Following our reflection on the article “Easy-to-Open, Hard-to-Cancel Credit Cards”, many customers continued to share their own struggles with card cancellation.

Mr. Nguyen Nam, a resident of Ho Chi Minh City, shared that he applied for a credit card with a limit of VND 30 million at the request of a friend working at a joint-stock bank in the city. The application process was straightforward, requiring only his ID card, phone number, and proof of salary for the last three months.

After more than a week, Mr. Nam received his card and was instructed by his friend to top up VND 100,000 to activate it. As he had no spending needs for about two months, he decided to cancel the card through the bank’s app but was unsuccessful. When he contacted the customer service representative, he was directed to either visit a branch or call the hotline to process the cancellation.

Due to his busy schedule, Mr. Nam opted for the latter option and made multiple attempts to cancel through the hotline, to no avail. Eventually, he temporarily locked the card on the app to prevent potential misuse.

“Later, I received a notification from the bank about an annual fee of nearly VND 300,000. As I couldn’t figure out how to pay this fee and was worried about potential negative credit impacts, I visited a bank branch and was informed that I could only pay the annual fee there, and for card cancellation, I had to call the hotline or visit another branch in a different district,” Mr. Nam recounted.

Customers are left wondering why card issuance is swift, but cancellation is a lengthy and complicated process. On the bank’s app, users can only temporarily lock the card or disable online payment functions, not register for cancellation.

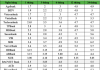

Many banks require card cancellation through hotlines instead of branch visits. |

According to the reporter’s investigation, the nature of credit cards, which allow spending now and paying later with an interest-free period of 45-55 days (depending on the card type), necessitates a review process with card organizations when a customer requests cancellation.

|

Why do many banks mandate card cancellation through hotlines instead of branch visits? Several banks explained that centralizing cancellation requests through hotlines is intended to provide customers with the convenience of handling the matter from the comfort of their homes or offices. This arrangement also aligns with the busy lifestyles of most card users, particularly the younger 8x and 9x generations, who often have limited time during regular business hours… |

A representative from one bank shared that when a customer’s credit card balance reaches zero and they wish to cancel, the card is temporarily frozen. To proceed with the cancellation, customers need to call the hotline, and the bank will review the card. If it meets the requirements, the card will be temporarily blocked, and within 30 days, it will be canceled.

This is a standard procedure across many banks to account for potential delays in transaction processing by intermediary payment organizations and system errors that may cause outstanding debt to be updated late.

An official from the card center of another joint-stock bank in Ho Chi Minh City added that their card cancellation process typically takes three business days. During this period, cardholders must settle all outstanding debts, including recent or pending transactions.

“For recent transactions, cardholders may need to wait a few days for the merchant’s bank (the bank that issued the card machine where the cardholder made the purchase) to settle the transaction with the card-issuing bank. This settlement process can take up to 30 days, as per the agreement between the parties,” the official explained.

|

Banks advise cardholders to pay attention to essential card information, including card features, statement closing date, payment timing and methods, applicable fees and their benefits (if any), a comprehensive fee schedule, and the mechanism for calculating interest on unpaid balances… |

Thai Phuong – Le Tinh