Without any supporting information, the market entered a pull-and-dump phase as blue-chip stocks were continuously pumped while the rest were heavily sold off.

The index ended the session slightly higher, gaining a mere 0.54 points to close at 1,280, but the number of declining stocks was significant at 235, with only 169 stocks advancing. Real estate led the gains, surging 1.74% as the Vin group once again played a pivotal role in propping up the index. VIC soared to the daily limit, VHM rose 2.22%, and VRE climbed 1.01%. These three stocks alone contributed 4 points to the overall market.

On the flip side, banks declined by 0.32%, materials shed 0.17%, securities fell 1.01% after a strong rally driven by the news of the pre-funding draft, insurance dropped 0.34%, and telecommunications slid 2.05%. Adding to the market’s woes were top stocks BID and VCB, which wiped out 1.5 points, along with GAS, HPG, SSB, and SSI.

Selling pressure persisted throughout the session, but bottom-fishing funds remained cautious, resulting in a decline in liquidity across the three exchanges to nearly VND 18,000 billion. Foreign investors sold a net VND 243.8 billion, with a net sell of VND 44.0 billion in matched orders.

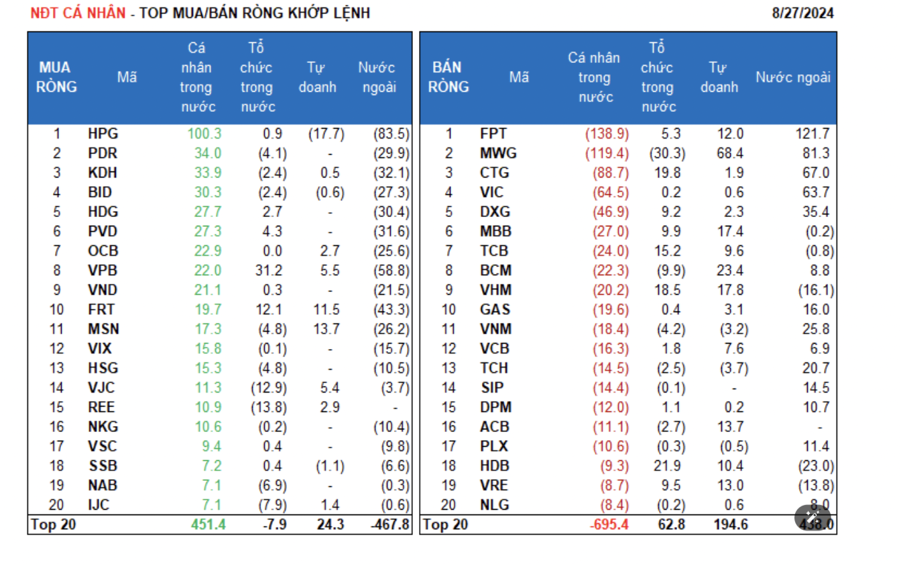

The main sectors that foreign investors bought on a matched basis were Information Technology and Retail. The top stocks in this category included FPT, MWG, CTG, VIC, DXG, VNM, TCH, FUEVFVND, GAS, and SIP.

On the selling side, foreign investors offloaded Banking stocks on a matched basis. The top stocks in this category were HPG, VPB, FRT, KDH, PVD, PDR, BID, STB, and MSN.

Individual investors sold a net VND 31.8 billion, including a net sell of VND 250.2 billion in matched orders.

Looking at their matched orders, individual investors bought 9 out of 18 sectors, mainly Basic Materials. The top stocks in their buying portfolio included HPG, PDR, KDH, BID, HDG, PVD, OCB, VPB, and VND, and FRT.

On the selling side, they offloaded 9 out of 18 sectors, primarily Information Technology and Real Estate. The top stocks in this category were FPT, MWG, CTG, VIC, DXG, MBB, BCM, VHM, and GAS.

Proprietary trading accounts bought a net VND 383.3 billion, including a net buy of VND 267.8 billion in matched orders.

Focusing on their matched orders, proprietary traders bought 12 out of 18 sectors, with Retail and Banking being the most prominent. The top stocks in their buying portfolio included MWG, BCM, VHM, MBB, ACB, MSN, VRE, FPT, FRT, and HDB.

The top-selling sector was Basic Materials. The most sold stocks included HPG, TCH, VNM, VIB, TLG, SSB, FUEVFVND, BVH, BID, and PLX.

Domestic institutional investors sold a net VND 109.3 billion, but when considering only matched orders, they were net buyers to the tune of VND 26.4 billion.

Drilling down into their matched orders, domestic institutions sold 11 out of 18 sectors, with Retail being the most significant in terms of value. The top stocks they offloaded included MWG, FUEVFVND, REE, VJC, BCM, PNJ, IJC, NAB, HHV, and TV2.

On the buying side, they focused on Banking. The top stocks in this category were VPB, STB, HDB, CTG, VHM, TCB, FRT, MBB, VRE, and DXG.

Block trading today reached VND 1,961.7 billion, a slight increase of 2.3% from the previous session, contributing 11% to the total trading value.

Notable block trades were observed among domestic individuals in VIC, VHM, and KOS.

Additionally, there were block trades between investor groups in SHB, MSB, TLG, and MWG.

Money flow allocation increased in Real Estate, Retail, Oil & Gas Equipment, and Petroleum Distribution while decreasing in Banking, Securities, Food & Beverage, Steel, Chemicals, and Personal Goods.

Focusing on matched orders, the money flow allocation increased in the large-cap VN30 group and decreased in the mid-cap VNMID and small-cap VNSML groups.