At the conference to solicit opinions on the draft amendment and supplementation of several articles of the Health Insurance Law, on August 29, Ms. Tran Thi Trang, Director of the Health Insurance Department (Ministry of Health), said that this draft amendment of the Health Insurance Law focuses on adjusting 4 policies.

The Ministry of Health proposes additional benefits for insured patients at the grassroots level

Proposing to Supplement Benefits for Health Insured Patients

That is to adjust the subjects of health insurance participation in synchronization with the relevant legal regulations; adjust the scope of health insurance benefits in accordance with the contribution level, balancing the health insurance fund, and health care requirements in each period…

According to Ms. Trang, more than 40% of the health insurance fund’s revenue comes from the state budget, which is used to purchase and grant health insurance cards to the poor, children under 6 years old, near-poor households, and policy beneficiaries…

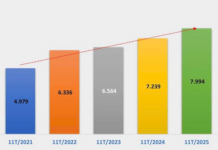

The fund’s revenue reached VND 126,000 billion/year (in 2023). This revenue has increased since July this year due to the increase in basic salary. Currently, the health insurance fund has a surplus of about VND 40,000 billion.

With this surplus, the Health Insurance Law draft proposes to add more benefits for patients, including technical treatment services that have not been implemented locally. Patients can go directly to higher levels for treatment and still enjoy full benefits without having to request a transfer letter.

The provincial Department of Health is responsible for publishing lists of medical services that the locality has not yet implemented, based on the actual assessment and granting of practice licenses, so that people can proactively go to higher levels when they get sick.

In addition, in the context of drug and medical supply shortages at public hospitals, which forces health insurance patients to purchase them themselves, the Health Insurance Law draft proposes that hospitals will pay patients first, and then these costs will be settled by the health insurance fund.

The Ministry of Health also proposes to adjust some contents related to professional techniques, especially regulations on transferring patients between medical facilities and settling treatment costs related to patient transportation.

Currently, the health insurance fund pays for the transportation of patients from the district to the province and from the province to the central level, while the transportation of patients between facilities of the same level and the same professional technique is not paid. Therefore, the Ministry of Health proposes that patients who are indicated for transfer to another facility will be covered by health insurance.

According to Ms. Trang, the Ministry of Health proposes to adjust benefits while balancing contributions and health care requirements in each period. This time, it is proposed to adjust some benefits without abnormally increasing costs from the health insurance fund.

The Health Insurance Fund is Spending More than it Takes in

Commenting on the expansion of the scope of benefits when examining and treating health insurance, Mr. Nguyen Tat Thao, Deputy Head of the Health Insurance Policy Department (Vietnam Social Security), said that the Ministry of Health needs to have a comprehensive assessment, and each extended policy will increase the health insurance fund’s expenditure. How much, ensuring a balance between revenue and expenditure of the health insurance fund.

VSS representative proposed a comprehensive assessment when expanding health insurance fund spending

Regarding the revenue and expenditure of the health insurance fund over the years, Mr. Thao said that in the period 2005 – 2009, the settlement of medical examination and treatment costs for health insurance was according to the service fee, without a payment ceiling and co-payment, the health insurance fund had a deficit of more than VND 2,000 billion.

Years 2009 – 2015: Adjusted to increase the contribution rate from 3% to 4.5% of the basic salary; there is a regulation on the payment ceiling and co-payment, the health insurance fund has balanced revenue and expenditure.

Years 2016 – 2023: Medical service prices are adjusted, including the salary structure of medical staff, expansion of the drug list, and the increase in the number of medical examinations and treatments after the COVID-19 pandemic, the fund has been imbalanced in revenue and expenditure.

Only the 3 years 2020 – 2022 had a large surplus due to the COVID-19 pandemic. In the 3 years of the pandemic, the health insurance fund had a surplus of more than VND 33,000 billion due to the sharp decrease in the number of examinations, lack of drugs and medical supplies, so the payment decreased. The rest of the years are mostly negative. Currently, the total health insurance fund surplus is VND 40,000 billion.

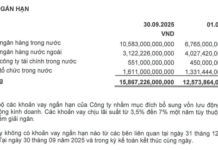

The Social Security representative said that if the management cost structure is included in the medical service price, the expenditure will increase by about VND 2,500 billion/year. If the cost of equipment depreciation and fixed assets is included in the medical service price, the health insurance fund will increase its expenditure by about VND 67,000 billion.

For example, in 2023, the high number of medical examinations and treatments led to expenditure exceeding revenue by more than VND 10,000 billion. Therefore, the Ministry of Health should consider the balance between revenue and expenditure when expanding the rights and interests of health insurance patients.

Consider Adjusting Benefits for Cancer Patients

Regarding the settlement of health insurance for diseases with high treatment costs such as critical illnesses and cancer, Ms. Tran Thi Trang said that currently, there are about 76 drugs for cancer treatment and immune regulation in the list of drugs covered by health insurance. These drugs are costing about VND 7,600 billion/year for treatment. This is a great benefit for patients.

The current regulations stipulate the rate of health insurance payment for patients (benefit rate) equally for all diseases, with no specifics for any disease. For cancer, there are some new treatments that are very expensive, so the health insurance fund is very difficult to pay immediately or 100%.

In the future, the Ministry of Health will build a list of drugs updated in the list of drugs covered by health insurance on the basis of assessing the impact and balancing the revenue and expenditure of the health insurance fund, to increase benefits for patients.

In the long term, the representative of the Ministry of Health also recommended that people screen for diseases early, detect and treat them early, and at the same time reduce the use of high-risk factors leading to cancer, such as smoking, alcohol use, and unhealthy eating habits…

Special privileges only for those who have been contributed to health insurance for 5 consecutive years to be implemented by 2024

Continuous health insurance for 5 years is when a person has been enrolled in health insurance for a continuous period of 5 years or more, with a maximum interruption of no more than 3 months. By participating in health insurance for the required 5-year period, individuals will be entitled to various benefits.

Proposed Addition of Mandatory Health Insurance Coverage for Specific Individuals

As per the proposal from the Ministry of Health, individuals with employment contracts lasting for at least 1 month will be required to contribute to the health insurance scheme, instead of the current requirement of “3 months”.