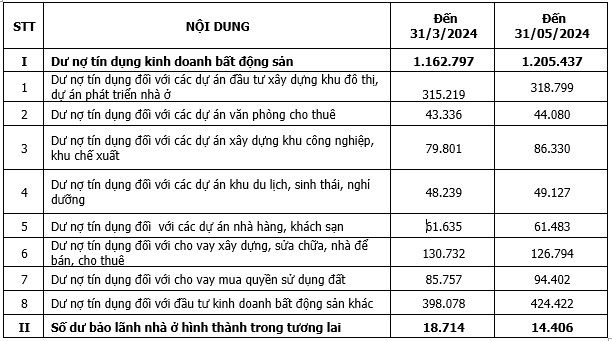

According to a report by the State Bank of Vietnam (SBV), as of May 31, 2024, credit outstanding for real estate business activities exceeded VND 1.2 quadrillion, a nearly 4% increase compared to the figure on March 31.

|

Credit outstanding for real estate business activities as of May 31, 2024 (Unit: VND trillion)

Source: Ministry of Construction

|

The SBV stated that one of the main sectors for credit growth in the past period, real estate lending, has decreased significantly. Both enterprises and individuals are slowing down their loan demands due to high property prices, which are disproportionate to people’s income amid economic difficulties.

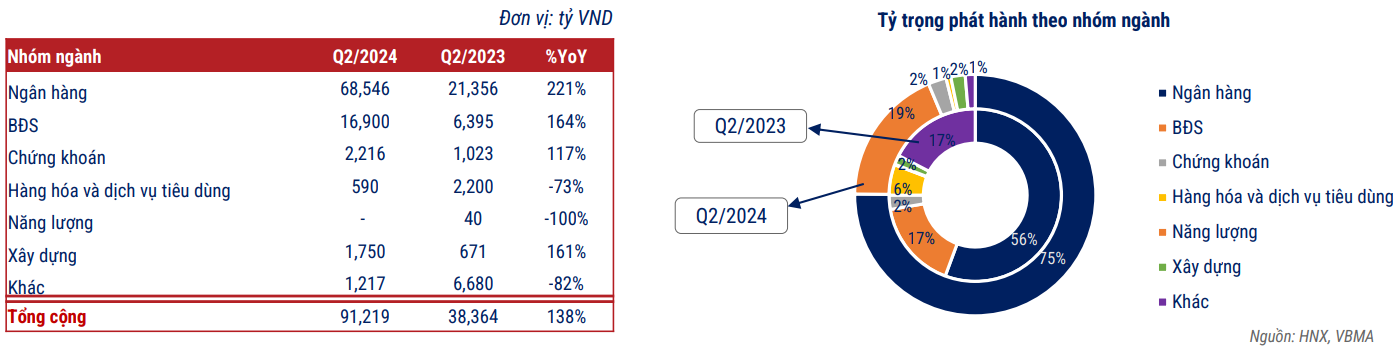

For the corporate bond market, in the second quarter of 2024, there were four public bond issuances, valued at VND 2,500 billion, accounting for nearly 3% of the total issuance value; and 84 private placements valued at VND 88,719 billion, accounting for more than 97%.

Of which, the total bond issuance value of real estate enterprises was VND 16,900 billion, accounting for 19% of the total issuance value and 2.6 times higher than the same period last year.

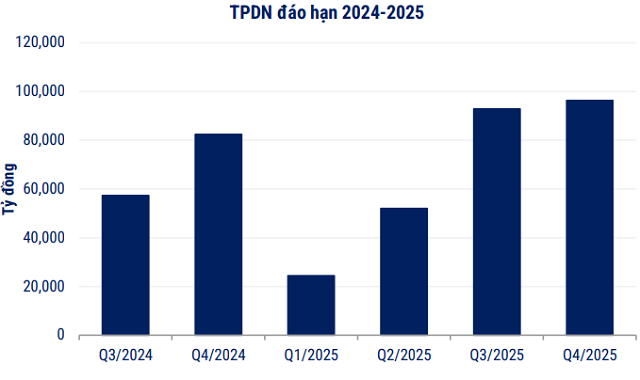

On the other hand, the value of bonds maturing in the second half of this year is very large, amounting to VND 139,765 billion; of which, VND 58,782 billion are real estate bonds, accounting for 42%.

