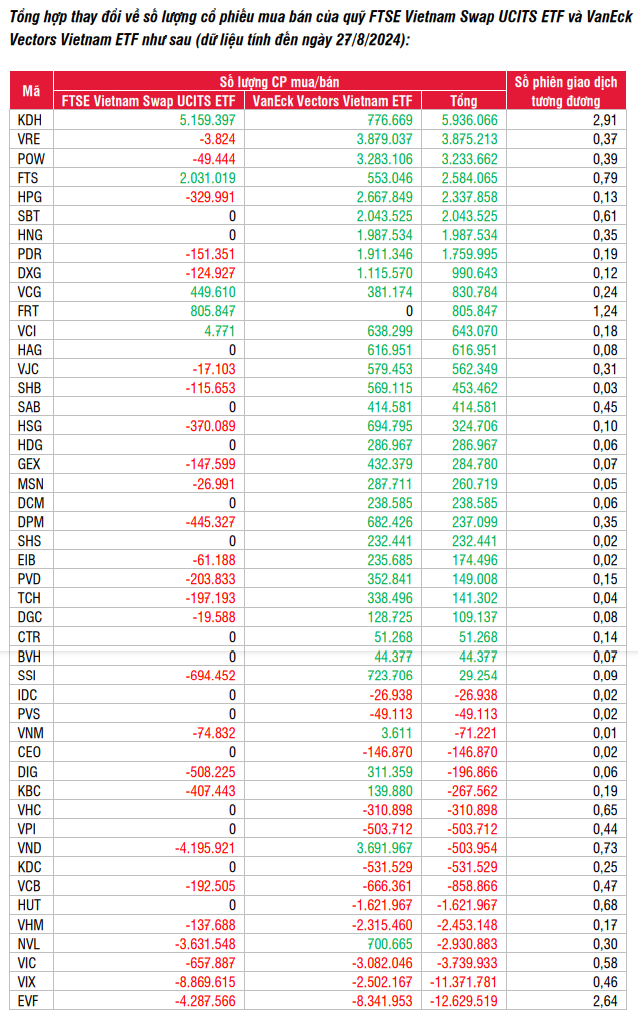

The latest report by SSI Research, based on data as of August 27, predicts significant changes in the investment portfolios of the two reference indices: FTSE ETF and VNM ETF.

1. FTSE Vietnam Index (FTSE ETF)

For the FTSE Vietnam Index, three stocks, KDH, FRT, and FTS, are likely to be added to the index. KDH has met the foreign ownership limit criterion, while FRT and FTS have satisfied the liquidity requirements. On the other hand, EVF may be removed due to failing to meet the free-float ratio and free-float market capitalization conditions. After these changes, the FTSE index portfolio is expected to comprise 30 stocks.

The total assets of the FTSE Vietnam Swap UCITS ETF stood at VND 7,377 billion as of the report, a 16% decrease from the beginning of the year. The fund experienced net outflows of VND 1,243 billion. SSI Research estimates that the fund will purchase approximately 5.1 million KDH shares, 805,000 FRT shares, and 2 million FTS shares, while selling about 4.29 million EVF shares.

2. MarketVector Vietnam Local Index (VNM ETF)

For the VNM ETF, no new stocks are predicted to be added, while EVF is also at risk of removal due to failing to meet the free-float market capitalization requirement. After adjustments, this index is expected to consist of 45 tickers.

The total assets of the VNM ETF on the reporting date reached VND 12,438 billion, a 5.1% decline from the start of the year. Net outflows were recorded at VND 316 billion. During this restructuring, the fund is expected to sell approximately 8.3 million EVF shares.

Based on the above forecasts, SSI Research estimates that these two funds, valued at nearly VND 20,000 billion, will buy more than 5.9 million KDH shares, 3.9 million VRE shares, and 3.2 million POW shares. Conversely, approximately 12.6 million EVF shares and 11.4 million VIX shares may be sold during this review.

Vu Hao

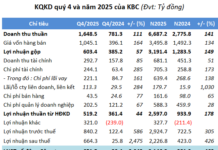

Khang Dien (KDH) guarantees a loan of 4,270 billion VND for its subsidiary company.

Khang Dien’s Board of Directors (KDH) has recently approved the full and timely guarantee of the entire debt obligation amounting to 4,270 billion VND of its subsidiary, Khang Phuc, at Vietinbank.