LDG Joint Stock Investment Company (stock code: LDG-HOSE) has announced its audited and unaudited semi-annual financial statements for 2024.

The company’s net profit after tax for the first six months of the year showed a significant increase of VND 100.1 billion, or 34.3%, compared to the previously published figures. This change is a result of the current auditors’ adjustments to the provisions for doubtful accounts receivable and financial investments in the audited standalone financial statements for the second quarter of 2024.

The net profit after tax in the audited consolidated financial statements for the same period also increased by VND 100 billion, equivalent to 33.8%. This adjustment was mainly due to the current auditors’ decision to increase the allowance for doubtful accounts receivable compared to the previous consolidated financial statements for the second quarter of 2024.

As of June 30, 2024, the inventory balance of the Tan Thinh Residential Area Project was VND 516,861,733,495. The company is committed to completing all procedures in accordance with the laws of land, real estate business, and construction. This is based on Conclusion No. 01/KL-UBND dated March 23, 2023, by the People’s Committee of Dong Nai province regarding the comprehensive inspection of the Tan Thinh Residential Area Project in Tan Dong, Trang Bom district, Dong Nai province. The goal is to resume and complete the project.

LDG believes that the Tan Thinh Residential Area Project will continue to receive the necessary approvals to move forward, ending the interruption caused by the inspection.

On July 22, 2024, the People’s Court of Dong Nai province issued Decision No. 01/2024/QD-MTTPS to initiate bankruptcy proceedings against the company, following a request from Phuc Thuan Phat Trading and Construction JSC. However, on August 13, 2024, the Ho Chi Minh City High People’s Court decided to accept the petition for review and revoke the previous decision made by the People’s Court of Dong Nai province.

Regarding this matter, LDG stated that they are working closely with the contractor to finalize the necessary documents to fulfill the payment requirements as per the agreed-upon terms between the two parties.

LDG also addressed the investigation of Mr. Nguyen Khanh Hung, former Chairman of the Board of LDG, and Mr. Nguyen Quoc Vy Liem, former Deputy General Director, for alleged “deceptive customer” practices related to the Tan Thinh Residential Area Project. The company assured that this situation does not alter or impact their business plans, strategies, operations, or investments. LDG pledged to make every effort to stabilize all business activities and protect the rights and interests of customers, shareholders, and partners.

Additionally, LDG mentioned their ongoing efforts to implement various solutions and plans to address their cash flow issues. These include asset and project restructuring, project development collaborations, project transfers, and sales of shares held by the company or its subsidiaries to meet financial obligations, such as bond, bank, and other debts. This ensures the availability of funds for project development.

LDG has successfully recovered all loaned amounts, and they are in the process of collecting outstanding receivables as they become due according to the agreed-upon repayment schedules.

The company is actively negotiating with banks to restructure and extend the repayment schedules for their loans. Specifically, on July 30, Sacombank – Branch of District 11, agreed to extend the repayment period by an additional 12 months.

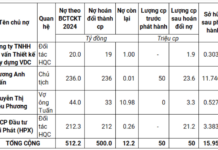

LDG is also in discussions with bondholders to extend the debt obligations. The principal amount of VND 180 billion in bonds will be fully repaid once the corresponding interest is paid. The company plans to fulfill its remaining bond obligations by the end of 2024.

Optimizing the value of the company’s existing real estate assets in Ho Chi Minh City, Dong Nai, and Binh Duong provinces is another key strategy.

LDG will continue to implement cost-cutting measures, optimize operating expenses, enhance debt collection efforts, and reinvest in potential projects. They will also focus on diversifying their capital sources through the stock market and credit institutions, as well as negotiating with key partners to supplement their operating capital for business operations, debt repayment, financial restructuring, and strengthening their financial capabilities.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.