCF share gaining 15,200 VND, while HLB jumped by 38,300 VND per share in just one trading session.

Despite the strong gains, due to their high prices and concentrated shareholder structure, the liquidity of HLB and VCF was not very active. The matched volume for VCF on August 26 was 2,400 shares, while HLB saw a meager volume of just 100 shares.

Purple color indicates the strong performance of HLB and VCF stocks

Nearly 60 years of establishment and development in the beverage industry, earning thousands of billions each year

Regarding HLB, its predecessor was Hong Gai Food Joint Stock Company, established in 1967. After undergoing several changes, the company officially transformed into Ha Long Beer and Beverage Joint Stock Company in February 2003. HLB was listed on the UPCoM exchange in February 2017, and its charter capital currently stands at nearly VND 31 billion. HLB’s products include Ha Long Classic beer, Ha Long Sapphire beer, and Ha Long Golden beer…

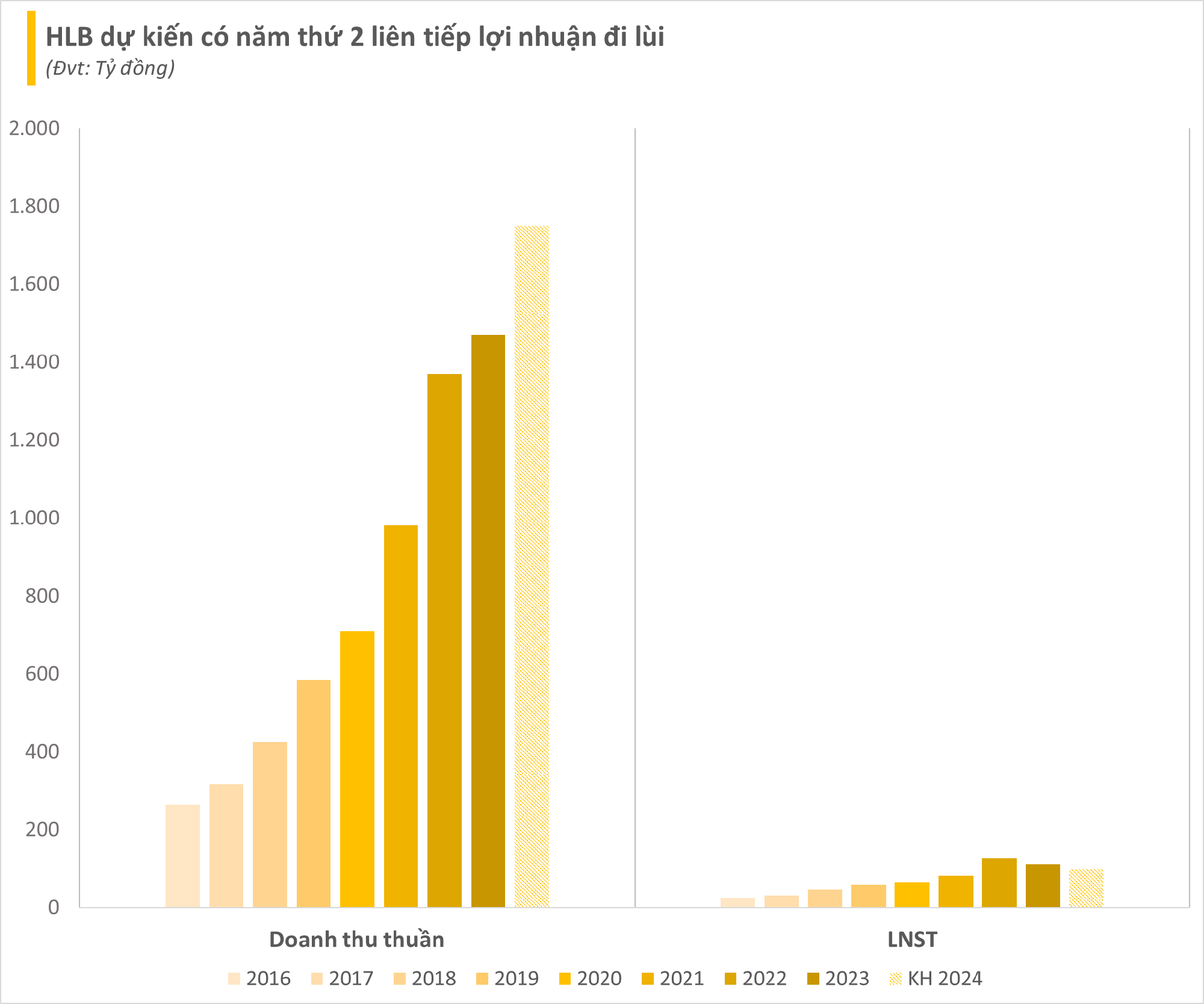

In terms of business performance, after a challenging 2023, HLB remains cautious in its planning for 2024. The company forecasts net revenue of VND 1,751 billion, up 19% from the previous year and setting a new record high. However, profit after tax is targeted at only VND 98.1 billion. If the plan is realized, this will be the second consecutive year of profit decline for the company after a consistent growth streak previously.

