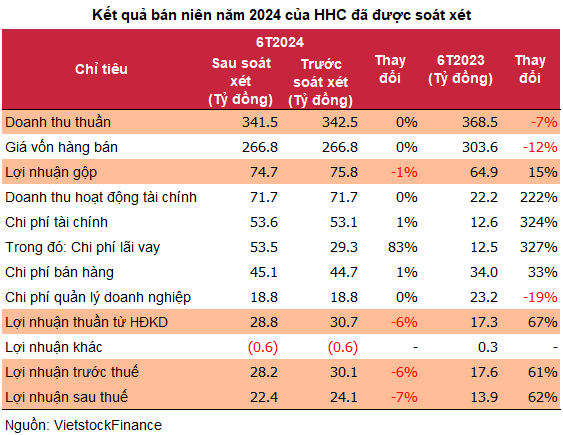

Following the review, interest expenses increased by 24 billion VND, reaching 53.5 billion VND, an 83% deviation from the self-prepared report. Additionally, selling expenses inched up by 1% to over 45 billion VND.

Meanwhile, net revenue slightly dipped to 341.5 billion VND, while cost of goods sold remained unchanged, leading to a gross profit of below 75 billion VND. The gross profit margin stood at 21.8%.

Compared to the same period in 2023, semi-annual revenue decreased by 7%, but net income surged by 62%, mainly due to increased financial income, with revenue in this segment reaching nearly 72 billion VND, more than 3.2 times higher.

For 2024, the company aims for 1,200 billion VND in revenue and 70 billion VND in pre-tax profit, representing a 22% and 8% year-over-year increase, respectively. As of the six-month results, the company has achieved over 40% of its annual pre-tax profit target, surpassing 28 billion VND, while only attaining a quarter of its revenue target.

As of June 30, 2024, HHC’s total assets exceeded 1,600 billion VND, with accounts receivable accounting for over 1,200 billion VND. In contrast, cash and bank balances stood at just over 16 billion VND. On the liabilities side, total liabilities neared 1,000 billion VND, including financial debt (comprised entirely of bank loans) of 167 billion VND.

In a related development, Hai Ha Confectionery received an administrative penalty decision for tax violations during the 2021-2022 inspection period from the Hanoi Tax Department. Consequently, the company is required to pay administrative fines, back taxes, and late payment fees totaling over 1.32 billion VND.

This penalty stems from HHC’s improper value-added tax deductions involving invoices from inactive units and unreasonable or ineligible expense invoices. Additionally, the company failed to adjust cost of goods sold corresponding to reduced revenue from returned goods and recorded ineligible expense invoices.

The decision came into effect on August 26, 2024.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.