One of the main reasons Masan decided to acquire the VinMart/VinMart+ supermarket chain from VinCommerce (now rebranded as WinMart/WinMart+ under WinCommerce) was to own and develop its exclusive distribution network. Masan’s new brand at the time – MeatLife chilled meat – quickly gained a strong market position, thanks to its wide distribution across the WinMart/WinMart+ supermarket chain, along with its diverse ecosystem of condiments and food products that already had a strong foothold, such as fish sauce, soy sauce, instant noodles, and sausages.

Of course, it’s not just Masan, but many food production companies have also recognized the importance of distribution, including GreenFeed, Ba Huan, and Hoang Anh Gia Lai. However, reality has proven that this is not an easy equation to solve, especially for companies that do not have a wide range of products to offer to end consumers.

Is Ba Huan following in the footsteps of G Kitchen?

In 2019, GreenFeed, a well-known animal feed and meat company, launched a B2C food brand named “G” with its flagship brand being G Kitchen, targeting the same chilled meat segment as MeatLife, which was launched by Masan in 2018.

In March 2022, G Kitchen shared that they had 95 stores in the southern region, specifically in Ho Chi Minh City, Dong Nai, and Binh Duong. However, currently, on their official website, G Kitchen has only 19 stores located in Ho Chi Minh City.

G Kitchen once had 95 stores covering Ho Chi Minh City, Dong Nai, and Binh Duong.

G Kitchen stores offer a variety of fresh and frozen meats, including pork, beef, chicken, and fish, as well as cold cuts like sausages, hams, and meat balls; dried and snack foods such as fish skin and sausages; and convenient meals like ready-to-cook and ready-to-eat foods.

In mid-2023, Ba Huan also launched a range of new products alongside its traditional strengths in chicken and duck eggs, including fresh chicken meat and ready-to-eat foods such as Thai-style chicken feet, shredded chicken jerky, traditional stuffed chicken gizzards, sausages, shredded pork, sausages, chicken breasts, and chicken balls.

Towards the end of 2023, Ba Huan opened a store called “Ba Huan Fresh” in District 2 of Ho Chi Minh City.

With a relatively diverse product portfolio, Ba Huan decided to open a store in District 2, Ho Chi Minh City, early in 2023.

“After more than half a century of building and developing in the livestock, food, and agriculture industry, providing mainly poultry eggs and fresh chicken meat to consumers, Ba Huan has transformed into a company that offers comprehensive clean food solutions to customers, including individual consumers, partners, and businesses with a need to develop in the culinary industry.

Ba Huan Fresh Store is not just a place for daily grocery shopping but also offers a unique and quality shopping experience for customers. With a modern design and attractive displays, our new store will provide a diverse range of products, from fresh chicken meat to high-quality packaged processed food products, meeting all the needs of our customers,” said Ba Huan in a statement.

However, up to this point, Ba Huan has not opened any other stores besides the first one mentioned above.

After the COVID-19 pandemic and the economic recession, there has been an excess of retail space, and opening a chain of stores is not as difficult as it used to be. However, the challenge lies in operating them efficiently, quickly breaking even, and turning a profit, or positively impacting the overall business. The withdrawal of Hoang Anh Gia Lai from the BapiFood alliance remains a vivid lesson for all.

In its heyday, Bapi Food had nearly 200 distribution stores.

In 2022, Hoang Anh Gia Lai cooperated with Dong A Pharmaceutical Company to establish Bapi Food Joint Stock Company to distribute the agricultural products they produced, such as banana-fed pork, processed food, chicken, beef, bananas, jackfruit, mangoes, and vegetables. Bapi had a charter capital of about VND 50 billion, with HAGL holding 55% of the capital contribution, making Bapi Food a subsidiary of HAGL. This strategy followed the new trend in agricultural production: from farm to table.

By early 2023, HAGL announced that it had transferred part of its shares in Bapi. Specifically, Mr. Duc invited Mr. Do Xuan Dien, a member of the Board of Directors of THACO and a leader of HNG, to hold 35% of the capital in Bapi. Thus, after completing the issuance and capital increase, and the transfer, Bapi is no longer a subsidiary of HAGL.

In August 2023, Mr. Duc shared some of the difficulties Bapi was facing. According to him, HAGL’s pig farming business was not losing money, but Bapi was losing due to an unstable distribution system, although the loss was not significant.

HAGL’s leadership candidly admitted that the Bapi Food distribution system was not competitive in the market, and the reality was very harsh. In 2022, Bapi opened nearly 200 stores, but the chain did not meet business expectations and incurred losses. Therefore, Bapi Food reduced the number of stores to only 52 stores and supermarkets (46 of which were located in Ho Chi Minh City).

