The cement industry faced a challenging year in 2023, with a decline in domestic and export channels impacting production and business operations. For the first time in a decade, domestic consumption fell below 60 million tons per year, a decrease of approximately 9.4% from 2022.

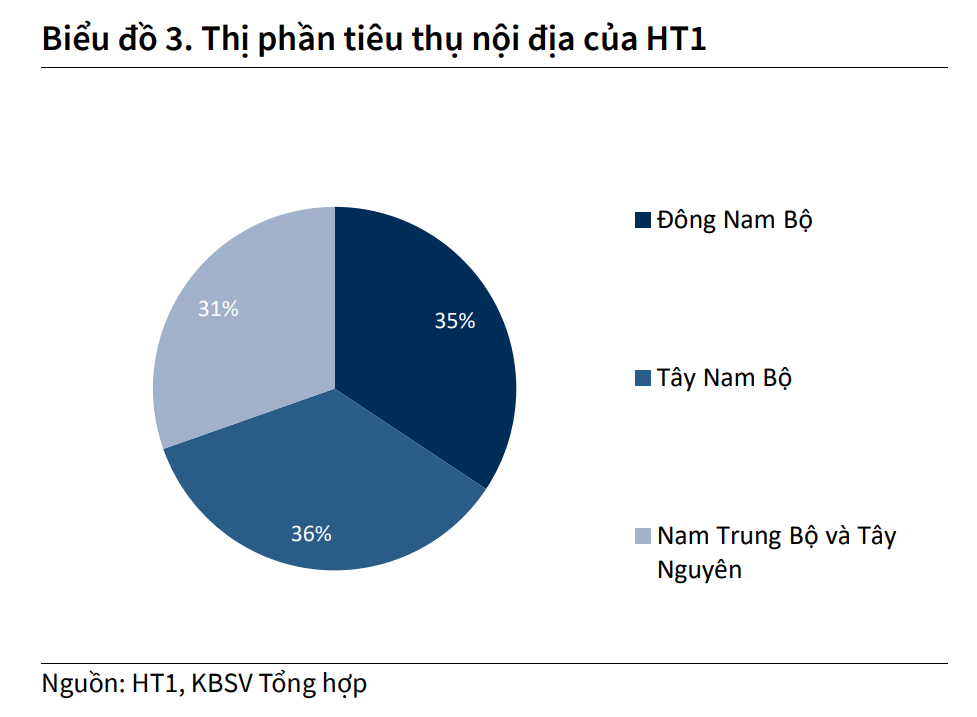

As a leading company in the industry, VICEM Ha Tien Joint Stock Company (HT1) also felt the market’s impact. HT1 is the largest cement producer under the VICEM Corporation, with a designed capacity of 7.5 million tons of cement per year. Since its establishment in 1964, its products, bearing the famous Green Unicorn logo, have been used in most civil and industrial projects throughout the South, giving it the highest market share in the region.

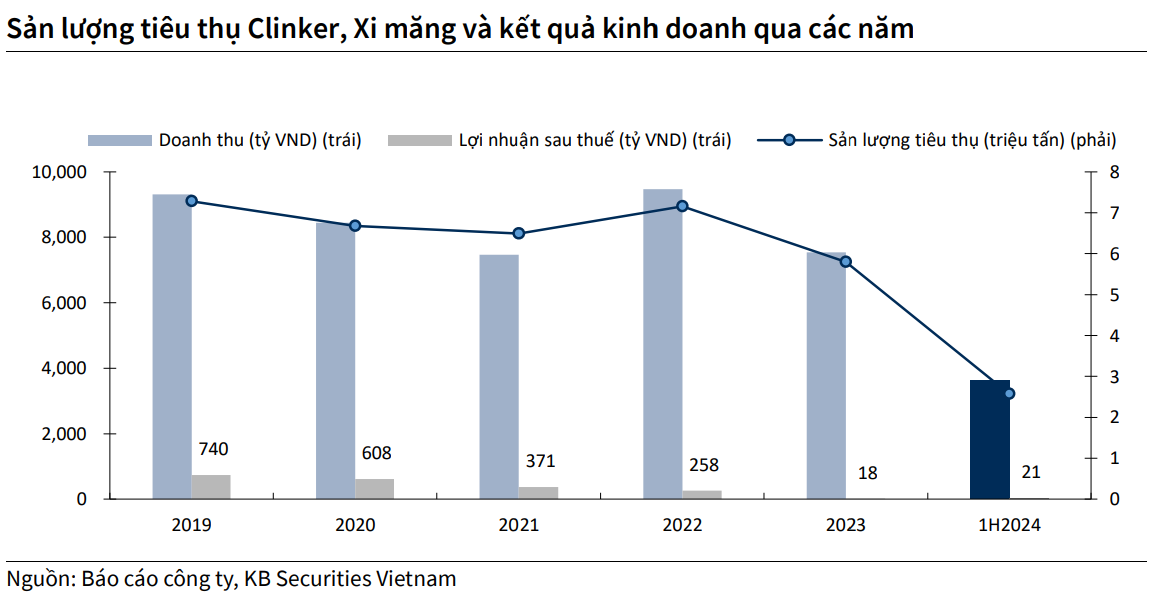

According to HT1’s semi-annual reviewed report for 2024, the company’s revenue for the first six months reached VND 3,400 billion, a decrease of more than VND 280 billion compared to the previous year. However, its after-tax profit was VND 21.2 billion, a significant increase compared to the loss of VND 27 billion in the same period last year.

