Market participants have witnessed numerous volatile sessions in the past two months. Notably, the VN-Index plummeted 48.5 points on August 5th. Prior to that, the index dropped 24.6 points on August 1st, lost 22.8 points on July 23rd, and previously fell 28.2 points on June 24th.

The frequency of these recent ups and downs can easily mislead people when assessing the actual stock volatility. The increasing participation of individual investors, along with the withdrawal of foreign investors, also contributes to the perception of a more erratic market.

However, data from VietstockFinance presents a different picture: During the last three years – despite market fluctuations with a 33% drop in 2022, followed by a 27% gain from the beginning of 2023 until August 2024 – stock volatility has been lower than in other periods.

|

Normal Volatility

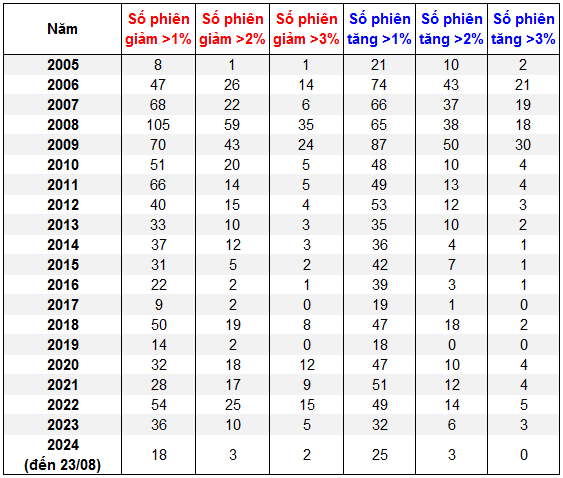

2020-2024 has seen more frequent occurrences of volatile sessions compared to the calmer period of 2016-2019, but it’s not the most volatile era yet. Data as of the close of August 23, 2024 – Source: VietstockFinance

|

Observing the frequency of volatile sessions over the past 20 years, the period from 2006 to 2009 was the true “seismic” era for Mr. Market. The occurrences of extremely volatile sessions – with the VN-Index rising or falling more than 3% in a single session – were much more frequent during those years.

2006-2009 was a period when the market experienced a stock bubble, peaking in early 2007, and then bursting as the economy faced intractable internal issues such as uncontrolled credit growth and runaway inflation, coupled with the global financial crisis.

The market became calmer from 2010 onwards (based on the statistical frequency of volatile sessions) until the period of 2020-2022, when stocks fluctuated with the unexpected risks brought about by the COVID-19 pandemic, the wave of individual investors entering the market, and the bond-real estate crisis that occurred two years ago, causing volatility to rise again.

|

The Bubble

In the three years from 2006 to 2008, the VN-Index surged nearly 300% and then plunged back to its starting point. Source: VietstockFinance

|

If we consider a longer time frame than individual sessions, the current stock volatility pales in comparison to the choppy market of 2014-2015. During those two years, the VN-Index went through five impressive waves before entering a prolonged bull market from 2016 onwards.

|

Surfer’s Paradise

The Choppy Market of 2014-2015 saw the VN-Index oscillate within a range of 510-640 points. Source: VietstockFinance

|

So, why do we perceive the 2024 market as highly volatile, even the most unpredictable ever, when it’s not? The culprits could be psychological traps that most people fall into.

While volatility is inherent in the market, people tend to overemphasize recent events while neglecting the past or future possibilities. This psychological trend, known as the recency effect, can cause investors to be overly influenced by new events, leading to an inaccurate assessment of their importance relative to similar historical occurrences.

However, it is a fact that frontier stock markets like Vietnam also tend to be more volatile than more developed markets, partly due to the unstable psychology of participants.

A classic example is Monday, August 5th, when global stocks wobbled due to carry-trade risks, and the Vietnamese market also witnessed a sharp decline. Although the causality was not clear, individual investors, who dominate daily trading, tend to have poor psychological control.

Carry Trade Japanese Yen: From “Money Printer” to Global Market Nightmare

What is Carry Trade and Why Does it Concern Global Investors?

Another issue is the lack of belief in the stock market as a long-term investment opportunity among Vietnamese individual investors. Instead of considering stocks as a long-term asset accumulation like real estate or gold, the majority of individual investors focus on short-term trading and the high liquidity of stocks.

This preference for short-term trading increases market volatility, as holders will quickly sell off stocks when unexpected negative events occur, regardless of the relevance of these events to the asset’s intrinsic value.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.