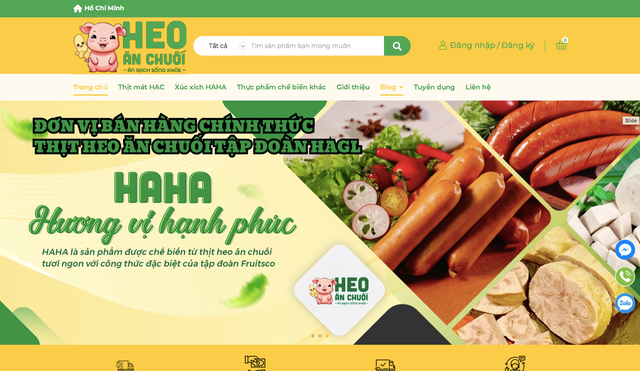

Current distribution channels for HAGL’s pork and self-produced processed products.

Currently, HAGL has completely divested from Bapi Food. The withdrawal of Hoang Anh Gia Lai, the ‘soul’ of the company, has almost killed the Bapi Food brand. HAGL now distributes its pork through the website heoanchuoihagl.vn/Zalo and four physical stores in Ho Chi Minh City, Hanoi, Dong Nai, and Binh Duong. In addition, the company also focuses on three main agricultural products: pork, bananas, and durian.

Hope for KIDO – MiniBao

Like all leading food producers in Vietnam, KIDO has never given up on its plan to build its distribution network, especially for the cold food segment, including ice cream and cakes. However, KIDO has not yet found the right approach, as the market for cafe and tea chains is highly competitive and requires substantial investment. Even before they could replicate the model across multiple locations, the Chuk chain could not bear the costs of personnel and premises. On the other hand, investing in the MiniBao model allows for easier adjustments in terms of costs and scale.

Thọ Phát had operated the MiniBao model as a franchise by partnering with individuals who owned small spaces and wanted to earn extra income. At that time, Thọ Phát mainly operated in Ho Chi Minh City. After taking over Thọ Phát, KIDO placed high hopes on this chain and is currently in the process of expanding it nationwide.

“We have implemented this plan for 45 days and have 150 stores nationwide – all of which are profitable. By the end of 2024, we will increase this number to 500 stores. After every 500 stores, we will pause to evaluate the KPIs and make adjustments and changes as needed,” said Mr. Mai Xuan Tram, Deputy General Director of KIDO Group, at the 2024 KIDO Annual General Meeting of Shareholders.

The MiniBao stores used to mainly sell steamed buns, dim sum, and hamburgers, but the 2024 version also offers sticky rice. Recently, KIDO has added a counter selling moon cakes from two brands, Thọ Phát and KIDO, in the MiniBao stores.

“As mentioned, this year is the first time we have introduced moon cakes produced and sold by Thọ Phát. Through this, we launched new product lines that vividly depict familiar Mid-Autumn Festival images: lion dance, lanterns… in the packaging design, while through traditional fillings such as mung bean, taro, coconut milk, lotus seed, assorted… consumers can indulge in the flavors of childhood.

For KIDO’s Bakery, we continue to focus on the premium traditional positioning with unique, luxurious, and 5-star global flavors such as abalone, fish maw, Alaska king crab, scallops… to meet the needs of gift-giving. I myself have a great passion for cuisine and have tried all the flavors of this season, and I am very satisfied with them” – said Mr. Tran Le Nguyen, CEO of KIDO Group.

KIDO starts selling moon cakes from two new brands, Thọ Phát and KIDO, in MiniBao stores.

With the combined strength of the MiniBao chain and the new Thọ Phát brand, KIDO is striving to become the leader in the traditional moon cake market (accounting for 50% market share) and the second-largest moon cake brand in Vietnam. The MiniBao chain will be a crucial piece in the company’s ambition to join the O2O (Online to Offline) sales game, as mentioned by their CEO.

“I want KIDO to restore its essence and scale. I look forward to the system of 12,000 miniBao stores selling Thọ Phát steamed buns and dim sum in the next few years,” said Mr. Tran Kim Thanh, Chairman of KIDO Group.

Not only KIDO but also large F&B manufacturers in Vietnam are eagerly awaiting the results of the MiniBao project to see if this ‘elder brother’ can solve the extremely difficult puzzle of building a distribution chain.

Retailers Collaborate to Promote Safe Food Business

In recent times, the food safety industry has witnessed significant growth and strong participation from various modern distribution chains, operating nationwide. This development has also brought about positive transformations in the traditional retail channel…