Hanoi’s real estate market: A tale of fluctuating investor interest and soaring prices

A look back at Hanoi’s real estate market from 2015 to 2017 reveals a fascinating shift in investor sentiment. During this period, veteran real estate investors vividly recall the vibrant and booming supply of apartment condominiums in the city. Weekend events were packed with groundbreaking, topping-out, and sales launch ceremonies. The surge in supply resulted in relatively affordable apartment prices.

Data indicates that luxury apartments in central areas, such as Royal City, were priced at around 30 million VND per square meter. Meanwhile, affordable housing projects like HH Linh Dam and Dai Thanh offered units starting from 12 million VND per square meter. However, at that time, apartments primarily catered to actual housing needs and were considered “consumer goods,” making them less appealing to investors.

In contrast, during the same period, villa prices in outlying districts and counties of Hanoi were only half or even a third of the price of a seaside villa. For instance, a 200-square-meter twin-detached villa in urban areas like Geleximco, Nam An Khanh, or Thien Duong Bao Son was priced at approximately 6 billion VND, equivalent to 30 million VND per square meter. Villas in Ecopark’s Vuon Mai area were also reasonably priced at 3-4 billion VND per unit.

Despite the attractive pricing, investors showed little interest in these villas, even though the infrastructure was fairly well-developed. In fact, according to seasoned investors, villa prices in the Nam An Khanh and Bac An Khanh areas during that period were about 30% cheaper than in the 2009-2010 boom.

While Hanoi’s real estate market was being overlooked, coastal condotels and villas were attracting strong interest from property investors. The emergence of condotels, with their staggering profit commitments of up to 10-12%, blinded buyers. Through a “robbing Peter to pay Paul” scheme, condotels, which are essentially second homes for vacation purposes, were transformed into financial instruments by developers to raise capital.

Playing on investors’ greed, condotel prices were inflated beyond their true value, accompanied by extravagant profit guarantees. At that time, vacation homes in Da Nang and Nha Trang were priced on par with Hanoi’s luxury apartments. Advertisements for coastal resorts were ubiquitous, from major airports to prime-time slots on television.

Driven by herd mentality and the psychological pull of catchy advertisements, countless investors were lured by grandiose visions of bustling entertainment metropolises. As a result, in 2016, condotel liquidity reached unprecedented heights.

However, the dream turned sour in 2018-2019 when legal issues surrounding condotel ownership and the collapse of the Cocobay project jolted investors back to reality. In 2020-2021, as many projects began operations, the inability to fulfill initial profit commitments officially crippled this segment, leaving investors with a bitter taste.

Soaring Prices and Buyers’ Dilemma

Entering the 2022-2024 period, investors are returning to Hanoi’s real estate market. This influx, coupled with legal bottlenecks that have constrained supply, has driven up property prices in the capital over the past two years.

Many apartment complexes have doubled in price compared to their initial launch five to seven years ago. Even aging apartments like HH Linh Dam, Kim Van Kim Lu, and Dai Thanh have seen their values surge to an average of 30-35 million VND per square meter, representing a 2.5-fold increase. In the primary market, outer-city apartments continuously set new price records, reaching up to 60 million VND per square meter, with some projects even surpassing the 100 million VND mark.

Following the upward trend, villas in the suburbs have also witnessed remarkable price appreciation. Specifically, villas in areas like Nam An Khanh, Geleximco, Duong Noi, and Bac An Khanh, which were priced at around 6 billion VND in the 2015-2016 period, have now skyrocketed to 28 billion VND, reflecting a 4.5-fold increase. However, supply is limited as few owners are willing to sell, opting instead to hold onto their properties in anticipation of further price increases.

