The Trend of Accumulating Wealth is on the Rise Again

Over a month ago, Mr. Tran Ngoc Linh from District 4, Ho Chi Minh City, decided to purchase a 50-square-meter apartment in Thu Duc City for VND 2.6 billion. This is the second property owned by Mr. Linh and his wife. When not in use, Mr. Linh plans to rent it out.

Similarly, despite already owning a house in District 11, Ho Chi Minh City, Ms. Vu Bich Ngoc has just made a deposit on a plot of land in Binh Chanh. This 35-square-meter plot allows car access. The two parties plan to finalize the transaction, sign the contract, and transfer ownership by the end of the seventh lunar month.

According to economic experts, the trend of buying real estate for wealth accumulation is on the rise. “In the last three months, most home or land buyers have had the intention to accumulate assets.”

Mr. Quang Minh, a real estate investment veteran and director of a real estate company, attributes the current surge in asset accumulation to multiple factors.

Firstly, as of August 1, 2024, all three laws: the Business Law, the Housing Law, and the Land Law, will be in effect. Real estate transactions will be stricter. Mr. Minh emphasizes that tax policies in the real estate sector are changing, with an increase in tax rates. This leads to higher transaction costs and could be a reason for rising home and land prices. This also strongly influences the psychology of investors when making financial decisions.

Secondly, while some real estate prices have increased recently, they are still at a good level compared to the peak of 2020-2021. In the future, apartment, land, and house prices are expected to continue rising due to the small number of approved projects and limited supply.

Thirdly, cheap money continues to attract investors. Especially policies such as principal grace periods and reduced prepayment penalties help investors reduce financial pressure. Some banks are also offering loans to repay debts to other banks at low-interest rates, which many investors are taking advantage of to restructure their loans and benefit from lower interest rates. This helps them reduce financial pressure and redistribute cash flow.

The Investment Equation for This Time

Mr. Tran Ngoc Linh shared that his decision to buy an apartment was driven by the concern of rising apartment prices. “Just a few years ago, a 50-square-meter apartment in a project in Thu Duc City cost about VND 1.7 billion. Now, the average price of this type of apartment is VND 2.2-2.3 billion, an increase of VND 500-600 million. It would be difficult to wait and save up enough money to buy later, as income may not keep up with rising home prices. Meanwhile, loan interest rates for apartment purchases are very attractive right now.”

