The market demand has shown signs of slowing down in recent sessions as the VN-Index approaches the strong resistance level of 1,300 points. The index’s repeated failures to conquer this milestone in the past have investors concerned about the market’s potential recovery in the coming period.

One of the expectations for a breakthrough in global financial markets and the Vietnamese stock market is the US Federal Reserve’s (Fed) preparation to loosen monetary policy.

At the “Matching Orders – Financial Prosperity” program organized by VTV and VPBank Securities (VPBankS), Mr. Tran Hoang Son, Director of Market Strategy at VPBankS, assessed the market scenario for the coming period.

Commenting on the current context, Mr. Son believes that the rise in stock prices alongside liquidity indicates that sidelined money is getting “impatient,” and investors have started to allocate capital. Additionally, many stock groups have recorded their second consecutive weekly gain, benefiting investors with good profit margins.

However, after two weeks of strong gains, the market is sideway within a very wide range, and profit-taking pressure at the 1,300-point resistance level is significant. In fact, many investors who successfully “caught the bottom” in the past three weeks have also tended to take profits. As the sector has already gained 7-10%, a correction is likely. Therefore, pressure at the 1,285 – 1,305-point range could intensify, and investors should not buy indiscriminately during this phase.

Moreover, the market is about to enter a three-day holiday for National Day. The market is likely to test short-term demand as, upon reaching the technical resistance zone at the high-point region, and with liquidity showing signs of slowing down, the market may experience a pullback or sideways fluctuation in individual sessions.

Patience is key when investing in leading sectors

Presenting two specific scenarios for the VN-Index in the short term, the VPBankS expert suggests that if the VN-Index touches the 1,300-point mark and fluctuates around this threshold, the support zone will be at 1,256 points.

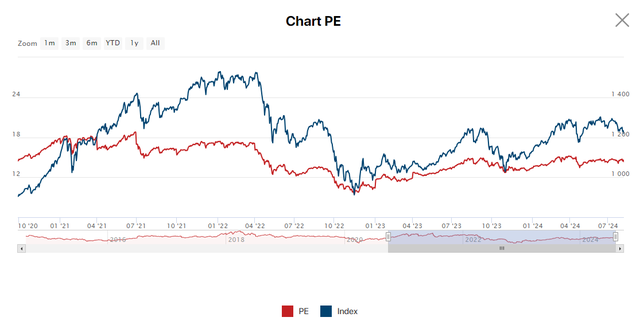

It is necessary for the market to build a foundation in this area to accumulate liquidity and create new momentum for the market in the subsequent phase. If it is expected to surpass 1,300 points and go further, this phase requires a new foundation and liquidity accumulation to overcome the very strong resistance zone in the past two years.

In the second scenario, if the VN-Index fails again at the 1,300-point threshold, a correction is likely, similar to the two occurrences earlier this year.

In the short term, Mr. Son still leans towards an optimistic scenario. If the Fed cuts interest rates, it will be an important boost in this phase, not only for the Vietnamese market but also for the global market, as most investors are awaiting more relaxed policies.

Regarding recommendations for investors whose accounts are still heavily negative despite the market’s gains, the VPBankS expert suggests that investors may need to be patient if they hold fundamentally strong stocks with good fundamentals. Conversely, for underperforming stocks, investors need to “plant flowers and weed out the weeds,” meaning restructuring their portfolios by shifting to sectors benefiting from positive signals in cash flow and positive business results.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.