|

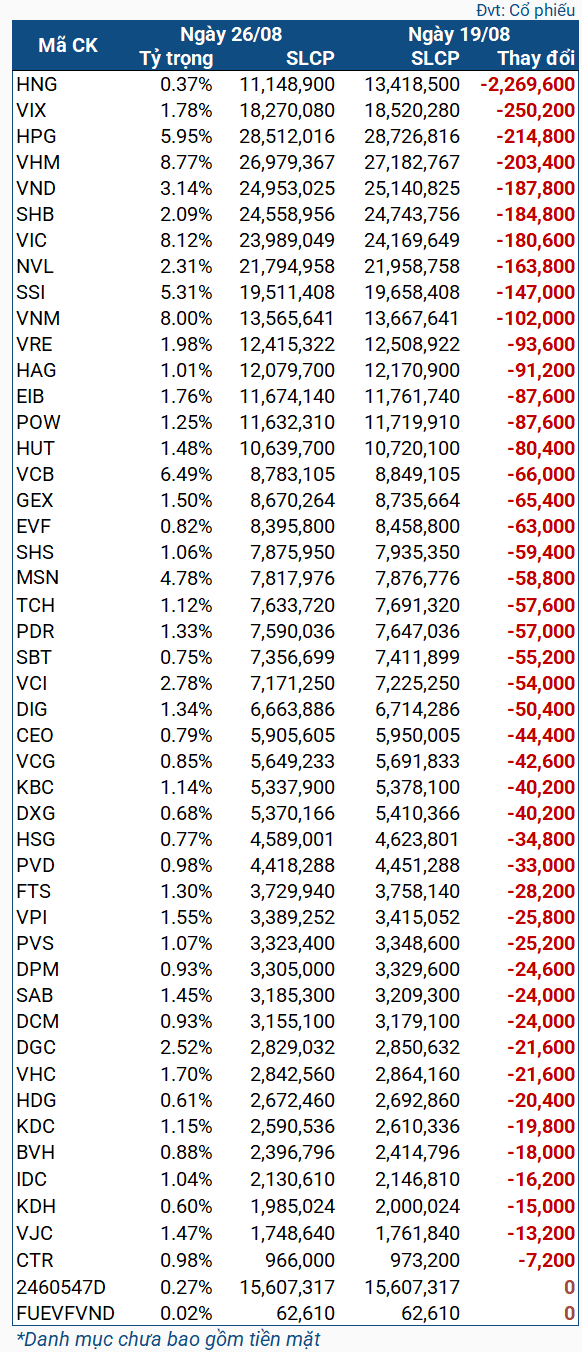

Changes to VNM ETF Stock Holdings During the Period from 08/19/2024 to 08/26/2024

|

HNG was the stock that VNM ETF offloaded the most during this period, with a volume of nearly 2.27 million shares. This number far exceeded that of VIX, which came in second with 250,200 shares sold. Additionally, HPG and VHM also witnessed sales of over 200,000 shares during this timeframe.

In the case of VIX, despite the significant selling, VNM ETF currently holds 15.6 million warrants for this stock (2460547D), which are part of VIX’s share offering to existing shareholders to raise capital. The exercise ratio is 100:95, meaning one share warrants the purchase of 95 new shares. With these warrants, VNM ETF will be entitled to purchase approximately 14.8 million VIX shares in the future.

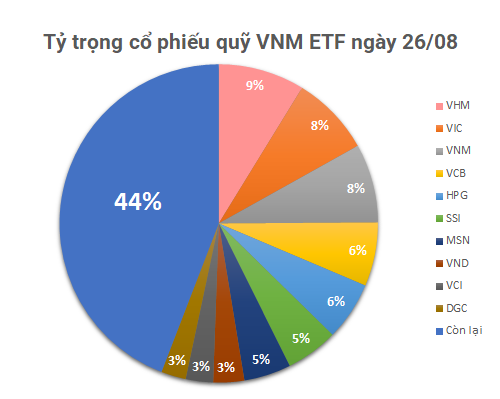

As of August 26, the net asset value of VNM ETF exceeded $500 million, up from $496 million on August 19. The entire portfolio comprises Vietnamese stocks, with the top weights assigned to VHM (8.77%), VIC (8.12%), VNM (8%), VCB (6.49%), and HPG (5.95%).