The banking industry recorded positive profits in the first half of 2024, with net interest income increasing by 13.73% and post-tax profits rising by 15.82% year-on-year. While the overall growth figures are impressive, they mask the challenges faced by smaller banks, which constitute a significant portion of the industry. These banks are grappling with intense competition from larger banks and the complex task of managing non-performing loans.

With lending rates at historic lows, most banks are pushing credit growth to boost interest income. However, this strategy is proving particularly challenging for smaller banks as they compete with larger institutions that have more attractive lending rates and a broader customer base. The pressure on senior management to devise effective operational strategies is immense, as evidenced by the recent high-level personnel changes within the industry, predominantly in smaller banks.

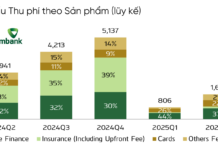

Smaller banks are facing intense competition, especially as larger banks diversify their customer base. Well-resourced larger banks can offer a diverse range of loan packages to all customer segments, from individuals to small and medium-sized enterprises, as well as large corporations. Additionally, larger banks are increasingly focusing on generating income from non-credit areas, such as providing comprehensive payment facilities and specialized financial advisory services, which are key to attracting and retaining customers. Meanwhile, smaller banks are struggling to establish their market position.

According to the financial reports of 27 listed commercial banks, as of Q2 2024, the top seven banks in terms of asset size held more than 65% of the credit market share, leaving a mere 35% to be divided among the remaining 20 banks. In terms of resources, the top seven banks almost double the combined assets of the other 20. This significant disparity in resources and market share puts smaller banks at a distinct disadvantage in the highly competitive banking environment.

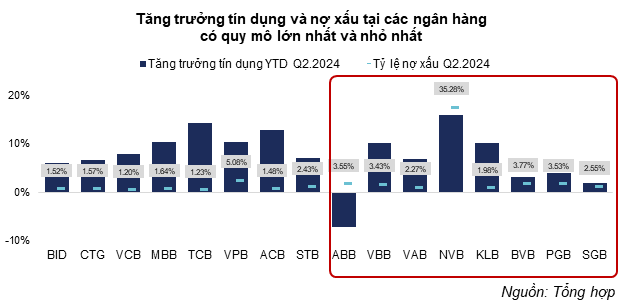

A closer look at the Q2 2024 financial reports reveals the challenges faced by smaller banks in terms of credit growth and non-performing loans. The state-owned banks, including BIDV, Vietinbank, and Vietcombank, maintained a credit growth rate of 6-8%, while larger private banks achieved more impressive results, with rates ranging from 10-14%. Among the smaller private banks, there was a notable divergence in credit growth rates, with the highest being Quoc Dan Bank (NVB) at 16% and the lowest being An Binh Bank (ABB), which saw a decline of over 7% compared to the previous year. However, the high credit growth rates among smaller banks come with increased risks, as evidenced by their non-performing loan ratios, which range from 2.2% to 3.5%, significantly higher than the industry average of below 2%.

Smaller banks often have to resort to aggressive lending practices to maintain their operations, but this strategy comes with higher risks. Non-performing loans not only burden the banks financially but also damage their reputation and market credibility, creating even more pressure on risk management. While the non-performing loan ratio for the industry as a whole has remained stable, it is surging among smaller banks. According to Q2 2024 financial reports, the top eight smallest banks experienced a sharp increase in non-performing loans, totaling nearly VND 35,800 billion, a 43% jump compared to Q2 2023. This not only highlights the challenge of credit quality control but also indicates the limited ability of smaller banks to selectively lend to lower-risk borrowers.

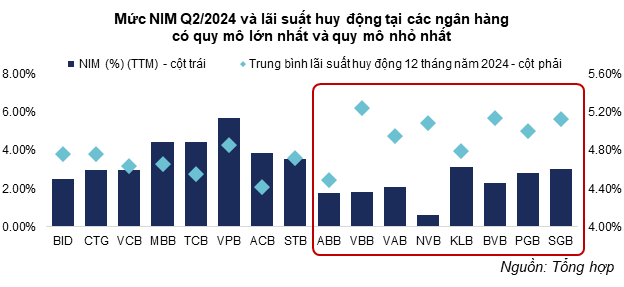

The net interest margin (NIM) of smaller banks is under significant pressure. Lending rates are a critical factor in customer selection, with lower rates offered to financially strong borrowers and higher rates charged to riskier clients. This dynamic underscores the importance of optimizing capital costs, as it directly impacts the bank’s borrower profile and credit management capabilities.

Larger banks, particularly state-owned institutions, have the advantage of their established reputation and can attract savings from the economy at the lowest costs. On average, the 12-month deposit interest rate for this group hovers around 5%. Smaller banks, on the other hand, have to offer rates of 5.5%, which might seem like a small difference but has a significant impact on capital costs, especially in highly leveraged industries like banking. For example, to attract VND 10,000 billion in 12-month term deposits, a state-owned bank would incur a total interest expense of VND 480 billion, while a smaller bank would have to pay VND 500 billion. Moreover, larger banks have an edge in attracting non-term deposits (CASA) with interest rates of approximately 0.5%, further widening the gap in capital costs.

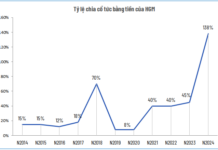

This competition in capital costs affects the NIM of smaller banks. The NIM for the past four consecutive quarters (TTM) shows a clear divergence between larger and smaller banks, with the former enjoying higher NIMs ranging from 2.5% to 4.5%. As mentioned earlier, the advantage in deposit interest rates contributes to the superior NIM of larger banks. In contrast, smaller banks struggle with the burden of interest expenses on their deposits. Aside from capital costs, larger private banks like Techcombank and MBBank have slightly higher credit growth rates than the industry average and a CASA ratio of nearly 40%, while VPBank, specializing in consumer lending, also achieves a favorable NIM.

The larger the gap in deposit interest rates, the heavier the burden on smaller banks. However, if this gap narrows, smaller banks face the challenge of attracting deposits as customers may prefer to place their funds in larger, more established institutions. In the current context of low-interest-rate policies, larger banks can easily attract capital at lower costs. Conversely, smaller banks have to offer higher deposit rates to remain competitive, resulting in increased capital costs. Given that interest expenses account for 60-75% of smaller banks’ total expenses, they are compelled to maintain higher lending rates to sustain profitability. Consequently, smaller banks find it challenging to compete with larger banks on lending rates, limiting their ability to selectively lend to lower-risk borrowers. Moreover, when faced with difficulties in attracting deposits, smaller banks with high loan-to-deposit ratios (LDR) have to rely on short-term interbank loans to support their lending activities and maintain capital adequacy ratios, further exacerbating liquidity pressures.

In the highly competitive credit market, smaller banks are confronted with a delicate balance between pursuing growth and managing risks effectively. Their stability and ability to sustain growth are threatened by intense competition, rising non-performing loans, and high capital costs. Without effective risk management practices and appropriate business strategies, these banks will continue to struggle to maintain growth and survive in the dynamic and challenging environment of the banking industry.

Lê Hoài Ân, CFA – Nguyễn Thị Ngọc An – HUB