Opportunities for Danang’s Condotels: An Insider’s Perspective

At a recent seminar titled “Danang – Unlocking Potential, Elevating to International Standards,” organized by leading real estate companies VCRE, Nobu Danang, and CBRE, Master’s graduate Trinh Tuan Bao from the Danang Tourism Department shared insights into the city’s thriving tourism industry. He highlighted that over the past six years, tourism has been a shining star in Danang’s economic development.

Besides focusing on human resources, land, and urban infrastructure, the business environment is a key driver in elevating Danang’s status. “Danang boasts an impressive infrastructure for tourism accommodation, attracting renowned international hotel brands,” emphasized Mr. Bao.

Sharing a similar viewpoint, Mr. Nguyen Van Dinh, President of the Vietnam Real Estate Brokers Association (VARS), pointed out that Danang’s tourism is prioritizing the luxury segment, with several international operators already establishing a presence in the city. As a result, there is significant room for growth when comparing Danang to nearby, more established markets like Phuket, Thailand.

Currently, branded apartments in Phuket have an average price of approximately 200,000 THB (equivalent to 6,100 USD) per square meter. In contrast, branded apartments in Danang have an average price of just over 4,000 USD per square meter, excluding investor incentives.

Numerous positive signs point toward a promising comeback for Danang’s real estate market in the near future.

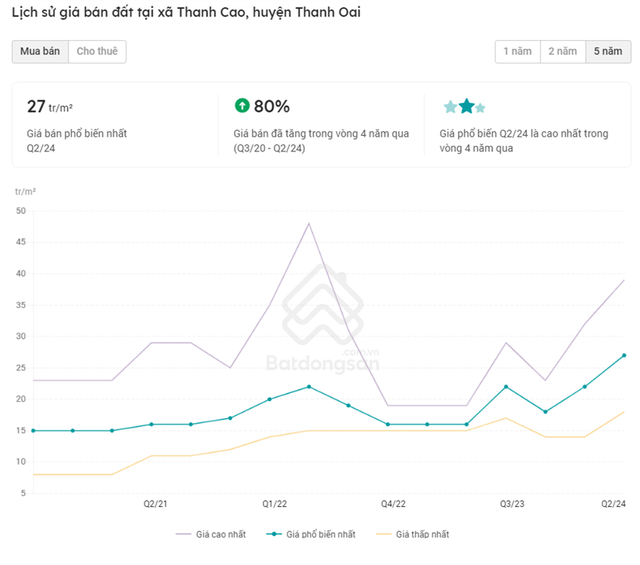

Mr. Dinh argued that Danang’s property prices have remained relatively stable over the past 3-4 years. With the recent approval by the National Assembly of special mechanisms and policies for Danang’s development, the enactment of three crucial laws related to real estate from August 1, 2024, and the tourism stimulation program, there are ample opportunities for price appreciation and an increase in the supply of vacation properties in Danang.

Analyzing the success story of Phuket, which transformed from a tourism-dependent economy into a branded real estate powerhouse, Mr. Dinh suggested that Danang could draw valuable insights for its next phase of development. “The dwindling central land bank in Danang will create a favorable environment for price appreciation for long-term investors,” he emphasized.

Dr. Can Van Luc, a renowned economist, highlighted the most positive change in the vacation property market in general and in Danang, in particular, is the improvement in legal procedures and the issuance of clear and transparent guidelines for obtaining certificates of ownership for various property types.

Specifically, Decree No. 10 of 2023 by the Government has allowed for the granting of pink books (ownership certificates) for tourism property types such as condotels, officetels, and vacation villas built on commercial and service land. As a result, condotels are expected to enter a new phase of development, not only fulfilling customers’ desires for a luxurious lifestyle but also providing a stable income stream from the growing demand for vacation properties.

Representatives from VCRE, who are collaborating with the prestigious Nobu Hospitality brand on a high-end real estate project on My Khe beachfront, emphasized the value of condotels within an integrated experience-focused complex. They attributed the limited supply of such properties as a strategic move by developers to maintain profitability, ensuring potential for price appreciation and stable long-term value.

In the current context, many investors are wondering, “Are there still opportunities for condotels in Danang?” According to industry experts, condotels are inherently geared towards investment cash flow, and their nature requires a forward-thinking approach and a long-term vision. Many believe that once the final legal hurdle of ownership certification is overcome, condotels will have a chance to rebound. Looking ahead over the next 10-20 years, condotels could very well become a significant component of investors’ portfolios.

A Balancing Act: Encouraging Signs and Lingering Challenges

Firstly, let’s consider the positive indicators in the tourism sector. According to the General Statistics Office, in the first half of 2024, the total number of guests served by accommodation establishments in Danang reached 5.1 million, a 25.6% increase compared to the same period last year. International visitors reached 2 million, a 40.3% increase, while domestic visitors totaled 3.1 million, a 17.7% increase. Revenue from food and accommodation services reached nearly VND 13,000 billion, a 22.2% increase, while retail revenue exceeded VND 37,000 billion, a 14.6% increase…

With the tourism industry showing signs of recovery, there are high hopes for a positive shift in the vacation property market in the near future.

Secondly, the National Assembly recently passed a resolution approving pilot mechanisms and policies for Danang’s development. As a result, the Prime Minister will decide on the establishment, adjustment, and expansion of the Danang Free Trade Zone.

On August 25, the Danang People’s Committee announced that on August 31, the city will host a conference to implement Resolution No. 136 of the National Assembly on the organization of urban governance and pilot mechanisms and policies for the city’s development. The event is expected to attract around 500 delegates from central and local governments, diplomatic missions, and businesses.

Key topics will include the investment and business of infrastructure in functional areas within the Danang Free Trade Zone, tourism waterway investments with a scale of VND 8,000 billion or more, and the overall development of Lien Chieu Port with an investment of VND 45,000 billion or more.

However, from the perspective of vacation property, Danang needs more time to regain its momentum. While the city’s tourism industry is showing positive signs, the market’s liquidity has been impacted by issues such as project violations, delayed construction, and broken promises, as seen in the case of Cocobay. These incidents have eroded investor confidence over time.

Looking ahead, Danang’s vacation property market has potential for long-term growth, but it may struggle to find short-term demand. In the new cycle of the real estate market, the vacation property segment will need to build momentum to catch up with other sectors.

Choose La Mia Bao Loc – Embrace a Fulfilling Life with an Ideal Green Living Standard

Not just a perfect blend of art and inspired Italian-style resort, La Mia Dalat also effortlessly brings each resident to the standards of peaceful living, well-being, and balanced body-mind-soul.

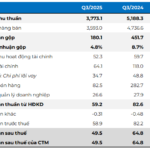

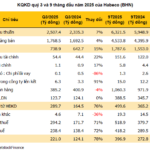

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.