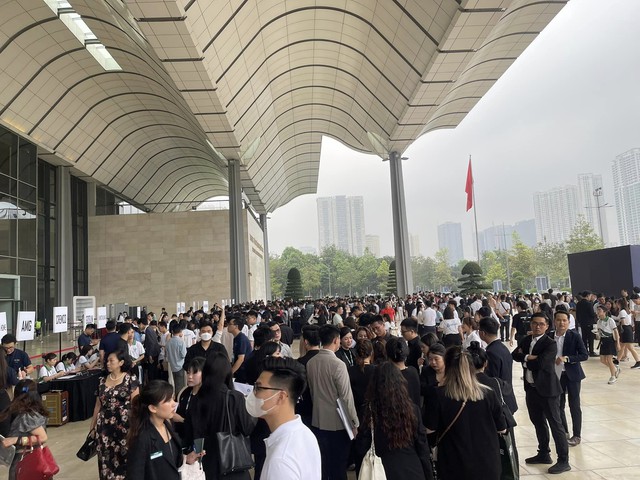

Despite the high prices, Hanoi’s apartment and villa markets are experiencing record-high liquidity. In the first eight months of the year, numerous projects witnessed “sold-out” statuses during their launch events. Interestingly, these projects tend to cluster around a few large developments in the west and east of the city, mainly concentrated among prominent developers such as Vinhomes, Masterise, MIK, and Capitaland.

Buyers flock to purchase suburban apartments with prices reaching up to 80 million VND per square meter.

Amid soaring prices, buyers and investors remain fiercely competitive, fueled by the fear of missing out (FOMO). The prevailing mindset is that “prices will continue to rise” and “if you don’t buy now, you’ll miss out.” Indeed, many individuals have been unable to purchase their desired apartments due to the rapid sell-out pace. Undeterred by the high prices, investors continue to buy and hoard apartments and villas in the suburbs, anticipating further price appreciation.

The staggering increase in Hanoi’s property prices has left Mr. Nguyen Quoc Khanh, Chairman of IDJ Vietnam, astonished: “In my 15 years in the industry, I never expected new apartments in the outskirts to be priced at 60-70 million VND per square meter.” The frenzied price escalation has even driven land prices in outlying districts like Thanh Oai and Hoai Duc to auction levels of up to 100 million VND per square meter.

Commenting on the Hanoi real estate market, Dr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, attributes the price surge to the influence of a particular interest group, which seems inappropriate given the economic context, market conditions, and stagnant income levels. He further asserts that the primary factor enabling this situation is the constrained supply, as no new projects have been approved and licensed in recent years. The majority of developments are either old or have changed hands multiple times.

Overcoming FOMO and Resisting the Temptation to Chase Trends

While Hanoi’s apartment market is sizzling, provincial real estate seems to be overlooked, despite prices being 10-20% lower than they were 2-3 years ago. In some areas, like Da Nang, Thai Binh, and Hai Duong, price levels have remained stagnant for the past five years.

A broader market observation reveals that, in other segments such as resort real estate and provincial land, only projects with strong media hype have witnessed liquidity. In contrast, most projects remain quiet despite offering reasonable prices and occupying potentially lucrative locations.

According to a real estate veteran with two decades of experience, the current wave of new and inexperienced buyers is caught in a frenzy, driven by FOMO and overwhelmed by the powerful media influence of major projects in Hanoi. “They are unable to broaden their perspective and consider real estate options beyond the capital, ultimately paying a premium for Hanoi properties,” he asserts. “Investors need to expand their horizons, avoid being manipulated by market giants, and make more informed decisions to align their expectations with reality.”

Indeed, real estate investors are becoming increasingly aware of the anomalies in Hanoi’s skyrocketing property prices. The recent news of the Hanoi Department of Natural Resources and Environment collaborating with the police to investigate a group of individuals suspected of “pumping” land prices serves as a wake-up call. Experienced investors are shifting their focus, and newcomers are exercising more caution, resisting the urge to chase trending investments.

There is a growing trend of investors looking beyond Hanoi to neighboring provinces with promising tourism and industrial development potential. For instance, a newly launched project in Ha Nam province attracted over 2,500 sales and investors to its launch event last weekend. Other projects in tourist destinations like Cam Pha and industrial hubs like Bac Giang, Thai Binh, and Da Nang have also garnered attention from investors.

Assessing the market outlook for the remainder of the year, Mr. Le Xuan Nga, Vice Chairman of BHS Group, predicts that the suppressed fever of Hanoi’s real estate market will spill over to neighboring areas, channeling investment capital into these “relatively calmer waters.”

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.