Illustrative image

In its recently published currency market report, Rong Viet Securities (VDSC) noted that the Vietnamese Dong’s appreciation trend continued last month due to the weakening US Dollar. As of August 23, the US Dollar Index had fallen to 100.7 – its lowest level since July 2023.

According to VDSC, the Fed Chair’s statement at the Jackson Hole conference last Friday once again confirmed that the time for a Fed rate cut has come. However, there may still be uncertainties ahead regarding the number and magnitude of rate cuts, even though the odds are tilting towards a faster pace of rate reduction than anticipated a few months ago.

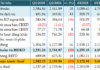

The Dong’s appreciation accelerated in August compared to July. The official USD/VND exchange rate averaged 24,978 VND/USD, a 1.1% decrease from the end of the previous month. Vietcombank’s selling rate also fell to 25,050 VND/USD on August 26, 370 VND/USD lower than at the end of July. Meanwhile, in the free market, the selling rate on August 23 dropped to 25,280 VND/USD, a 1.7% decline from the end of July.

“Thus, the USD/VND exchange rate has depreciated faster than our expectations due to the weak US Dollar,” VDSC stated. Accordingly, the analysts forecast that the pressure of increasing USD demand in the latter part of Q3 and early Q4 will not significantly impact the exchange rate outlook. The year-end USD/VND exchange rate is expected to fluctuate around 25,000 VND/USD, approximately 3% higher than last year-end.

VDSC also noted a notable adjustment in the open market interest rates during August. From August 5, the State Bank of Vietnam (SBV) reduced the refinancing and bill rates by 0.25 percentage points to 4.25% per annum. Subsequently, the bill issuance rate was further lowered by 0.15 percentage points last week to 4.15% per annum as of August 23.

This development coincides with the continued depreciation of the exchange rate last month, and the SBV also took advantage of the Fed’s expected policy rate cut next month to adjust the open market rates.

“With the current exchange rate trend, the SBV will not need to raise policy rates to cope with exchange rate pressure in the remaining months of the year,” VDSC stated.

Previously, in a report released in early July, VDSC suggested that the SBV would face exchange rate pressure in the second half of 2024 and might have to raise policy rates. The reasons cited were the expected strength of the US Dollar due to: (1) the interest rate differential between the US and other countries remaining high as the Fed cuts rates slower and less than other central banks, (2) the prediction by many economists that a Trump win in the upcoming US presidential election would lead to a resurgence of inflation, thereby influencing the Fed’s interest rate decisions, and (3) prolonged geopolitical risks increasing the demand for USD as a safe-haven asset.

Based on this outlook, the analysts argued that the SBV might have to continue depleting its foreign exchange reserves to stabilize the exchange rate. Vietnam’s foreign exchange reserves are limited, while the demand for USD typically increases in the latter part of the year. This situation could pose a risk that the SBV’s depletion of foreign exchange reserves might not achieve the desired effect of curbing the rise in the exchange rate.

“Therefore, in a scenario where the SBV is unable to further utilize foreign exchange reserves, it will raise policy rates by 25-50 basis points (0.25-0.5 percentage points) in the second half of 2024,” VDSC stated in its July Macro Report.

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.