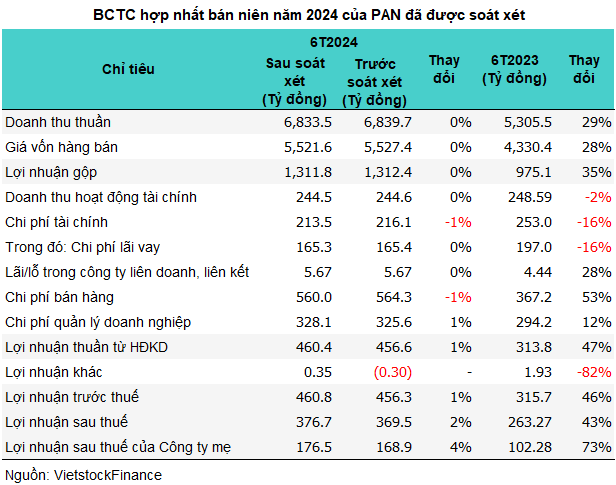

The increase in profits was attributed to PAN’s adjustment of financial and sales expenses, which amounted to VND 213.5 billion and VND 560 billion, respectively, a 1% decrease from the self-prepared report. Additionally, other income was recorded at nearly VND 350 million, compared to a loss of nearly VND 300 million before the review.

Following the review, half-year revenue remained unchanged from the self-prepared report, standing at over VND 6,800 billion, a 29% increase compared to the same period in 2023, and achieving 46% of the annual plan. The seafood and agriculture industries were the main drivers, contributing nearly VND 3,000 billion and over VND 2,800 billion in revenue, respectively, a 30% and 28% increase year-on-year. The food segment also performed well, generating over VND 1,000 billion in revenue, a 29% increase.

The growth in revenue contributed to improved profitability, with a net profit of VND 176.5 billion, a 73% increase compared to the first six months of 2023, surpassing 39% of the annual profit target.

As of June 30, 2024, The PAN Group’s total assets exceeded VND 23,300 billion, including nearly VND 11,700 billion in cash and financial investments. On the liabilities side, the group had nearly VND 15,000 billion in payables, of which financial borrowings accounted for nearly VND 12,800 billion.

In a separate development, on August 27, VFG – a member of The PAN Group – received a decision from the People’s Court of Khanh Hoa province approving the agreement between the parties involved in a commercial dispute over a joint venture contract at Hai Yen Company.

As a result, VFG and Fococev agreed to set Hai Yen Company’s charter capital at VND 60 billion, with VFG contributing 66.67% and Fococev the remaining 33.33%. VFG announced a change in its business model, with Hai Yen becoming a subsidiary. In 2024, Hai Yen’s business results will be consolidated into VFG’s financial statements.

|

In 2006, VFG and Centrimex jointly established Hai Yen Company to construct Novotel Nha Trang Hotel, with a charter capital of VND 60 billion. VFG held a 67% stake, while Centrimex owned the remaining 33%. Subsequently, the two parties agreed to increase Hai Yen’s charter capital to VND 90 billion. However, after the deadline for capital contribution commitments, Centrimex had only contributed VND 5.77 billion. To rescue Hai Yen and prevent the Novotel Nha Trang project from being revoked, VFG had to invest additional capital, leading to a dispute. The dispute was further prolonged due to the subsequent merger of Centrimex into Fococev. As a result, VFG was unable to consolidate the profits arising from the operation of Novotel Nha Trang Hotel into its financial statements, despite the hotel being in operation since November 2008.

|