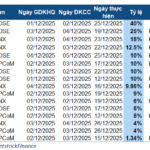

Vietdata, a platform providing macro, business, and industry research data, revealed that in 2023, bubble tea brands operating as chains saw a significant recovery in their financial performance compared to 2022, the peak of the COVID-19 pandemic. However, compared to 2022, their revenue and profits tended to decline. Among them, Toco Toco, Koi Thé, Ding Tea, and Bobapop were the least profitable brands.

Last year, Toco Toco experienced a drop of VND 77.5 billion in revenue and an additional loss of VND 58.5 billion. As one of the most premium-positioned brands in the market, the Koi Thé chain also witnessed a decrease in revenue and profit, amounting to VND 35.6 billion and VND 25 billion, respectively. Ding Tea, mainly operating in Northern Vietnam, and Bobapop, with a strong presence in the South, also faced double-digit revenue declines, but their profits remained relatively stable. Ding Tea lost VND 0.9 billion, while Bobapop improved its pre-tax profit by VND 1.1 billion.

Consumer demand decreases while competition among bubble tea brands intensifies. Illustration

According to an F&B services expert, the bubble tea market, especially in major cities, is becoming increasingly competitive. The dense opening of new outlets, coupled with stagnant consumer spending, has resulted in frequent promotional discounts, ultimately leading to declining sales.

Premium bubble tea segments, such as Koi Thé and The Alley, are expected to face challenges as consumers tighten their budgets. In contrast, brands that continue to thrive possess additional value-adding factors, mainly introducing new product lines (e.g., strong-brewed tea) or enhancing the customer experience.

Beyond consumer demand, a representative from one of the underperforming brands attributed their declining performance to a deliberate shift in strategy. This particular chain adjusted its menu and pricing to match the market average to enhance competitiveness.

To remain competitive with the lower price range of bubble tea options, this chain had to compromise on profit margins. While maintaining high-quality ingredients, the brand representative declined to provide specific figures or percentages regarding cost and profit margins.

In reality, the demand for dining out has significantly decreased since last year. A recent report by iPOS, a platform providing management solutions to over 100,000 restaurant and café businesses, revealed that 30,000 foodservice establishments closed in the first half of this year.

The report also indicated reduced consumer spending and a decrease in café visits, including bubble tea and other beverage options, during the first six months. A survey of 2,360 consumers, mainly in Hanoi and Ho Chi Minh City, found that 41.7% of respondents only occasionally drank beverages at cafes. Additionally, 32.3% visited cafes once or twice a week.

Despite the decline in sales for some chains, experts believe that the bubble tea market still holds potential due to the emergence of new brands and the expansion of established brands into provincial and suburban areas. Therefore, considering the overall landscape, the market remains promising.

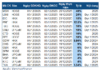

Among the notable newcomers is Mixue, a Chinese-franchised bubble tea and ice cream brand, which stands out as one of the few brands with increasing and breakthrough financial performance. According to Vietdata, the company reported revenue of over VND 1,257 billion in 2023, a 2.6-fold increase compared to the previous year.

The market has also witnessed the rise of Phê La, a new brand that started operating in 2023 and has already achieved impressive results. With nearly VND 300 billion in revenue and VND 52 billion in post-tax profits, Phê La’s revenue surpasses that of established chains like Gong Cha, Ding Tea, and Bobapop, while its profit trails only behind Mixue.