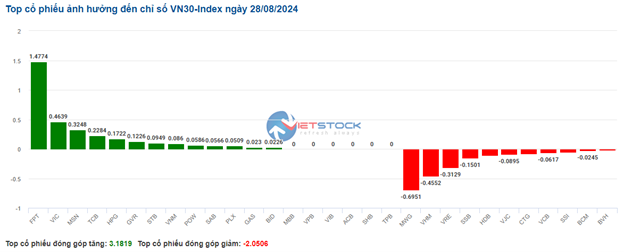

The VN30 basket witnessed a slightly greener landscape with 13 gainers and 11 losers. FPT stood out with a 1.47-point gain, followed by VIC (+0.46 points), MSN (+0.32 points), and TCB (+0.23 points). Conversely, MWG, VHM, VRE, and SSB faced selling pressure, shaving off over 1.5 points from the VN30-Index.

Source: VietstockFinance

|

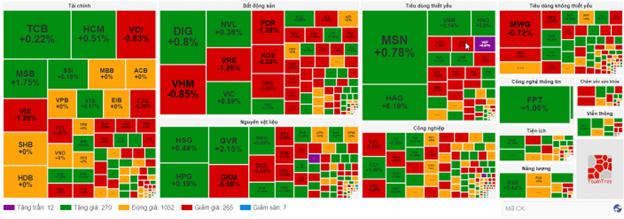

Information Technology stocks led the current rebound with a solid 1.1% gain. This was largely driven by FPT, which climbed 1.36%, and CMG, which rose 0.95%. The remaining stocks mostly traded flat or posted minor losses.

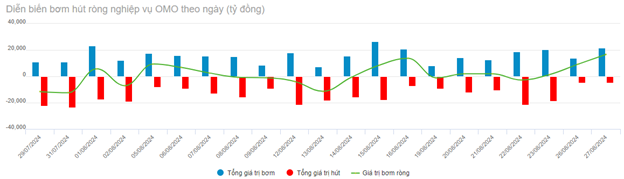

Meanwhile, the financial sector continued to witness strong divergence, with the selling pressure prevailing despite “easing” signals from the State Bank of Vietnam (SBV). Specifically, over the past month, the SBV injected more than VND 24,500 billion into the system through OMO operations.

Source: VietstockFinance

|

On the buying side, stocks that maintained their positive momentum included MSB (+1.32%), HCM (+0.34%), TCB (+0.22%), and LPB (+0.32%). On the flip side, VIX declined by 0.84%, EVF fell by 0.41%, ORS dropped by 0.39%, and notably, VCI slipped by 0.83% following news that Ms. Truong Nguyen Thien Kim, the wife of Mr. To Hai – Member of the Board of Directors and General Director of VCI, registered to sell 13.2 million shares of Vietcap Securities Joint Stock Company (HOSE: VCI) from September 4 to October 3, 2024.

A contrasting performance was observed in the non-essential consumer sector, which dipped by 0.16%. This decline was mainly driven by selling pressure in MWG (-0.72%), GEX (-0.23%), TNG (-0.71%), and FRT (-1.23%).

Compared to the opening, the market remained range-bound, with over 1,000 stocks trading flat and a relatively balanced buying and selling force. Specifically, there were 270 gainers and 265 losers.

Source: VietstockFinance

|

Opening: A gentle green hue

As of 9:40 am on August 28, the VN-Index had climbed over 3 points to reach 1,284.24, while the HNX-Index edged slightly lower to 238.8.

A sea of green emerged across sectors, with several large-cap stocks posting strong gains from the get-go. These included GVR, up 2%; VIC, up 1.88%; PLX, up 1.12%; and HPG, up 0.58%.

Heavyweights such as VIC, GVR, and FPT propelled the market higher, contributing over 1.5 points to the index. On the flip side, MWG, VCB, and BCM led the negative influence on the market, but their collective impact was less than 0.5 points.

Energy stocks took the lead in the morning session, with notable gainers including BSR (+1.67%), PVD (+0.18%), and PVS (+0.3%).

Additionally, materials stocks maintained their steady growth trajectory from the opening bell. Prominent performers in this sector included HPG (+0.78%), HSG (+1.44%), NKG (+1.61%), KSB (+1.06%), and KSV (+7.53%).

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.