Source: VBMA

|

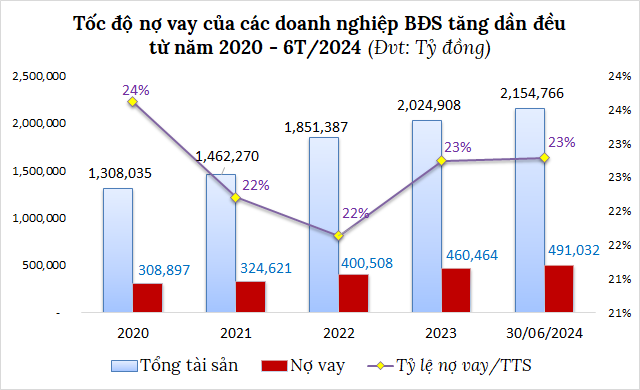

Most of the debt is increasing

According to statistics from VietstockFinance, 116 real estate enterprises listed on the stock exchange (HOSE, HNX, UPCoM) have published their Q2/2024 financial statements, with a total debt balance of more than VND 491 trillion as of June 30, 2024, a 7% increase compared to the beginning of the year. If compared to the beginning of 2020, this debt balance has increased by nearly 60%.

Source: VietstockFinance

|

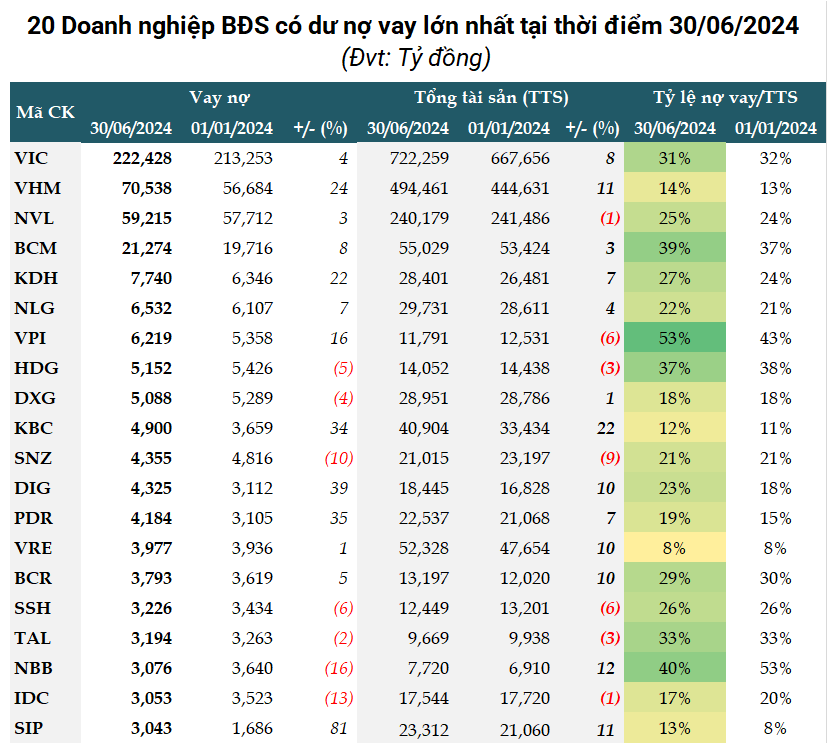

Among them, the four leading enterprises are also the ones with the largest debt balances, including: Vingroup Joint Stock Company (HOSE: VIC) with more than VND 222.4 trillion, Vinhomes Joint Stock Company (HOSE: VHM) with more than VND 70.5 trillion, Novaland Joint Stock Company (HOSE: NVL) with more than VND 59.2 trillion, and Becamex IDC Corporation (HOSE: BCM) with nearly VND 21.3 trillion. These four large enterprises alone account for 76% of the total debt of the surveyed real estate enterprises.

According to the top 20 enterprises with the largest debt balances in the market, only seven enterprises reduced their debt, while 13 continued to increase their debt in the first half of the year. In the aforementioned group of 20, the debt balance of Saigon VRG Real Estate Joint Stock Company (HOSE: SIP) increased by 81%, to VND 3,043 billion, accounting for 13% of total assets. The reason for this increase is that SIP incurred an additional long-term loan from Vietcombank (VCB) of more than VND 780 billion on June 28, with a term of 84 months, to compensate for and support site clearance for the Phuoc Dong Boi Loi industrial-urban-service complex project (phase 3) and nearly VND 600 billion in short-term debt from other banks.