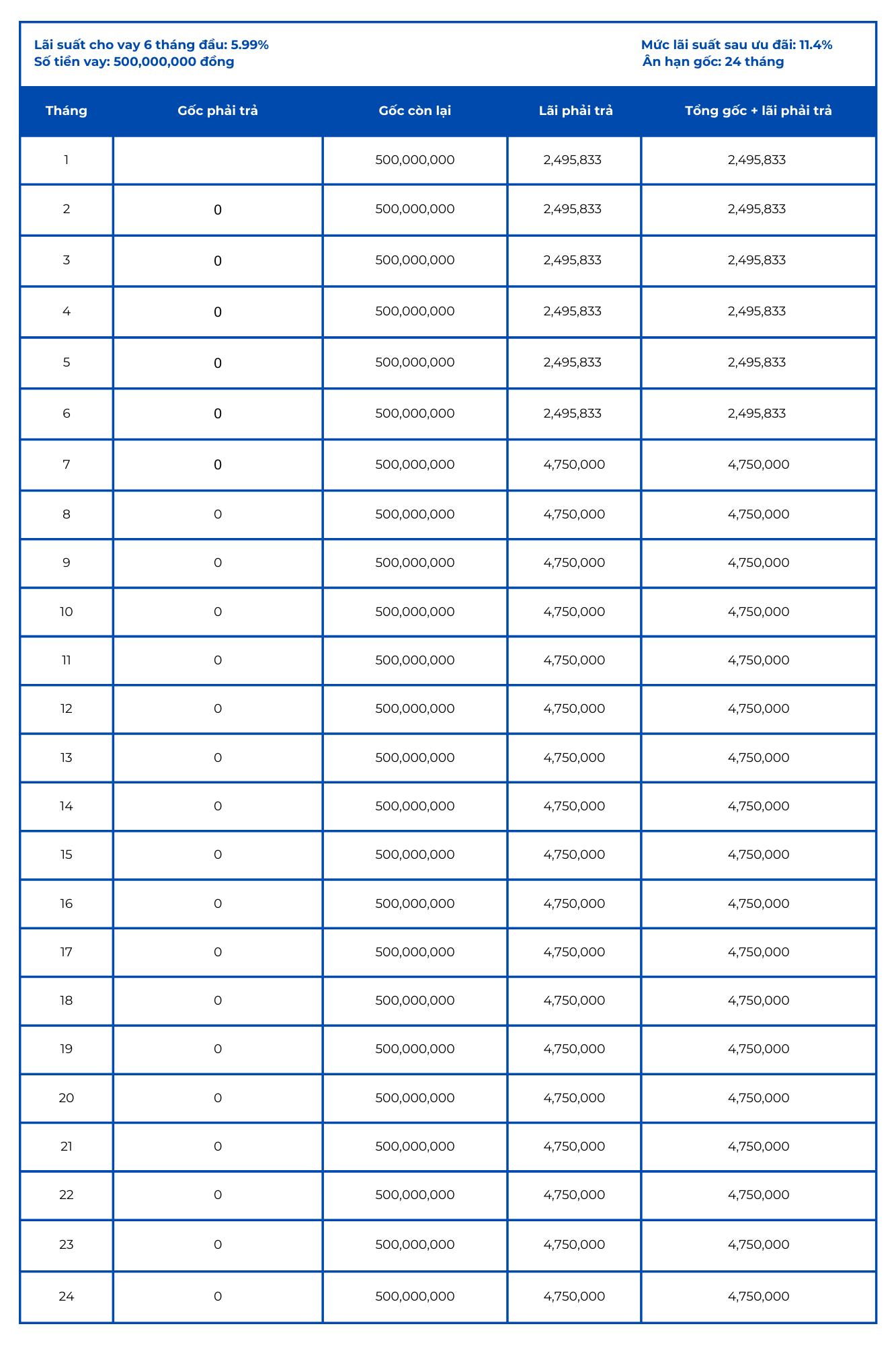

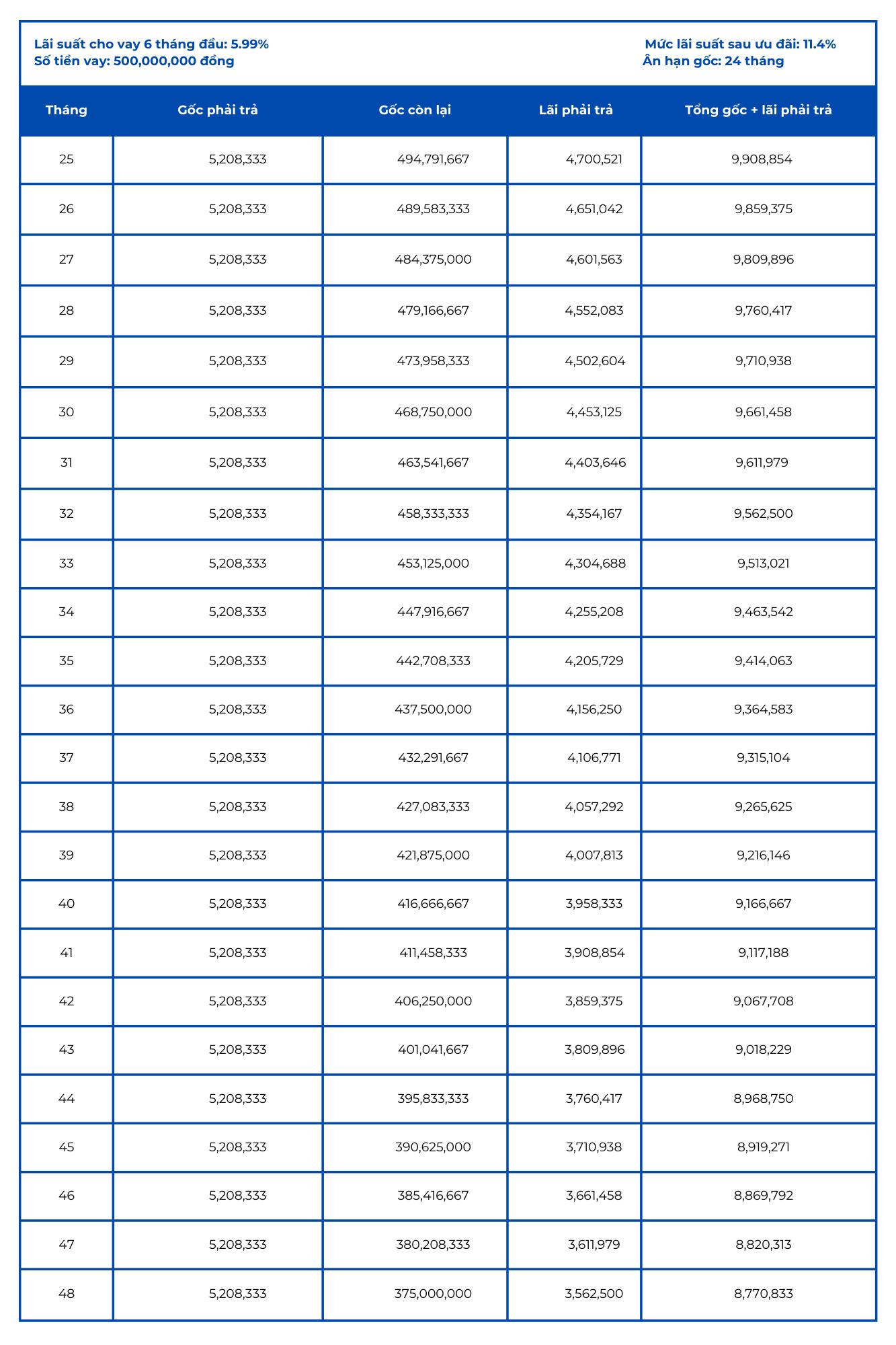

Mr. Linh also calculated: “With my own capital of VND 1.7 billion, I decided to borrow VND 500 million from the bank. I am availing of BVBank’s ‘Real Estate Accumulation’ loan product with a preferential interest rate of only 5.99% in the first six months, and an interest rate of about 11.4% after that. The loan term is ten years, and there is a 24-month grace period for principal repayment, meaning I only have to pay interest of VND 2.4-4.7 million per month during the first two years. From the third year onwards, the total principal and interest to be paid monthly range from VND 5.2-9.9 million, and this amount will gradually decrease over the loan term. Meanwhile, the apartment I bought can be rented out for VND 10.5 million per month. So, even with the loan, my family still makes a profit of millions of VND every month, and we have the peace of mind of owning a long-term asset.”

Principal and interest amounts to be paid in the first year of the loan from BVBank.

Estimated principal and interest amounts to be paid in the second year of the loan from BVBank.

On the other hand, Ms. Vu Bich Ngoc chose to invest in land instead of an apartment, expecting significant gains in land prices. “Loan interest rates for real estate purchases are at their lowest in a decade. Many people say that these are the lowest rates in ten years. The actual increase in land prices will be higher than the interest I have to pay. I estimate that if I borrow VND 400 million from the bank, I will only have to pay about VND 30 million in interest per year. If the land price increases by 10% annually, I will make a substantial profit.”

For more information on BVBank’s home loan packages, please visit: https://bvbank.net.vn/ca-nhan/khoan-vay/

Once a formidable competitor in the stock market, the total market capitalization of the entire real estate industry is now less than the combined market capitalization of three banks.

If you combine the market cap of Vietcombank and BIDV, along with the market cap of Vietinbank (which is approximately 960 trillion VND), it already surpasses the market cap of the top 30 largest real estate enterprises (which is around 788 trillion VND).