The Ministry of Finance proposes to expand the investment restriction ratio for public funds.

Currently, according to Article 110 of the 2019 Securities Law, securities investment fund management companies (FMCs) are not allowed to use the capital and assets of public funds to invest in securities of a single issuer exceeding 10% of the total value of the circulating securities of that organization, except for government bonds.

In addition, FMCs are also not permitted to use the capital and assets of public funds to invest more than 30% of the total assets of the public fund in companies within the same group of companies with ownership relationships (parent companies, subsidiaries; companies owning over 35% of each other’s shares; a group of subsidiaries with the same parent company)

According to the Ministry of Finance, the majority of public funds have complied well with the investment limit regulations in the Securities Law. However, in practice, there have been two limitations:

First, some funds have almost reached or exceeded the passive investment limit due to unfavorable market conditions and a decrease in net asset value (NAV), resulting in funds passively breaching the limit set by Article 110 of the Securities Law.

Being forced to sell to ensure compliance with legal ratios may impact investment performance, as sales occur when the market is unfavorable.

Second, passive limit breaches also occur with ETFs in the current phase. In reality, when the scale of some issuers (issuers with securities belonging to the reference index) is small compared to the growing scale of ETFs, the fund will passively breach the above-mentioned 10% limit.

A characteristic of ETFs is passive investment according to the securities portfolio of the index and the proportion of each security in the index. In such cases, the fund is forced to reduce its scale to avoid violating the investment limit, causing damage to the fund’s investment activities. The fund will also have to stop issuing additional fund certificates to investors, thereby affecting investors’ interests.

To overcome these limitations, the Ministry of Finance proposes, in the draft amendment to certain articles of the Securities Law that is currently collecting opinions, to expand the investment limit of funds from 10% to 15% for investment in securities of a single issuer and from 30% to 35% for investment in companies within the same group of companies with ownership relationships.

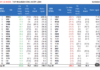

As of June 30, 2024, according to the Ministry of Finance’s summary of the implementation of the Securities Law, there are 43 operating FMCs and 116 established investment funds, including 34 member funds, 3 closed-end funds, 62 open-end funds, 16 ETFs, and 1 real estate fund.

The total assets under management (AUM) at FMCs as of June 30, 2024, are estimated at VND 696 trillion, a 4% increase compared to the end of 2023. The total post-tax profit of FMCs until the end of 2023 is estimated at VND 1,100 billion.

For securities investment funds, the total NAV as of June 30, 2024, is about VND 76,000 billion, an increase of VND 8,000 billion compared to the end of 2023.

What Are the Two FPT Family Stocks Likely to be Included in the $1 Billion Foreign ETF Basket in the Q3 Review?

The latest quarterly portfolio reshuffle witnessed a substantial accumulation of tens of millions of shares in the banking and securities sectors.