The debt balance of Khang Dien House Joint Stock Company (HOSE: KDH) increased by 22%, to VND 7,740 billion, accounting for 27% of total assets. KDH increased its long-term borrowing from banks from more than VND 4,900 billion at the beginning of the year to VND 6,070 billion to finance projects such as the Binh Trung Dong residential area, the Tan Tao Central Urban Area – Area A, and the Binh Hung 11A residential area.

Source: VietstockFinance

|

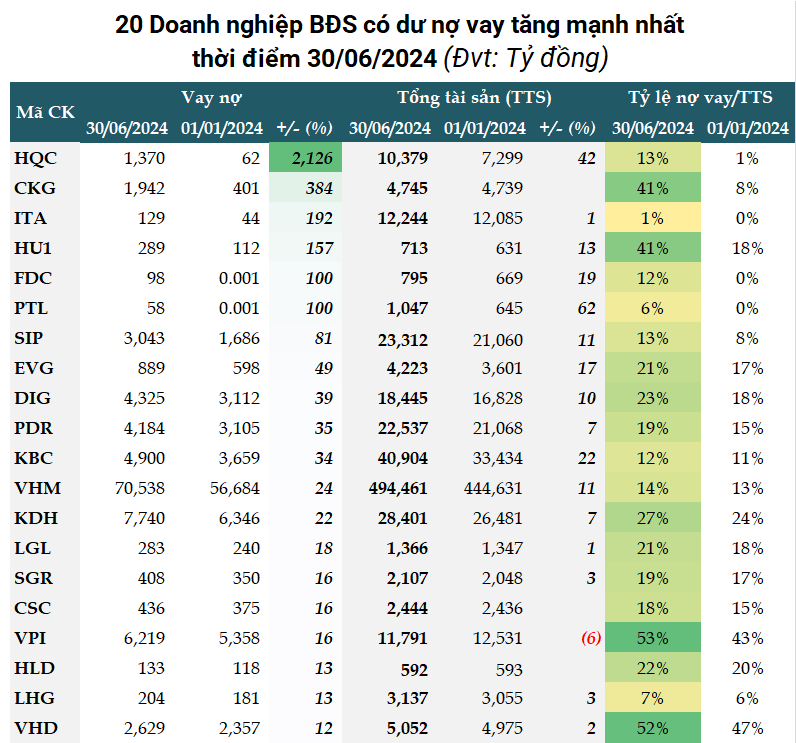

In terms of the rate of increase, Dia Oc Hoang Quan Joint Stock Company (HOSE: HQC), a social housing giant, witnessed the highest surge, with its debt balance at the end of June increasing by 22 times compared to the beginning of the year, to VND 1,370 billion, accounting for 13% of total assets. This dramatic increase was due to HQC’s acquisition of shares and consolidation of financial statements of Bao Linh Investment, Construction and Trading Joint Stock Company (HQC owns 98.04%) in Q1/2024.

Of this amount, nearly VND 1.3 trillion was a long-term loan from HDBank, including VND 340 billion for payment of cooperation contracts and construction with Bao Linh Investment, Construction and Trading Joint Stock Company, nearly VND 450 billion for supplementary capital for the implementation of the Golden City social housing project, and VND 500 billion for capital contribution in cooperation with Dia Oc Hoang Quan Mekong Trading Services Consulting Company Limited.

