Mr. Nguyen Duy Linh, son of Chairman Nguyen Duy Hung, sells SSI shares, with the buyer possibly being a related organization of the SSI Chairman.

According to the transaction report, Mr. Nguyen Duy Linh’s sale of 47 million SSI shares through a matched bargain transaction took place between August 19 and August 23, 2024. These shares accounted for 3.1% of the capital of SSI Securities Corporation. Following this transaction, Mr. Linh no longer holds any SSI shares.

Notably, during the period when Mr. Linh executed his transaction, an organization related to Chairman Nguyen Duy Hung made a purchase of SSI shares.

Specifically, NDH Investment Company bought 32 million SSI shares from August 21 to August 23, 2024. After the transaction, NDH Investment’s ownership in SSI increased to over 126.2 million shares, corresponding to a holding of 8.354% of the capital.

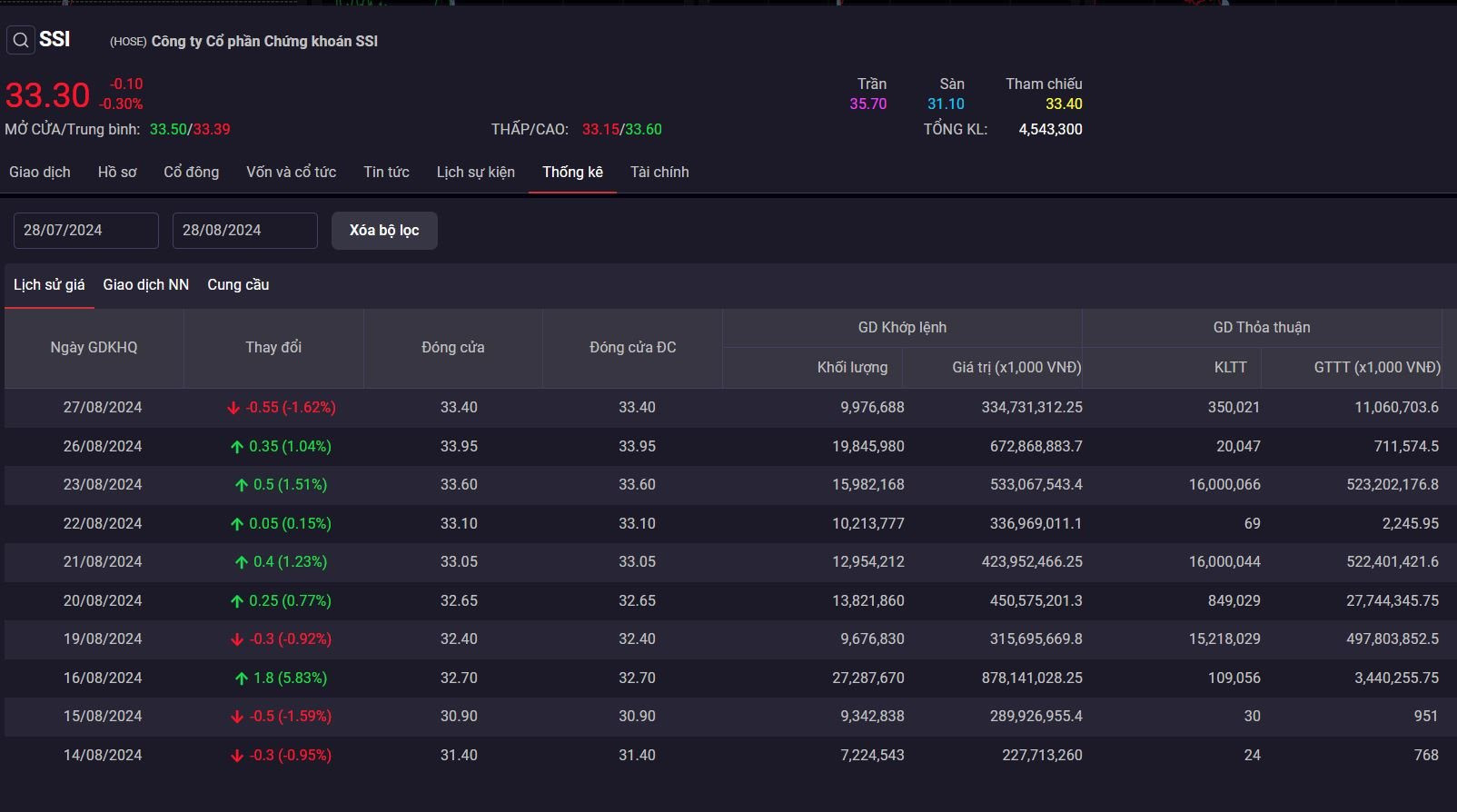

Statistics of SSI share matched bargain transactions. Source: SSI Iboard.

SSI shares witnessed large matched bargain volumes on August 19, August 21, and August 23, totaling the registered transaction volumes of Mr. Linh and NDH Investment. Market observers and investors in the stock market opined that this was likely a transfer deal from Mr. Linh to NDH Investment.

Mr. Nguyen Duy Hung is the owner and Chairman of NDH Investment, and another son of Mr. Hung, Mr. Nguyen Duy Khanh, is the General Director of the company.

Mr. Hung personally holds more than 11.6 million SSI shares (0.773% of capital), and Mr. Khanh holds nearly 3.5 million SSI shares (0.232% of capital). In total, the group related to the Chairman of SSI’s Board of Directors, Nguyen Duy Hung, owns 141.4 million shares of SSI Securities, equivalent to 9.359% of the capital.

During the period when Mr. Linh sold his shares, SSI’s average closing price was around VND 33,000 per share. Mr. Linh’s transaction was estimated to be worth nearly VND 1,550 billion.

Regarding NDH Investment, their transaction was estimated at approximately VND 1,065 billion. As of August 28, SSI is trading at VND 33,300 per share.

In terms of business results, for the first six months of 2024, SSI is estimated to have earned more than VND 2,000 billion in consolidated pre-tax profits, achieving nearly 60% of its annual profit target. The securities services segment accounted for the largest proportion of total revenue, at 47%.

Consequently, in the second quarter alone, the securities company chaired by Mr. Nguyen Duy Hung recorded a total revenue of approximately VND 2,311 billion, a 44.5% increase compared to the same period last year, and a pre-tax profit of approximately VND 1,041 billion, a 59% increase year-on-year.

SSI estimated its consolidated revenue to be VND 2,368 billion and pre-tax profit to be VND 1,060 billion. Cumulatively, for the first six months, the company is estimated to have achieved VND 4,381 billion in total revenue and VND 2,002 billion in pre-tax profit, completing 54% and 59% of its annual plans, respectively.

In 2023, SSI’s total assets were recorded at VND 69,241 billion, a 32.6% increase compared to 2022, maintaining its top position in the securities industry in terms of asset scale.

Net revenue reached VND 7,281 billion, a 11.5% increase, while pre-tax profit was VND 2,849 billion, a 35% increase compared to 2022, surpassing the targets set by the General Meeting of Shareholders by 105% for revenue and 112% for profit.

Strongest weekly gain for VN-Index in 14 months

The 3.82% increase of VN-Index in the past week is the highest since January 2023, thereby pushing Vietnam market’s PE valuation to 16.2 times.