Vietnam’s stock market traded in a tight range on August 28. The VN-Index edged slightly higher, gaining 0.88 points to close at 1,281.44. Foreign investors’ net selling of nearly VND 124 billion across all markets was a downside, marking the sixth consecutive session of net outflows.

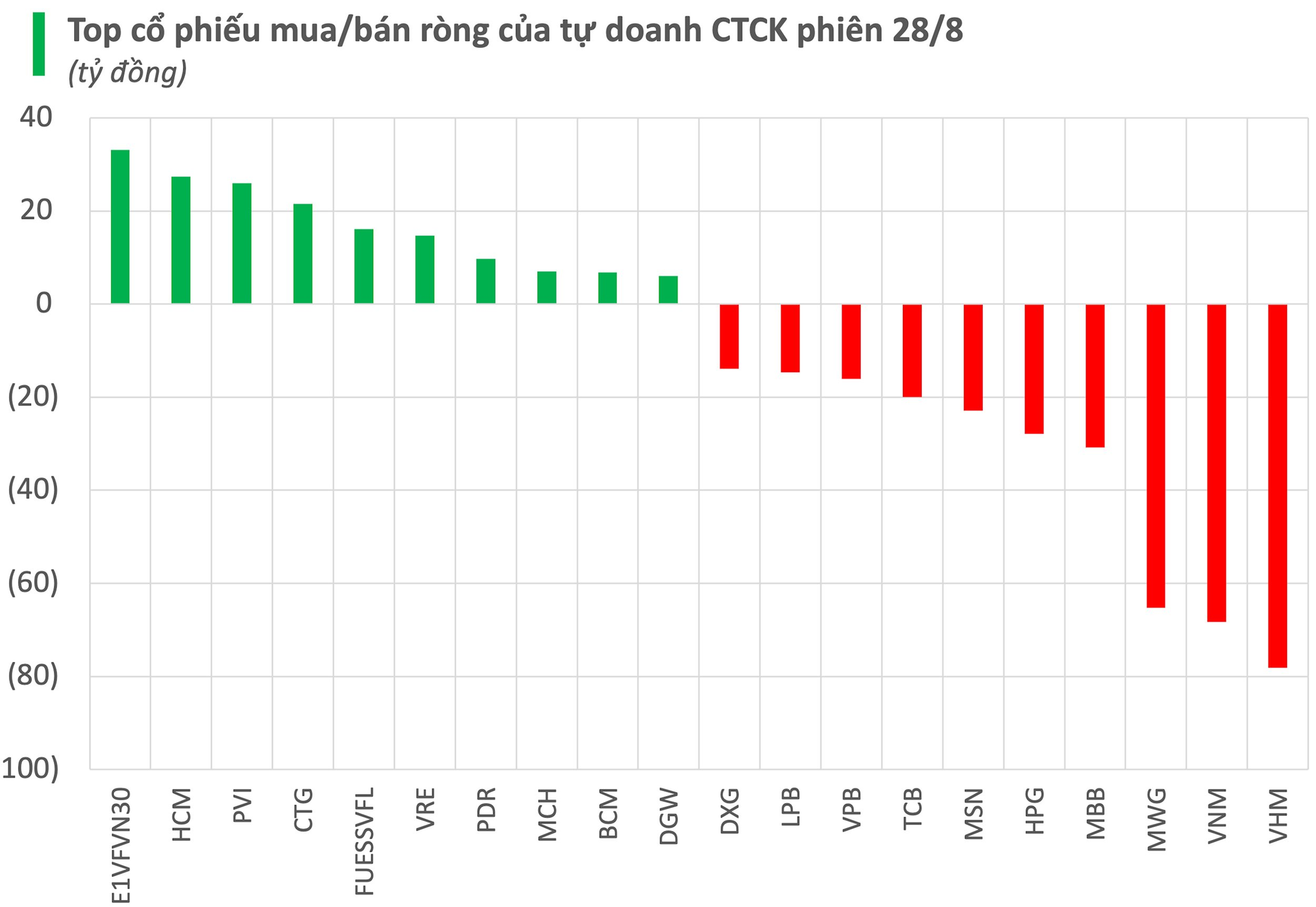

Securities companies’ proprietary trading recorded a net sell position of VND 251 billion across all markets.

On the HoSE, securities companies’ proprietary trading recorded a net sell position of VND 274 billion, including net selling of VND 325 billion on the matching order channel but net buying of VND 50 billion on the negotiated deal channel.

Specifically, VHM and VNM witnessed the largest net selling by securities companies, with respective figures of VND 78 billion and VND 68 billion. Other stocks that were net sold in the session included MWG, MBB, HPG, and MSN…

Conversely, the stocks that saw the largest net buying by securities companies were E1VFVN30 fund certificates (VND 33 billion), followed by HCM and CTG, with respective net buying figures of VND 27 billion and VND 22 billion. Other stocks that were net bought in this session included FUESSVFL, VRE, and PR…

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.