Source: VietstockFinance

|

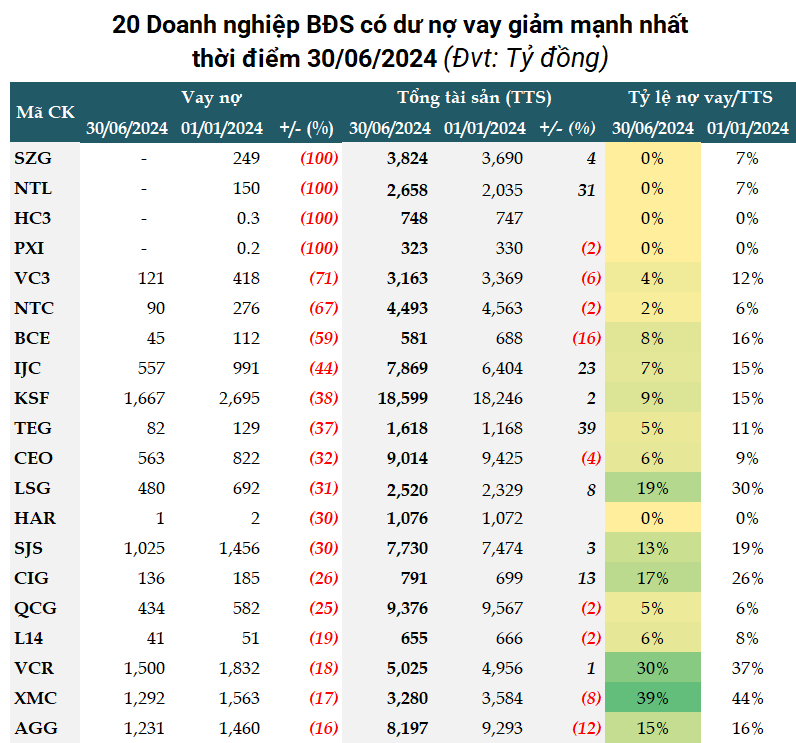

Four enterprises are debt-free

On the contrary, four enterprises were debt-free as of June 30, 2024, namely: Sonadezi Giang Dien (UPCoM: SZG), Do Thi Tu Liem Joint Stock Company (HOSE: NTL), Hai Phong Construction No. 3 Joint Stock Company (UPCoM: HC3), and Petroleum Industry and Civil Construction Joint Stock Company (UPCoM: PXI).

In addition, some enterprises with significant debt balance reductions include Nam Mekong Group Joint Stock Company (HNX: VC3), which decreased by 71% to VND 121 billion, accounting for only 4% of total assets; Nam Tan Uyen Industrial Park Joint Stock Company (UPCoM: NTC), which reduced its debt by approximately 90% compared to the beginning of the year, to VND 90 billion, accounting for 2% of total assets; and CEO Group Joint Stock Company (HNX: CEO), which decreased its debt by 32% to VND 563 billion due to the repayment of a short-term loan of approximately VND 300 billion at BIDV.

Source: VietstockFinance

|

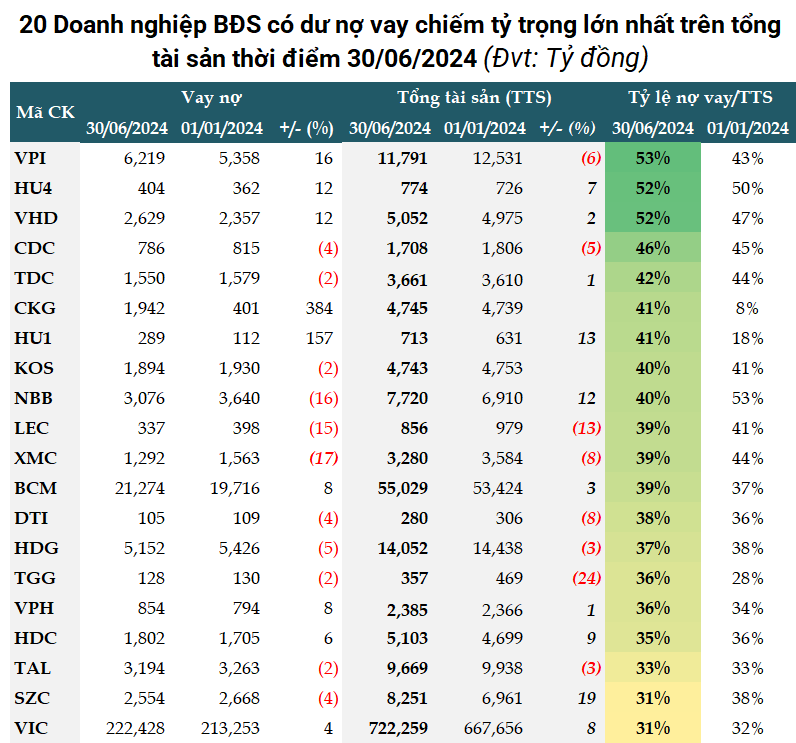

The debt-to-total-asset ratio is one of the important indicators to evaluate the financial health of an enterprise. If the debt is high but the business is not efficient, it will incur a huge interest burden, eroding the enterprise’s profits.

