According to IVB, the debt obligations of JSC Electrical and Water Installation and Construction No. 2 at this bank as of August 6, 2024, amounted to VND 41.5 billion. This includes principal debt of VND 20.428 billion, interest due of VND 1.17 billion, interest on overdue principal of VND 19.71 billion, and interest on overdue interest of nearly VND 200 million.

The first collateral for this debt is the land-use right of the Cowa Tower project, located at 199 Ho Tung Mau, Cau Dien, Nam Tu Liem, Hanoi. This includes two floors of commercial services, two basements, one technical floor, and five apartments.

Cowa Tower Project

The second collateral for the debt is the first and mezzanine floors of unit A102 in the D5 Cau Giay New Urban Area project (Dich Vong ward, Cau Giay district, Hanoi).

The third collateral is a house and land located at 65 Le Hong Phong street, Dien Bien ward, Ba Dinh district, Hanoi.

IVB stated that the bank is selling the debt in its current state, including all rights and interests attached to the debt that IVB holds over the borrower. This encompasses the right to handle secured assets and other related rights and interests as stipulated by law, as well as any benefits and obligations before, during, and after the debt sale.

The debt sale price is equivalent to the total debt obligations of JSC Electrical and Water Installation and Construction No. 2 at IVB at the time of the debt sale contract signing, tentatively calculated as VND 41.5 billion as of August 6, 2024.

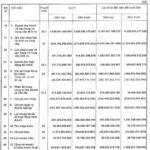

Surging Profits from Associated Joint Venture, Nam Long (NLG) Reports After-Tax Profit of over 800 billion VND in 2023

According to NLG, the primary revenue for the entire year came from the sale of houses and apartments, from two major projects Izumi and Southgate. Additionally, in the third quarter, NLG also had the Mizuki project, which was a significant handover project.