The final trading sessions before the long holiday break witnessed no significant fluctuations, as both buyers and sellers had reasons to reduce trading intensity. The pillar group took turns balancing each other, helping the indices maintain a narrow fluctuation range for the sixth session, although many stocks corrected more strongly.

Today’s highlight was the matched order liquidity of the two floors, which fell to just over VND 13,3k billion, the lowest in 10 sessions. The average trading volume of the previous 10 consecutive sessions was approximately VND 18k billion/day, so today’s decline was significant.

A decline in liquidity is often a negative signal when the VN Index is hovering around the 1300-point peak. However, this is not necessarily the case at the moment, as there are many indications that the market is in a fragile equilibrium phase, and this state will eventually change.

Firstly, the decline in liquidity is too significant, although trading has not been particularly large in the past week or so. It is likely that investors are consciously reducing the intensity of trading in both directions, rather than a decrease in capital inflows. In other words, money/stocks are still abundant in accounts, they are just not being poured into the market.

Secondly, stock prices did not fluctuate much despite the low liquidity. If sellers were to offload a large number of stocks, the current weak buying power would immediately cause prices to drop further. Conversely, if buying intensified, the thin selling would not be enough to hold back rising prices. Contrary to the first session of the week, both sides have been fairly balanced in the last three sessions.

Thirdly, the phenomenon of rotation among the pillars is still effective in terms of points and breadth. While the VN30 group cannot increase resonance to create a breakthrough for the VN Index, they are also not weak enough to trigger a sell-off. Looking at the breadth, the rotation of pillars contributes significantly to the differentiation. The market must be in a state of equilibrium in supply and demand to achieve this, as history has shown that a weak market will not be supported by pillars either.

As the market approaches the long holiday break, with two additional trading sessions next week, both buyers and sellers have reasons to wait. Buyers can purchase at any time, as the current tug-of-war is yet to lead to a breakthrough or a peak followed by a decline. Whichever scenario unfolds, those with cash can still act. Therefore, it is normal for them to wait until after the holiday to “decide”. The same goes for stockholders; the market is fluctuating, but the correction has not been significant, and a post-holiday breakthrough is also possible.

At present, there is no information strong enough to stimulate a change in the market’s state. The domestic situation is fairly calm, even positive, with exchange rate developments, money injections, and two days of compensation. If there are any surprises, they are likely to come from international sources. The global news flow is also uneventful, except for the performance of a few indices such as the S&P 500 and DJA, which are also stagnating at old peaks. Therefore, investors have a reason to “freeze” their state and rest assured during the break!

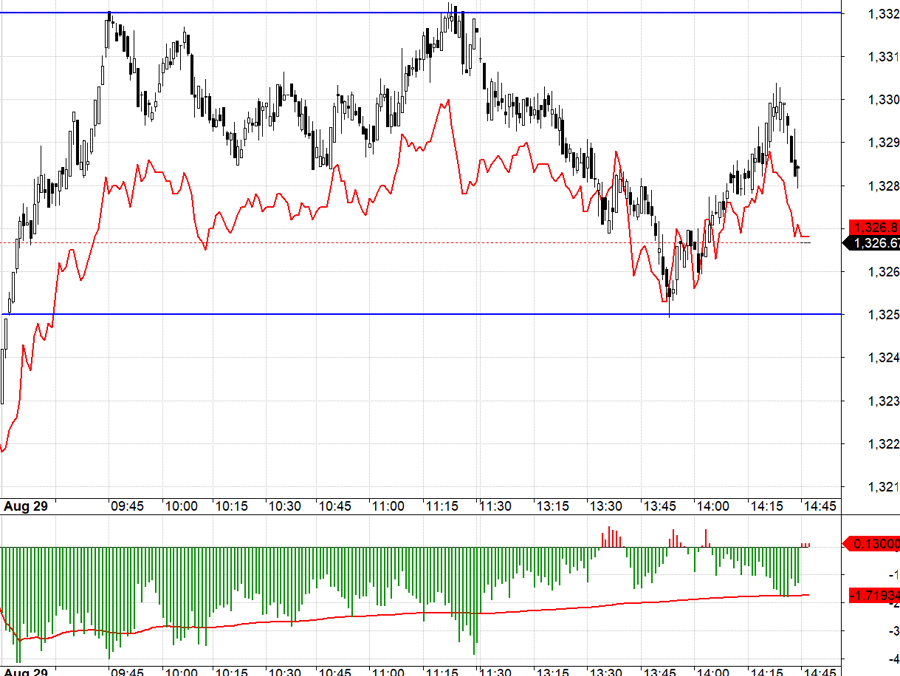

The derivatives market is maintaining very low liquidity as VN30 also has a narrow intraday fluctuation range. Although this index is outperforming the VN Index and is more clearly on an upward trajectory, intraday trading opportunities are scarce. The blue-chips are constantly rotating but not strong enough to “finish” the game. VN30 fluctuated today within the range of 1332.xx to 1325.xx, a span of approximately 7 points, but F1 has a discount, so both Long and Short are limited. It is normal for players to stay out when trading is difficult.

With only one session left until the holiday, it is easy for the “psychological thread” to break due to the interruption. Therefore, it is likely that the market will continue to hover around its current levels. There is a small possibility that the pillars will be influenced towards the end to create a “positive echo” during the break. In general, there are not expected to be many opportunities in derivatives, so it is best to also take a break.

VN30 closed today at 1326.67. Tomorrow’s nearest resistance levels are 1332; 1338; 1346; 1350; 1357. Supports are at 1325; 1319; 1311; 1307; 1301; 1295; 1290.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives, evaluations, and investment advice are those of the individual investor, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author are not responsible for any issues arising from the published evaluation and investment advice.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.