Joint Stock Company F88 successfully raised VND 100 billion in bond issuance with the code F88CH2425004 on August 14, 2024, with a term of 12 months, maturing on August 14, 2025.

About a week later, on August 20, F88 successfully issued another bond with the code F88CH2425005, valued at VND 50 billion, also with a 12-month term and maturing on August 20, 2025. Both bond issues carry a fixed interest rate of 11% per annum and are unsecured, non-convertible, and do not include warrants.

In May, the F88 pawnshop chain successfully raised a total of VND 100 billion through two bond issuances. These issuances took place on May 3 and May 7, with a value of VND 50 billion each, and had a term of 12 months with interest rates ranging from 11% to 11.5% per annum.

Prior to that, on April 19, 2024, F88 also successfully raised VND 50 billion through bond issuance, with a 12-month term and an interest rate of 11.5%.

Thus, from the beginning of 2024 until now, the F88 pawnshop chain has successfully raised a total of VND 300 billion through five bond issuances.

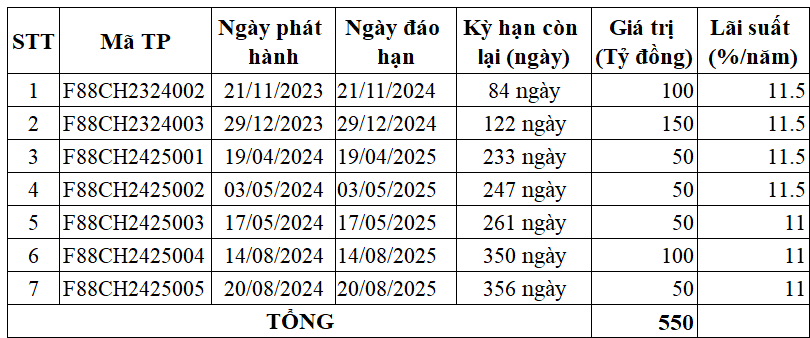

According to the Hanoi Stock Exchange (HNX), F88 currently has seven bond issues in circulation (including the two aforementioned new issues), totaling VND 550 billion.

|

7 bond issues currently in circulation by F88

Source: Author’s compilation

|

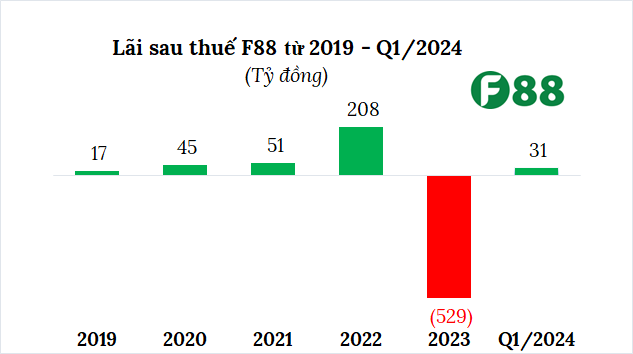

In terms of business performance, from 2019 to 2022, the company recorded profits in the tens of billions of VND each year, with a significant jump in 2022, where F88’s net profit surged to over VND 200 billion.

Interestingly, the profits made in the four years prior were wiped out, and the company even recorded a loss in 2023, with a massive loss of nearly VND 529 billion. F88 attributed this loss to their conservative provisioning policy.

After this challenging year, F88’s business is showing signs of recovery, with a net profit of VND 31 billion in Q1/2024 and a 2% increase in revenue compared to Q4/2023. While there are no detailed figures for comparison with the same period last year, the semi-annual business report for 2023 indicated a loss of over VND 368 billion (accounting for nearly 70% of the total loss for the year).

The debt-to-equity ratio as of the end of the period was 1.99 times, up from 1.8 times at the end of 2023, implying a total debt estimate of nearly VND 2,850 billion for Q1.

Source: Author’s compilation

|

F88 Bounces Back with Profits, Total Outstanding Loans Exceed VND 2,800 Billion

Established in 2013, F88 operates a pawnshop chain under the same name. The company aims to become a leading financial services provider in Vietnam, with a vision to operate 1,000 transaction offices offering convenient financial services across all 63 provinces and cities nationwide.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.