On the other hand, Vinacafe Bien Hoa is also a familiar name to Vietnamese consumers in the beverage industry. Established in 1963 as Bien Hoa Coffee Company, it has grown into one of the leading manufacturers of instant coffee in Vietnam over the past 60 years. VinaCafe Bien Hoa boasts a strong brand presence with well-known coffee products such as Vinacafé and Wake-up. The company also owns a modern production facility with an annual capacity of up to 50,000 tons.

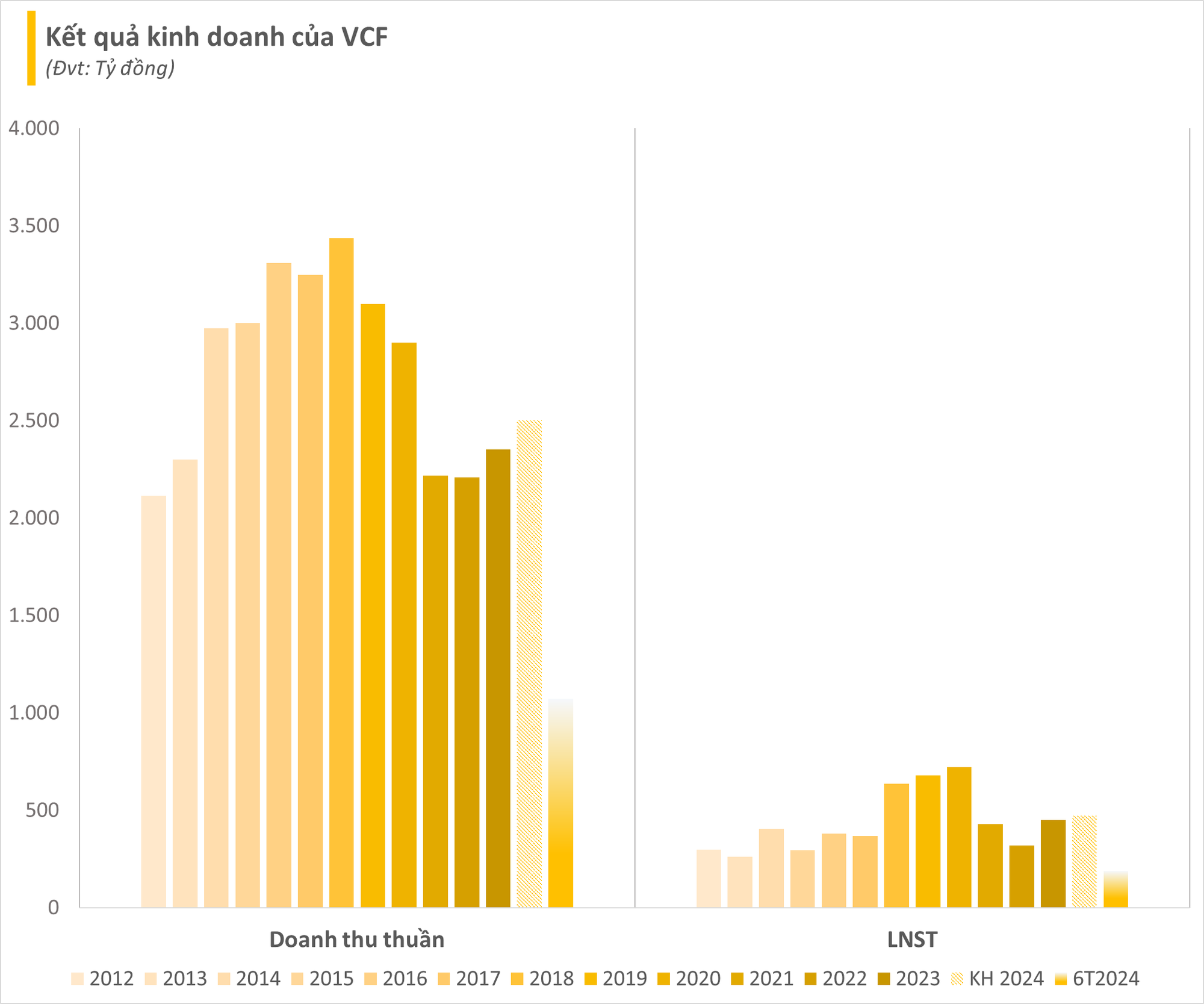

VCF’s business performance has been relatively stable, with net revenue and net profit after tax in 2023 reaching VND 2,353 billion and VND 450 billion, respectively, up 7% and 41%. For 2024, the company has outlined two scenarios: a conservative scenario with revenue of VND 2,500 billion and net profit of VND 470 billion, and a more optimistic scenario with revenue of VND 2,800 billion and net profit of VND 500 billion.