According to statistics, as of June 30, 2024, the three enterprises with a debt-to-total-asset ratio of over 50% were Van Phu – INVEST Investment Joint Stock Company (HOSE: VPI), with a debt balance of VND 6,219 billion, a 16% increase, and a debt-to-total-asset ratio of 53%; Investment and Construction Joint Stock Company No. 4 (UPCoM: HU4), with a debt balance of over VND 400 billion, a 12% increase compared to the beginning of the year, and a debt-to-total assets ratio of 52%; and Vinahud Urban and Housing Development Joint Stock Company (UPCoM: VHD), with a debt-to-total-asset ratio of 52%.

Source: VietstockFinance

|

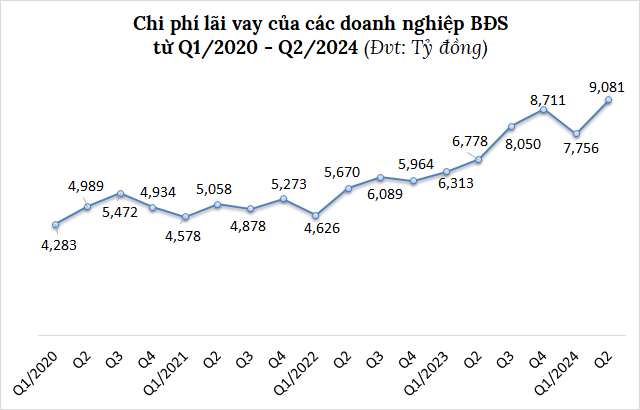

Interest expenses surge

The total interest expenses of 116 real estate enterprises in Q2/2024 amounted to VND 9,081 billion, a 34% increase compared to the same period in 2023, and this figure is showing a gradual increasing trend over the quarters.

Source: VietstockFinance

|

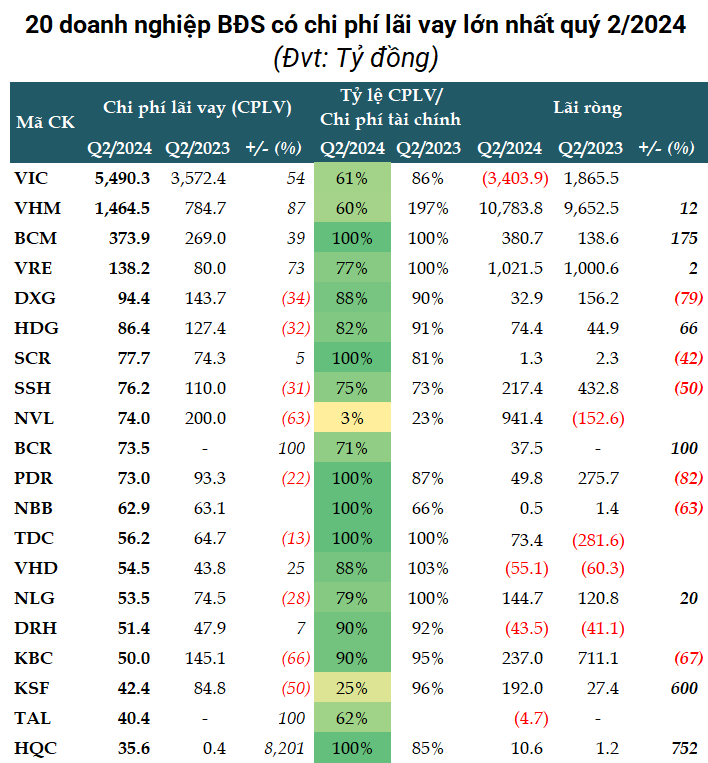

With the highest debt balance in the industry, VIC and VHM also had the highest interest expenses, amounting to more than VND 5,490 billion and nearly VND 1,465 billion, respectively. These figures represent a 54% and 87% increase compared to the same period last year and account for 61% and 60% of their respective financial expenses.

Becamex IDC Corporation, a leading industrial park developer in Binh Duong, also witnessed a 39% increase in interest expenses, to VND 374 billion, accounting for 100% of its financial expenses.

Source: VietstockFinance

|

Thanh Tu

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.