Illustration

The trading session on August 26 witnessed a notable development as the State Bank of Vietnam (SBV) halted its offering of treasury bills. This marked the first time in many months that the central bank refrained from issuing new treasury bills.

Prior to this, during the session on August 5, the regulator had lowered the interest rate on treasury bills from 4.5%/year to 4.25%/year, and subsequently reduced it further to 4.2% on August 20 and 4.15% on August 23.

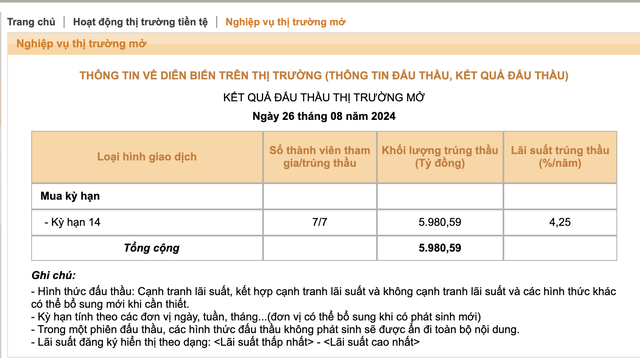

Meanwhile, the SBV continued to provide liquidity support through its open market operations (OMO) facility, with a scale of VND 5,981 billion, a 14-day term, and an interest rate of 4.25%. Compared to previous trading sessions, the OMO term has doubled while the interest rate remains unchanged. Previously, the SBV also reduced the OMO rate from 4.5% to 4.25% on August 5.

After offsetting maturing treasury bills and OMO, the SBV injected a net amount of over VND 9,100 billion into the banking system during the August 26 session.

Currently, the total outstanding treasury bills have decreased to VND 38,700 billion, while OMO outstanding has slightly increased to VND 39,484 billion. As a result, the SBV has shifted to a net injection position of VND 784 billion for the banking system, after consistently maintaining a net withdrawal stance since the beginning of June 2024.

The gradual interest rate reduction and cessation of treasury bill issuance during the August 26 session reflect the regulator’s orientation towards supporting liquidity for the banking system, with the aim of contributing to a lower interbank interest rate environment in the future. Additionally, the increase in the OMO term while maintaining the interest rate also demonstrates the SBV’s proactive approach in lowering the interbank interest rate landscape.

Source: SBV

The SBV has been consistently implementing accommodative measures amid the sharp decline in exchange rates in recent days.

In the interbank market, the USD exchange rate fell below the 25,000 VND mark last week and continued to weaken during the trading session on August 26, the first day of the new week. Since the beginning of August, the interbank USD exchange rate has decreased by 1.4%.

The USD exchange rate quoted by domestic banks has also been consistently declining in recent weeks, reaching the 25,000 VND range for selling and 24,700 VND for buying. Since the beginning of August, the USD rate at this bank has decreased by nearly 400 VND, equivalent to approximately 1.5%.

The exchange rate in the free market has also been falling sharply and is currently trading at 25,200-25,300 VND/USD. The free market rate started to drop significantly in the past month, especially in the first half of August. Compared to the peak of nearly 26,000 VND at the end of June, the current free market USD rate is lower by 700 VND, equivalent to a decrease of about 2.7%.

According to analysts, the rapid cooling of the exchange rate provides favorable conditions for the SBV to implement a more accommodative monetary policy, supporting liquidity for the banking system and the economy.

“Given the positive macroeconomic indicators and the SBV’s orientation, liquidity is expected to remain stable and ample, and interbank interest rates may decline again,” said Vietcombank Securities (VCBS) in a recent macroeconomic report.

Previously, in the second quarter and the first half of the third quarter, the SBV had to consistently implement tightening measures to curb the rising exchange rate, including increasing the OMO rate, raising the treasury bill rate, and selling foreign currency. These actions exerted pressure on the banking system’s liquidity and the interest rate environment in recent months.

Therefore, the SBV’s more relaxed stance in the monetary market is deemed necessary as credit growth is showing signs of acceleration, and deposit rates have been on the rise in recent months.

Data from the SBV shows that credit growth at the end of June 2024 reached 6%, significantly higher than the 3.4% recorded at the end of May. Meanwhile, deposit rates increased across the board in the second quarter and the beginning of the third quarter, with dozens of banks adjusting rates upwards each month.

“With the high likelihood of a cooling exchange rate and inflation by the end of the year, the SBV will have more room to ease and maintain interest rates at a reasonable level to support domestic businesses in their recovery,” said Shinhan Securities Vietnam (SSV) in a recent macroeconomic report.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.