In the first half of the year, VCF recorded a net profit after tax of VND 186 billion, completing about 40% of its profit target in the conservative scenario.

Sky-high cash dividends, “as regular as clockwork,” flowing mostly to major shareholders

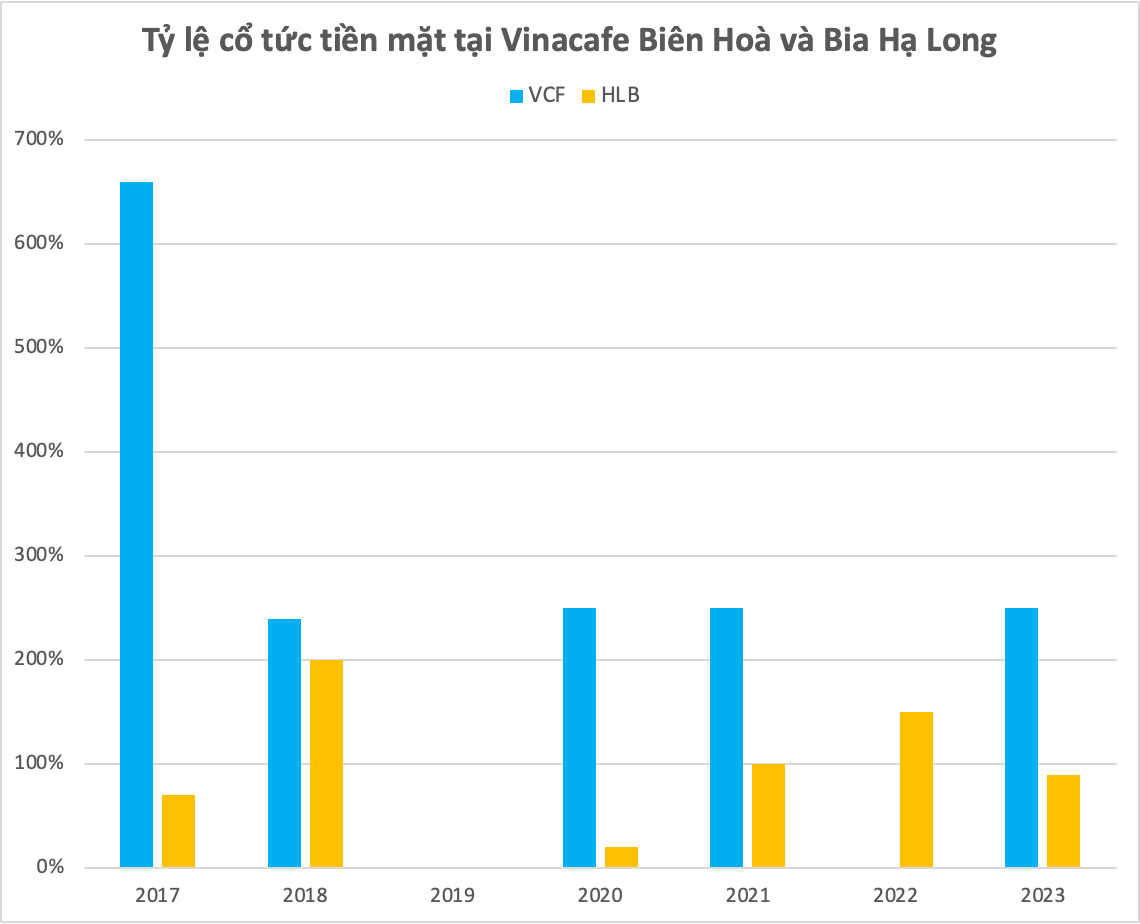

Another common trait between these two beverage companies is their generous dividend payouts to shareholders. Despite a challenging 2023 that disrupted their growth trajectory, Ha Long Beer maintained its tradition of paying high cash dividends, with a staggering rate of 90% (VND 9,000 per share).

In the preceding years of 2021 and 2022, the cash dividend payout ratio reached 100% and 150%, respectively. Remarkably, in 2018, the cash dividend payout even soared to 200%.

Currently, the two largest shareholder groups in HLB are the family of former Chairman Doan Van Quang, holding nearly 58% of the shares, and Aseed Holdings from Japan, with a 30.42% stake.

Similarly, VCF has consistently maintained an attractive dividend policy. In September, VCF will finalize the list of shareholders and distribute dividends for 2023, with a planned payout ratio of 250%, equivalent to VND 25,000 per share.

In recent years, Vinacafé Bien Hoa has regularly paid cash dividends to its shareholders at a rate of 240–250%. Notably, in 2018, the company went above and beyond with a massive cash dividend payout of 660%. However, the majority of these dividends will go to the Masan Beverage Company – a member of the Masan Group (MSN code), which holds 98.79% of VCF’s capital.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.