What Opportunities Lie Ahead for VICEM Ha Tien?

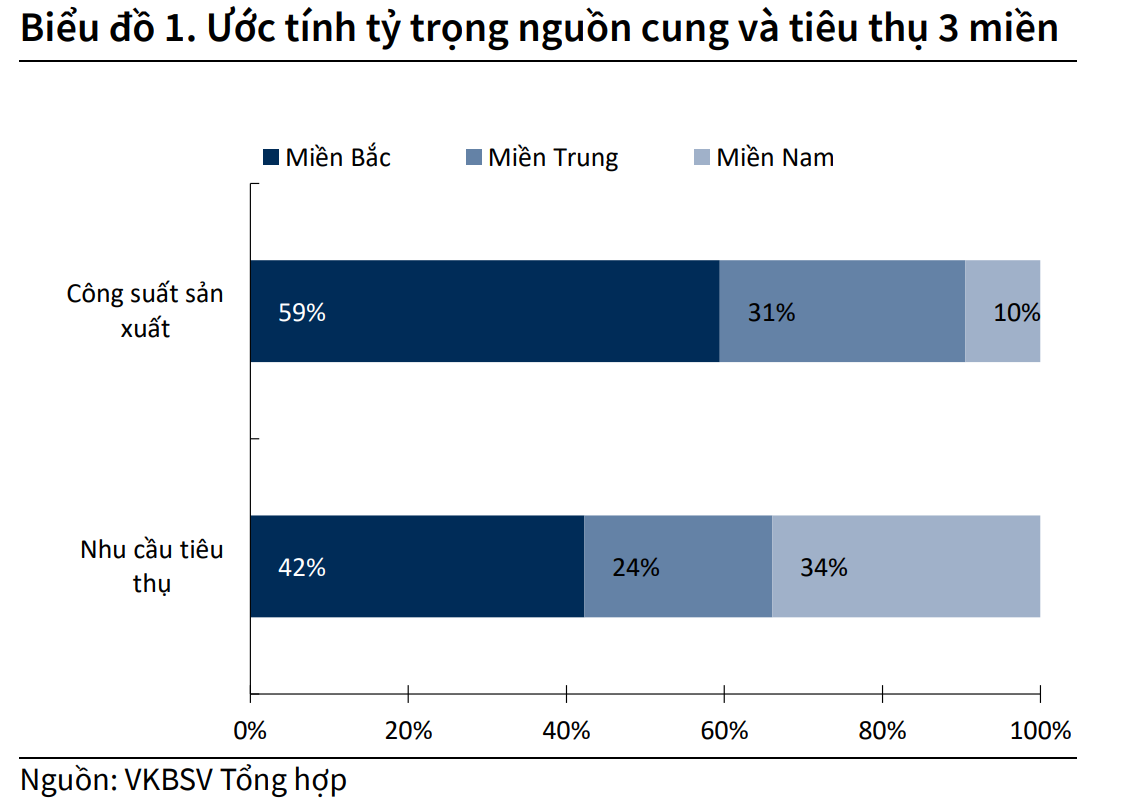

The Vietnam Cement Association (VNCA) assesses that the production capacity of enterprises in the South only meets 40-60% of the annual demand, in stark contrast to the North due to the concentration of clay and limestone mines in the North and North Central regions.

With the highest market share (34.7%) and coverage (5 factories) in the South, KB Vietnam Securities Company (KBSV) believes HT1 has a significant competitive advantage in ensuring output compared to regional rivals, especially those in the North.

KBSV notes that HT1 is shifting a portion of its output towards infrastructure and industrial construction, expecting to offset some volume from public investment projects accelerating from now until 2025 (the final year of the medium-term public investment plan) in the South.

According to the company’s management, HT1 has participated in supplying 50-100% of the cement volume for most of the region’s key infrastructure projects, including the Long Thanh Airport. The second half of the year will see an acceleration in construction progress, and KBSV projects HT1’s cement consumption in Q3 and Q4 to reach 3.1 million tons (up 19%), bringing the total cement consumption for 2024 to approximately 5.6 million tons (up 8.4%).

In 2023, the company introduced its new, independently-branded, low-cost cement product, Power Cement, to compete directly with low-cost cement brands that have been eating into the market share of enterprises. This new product is also expected to boost sales as factories lower prices to stimulate demand. Power Cement’s consumption is projected to reach about 600,000 tons in 2024.

According to VNCA, HT1 is transitioning by utilizing alternative materials and waste heat from exhaust gas to optimize production costs. The early adoption of auxiliary technology is expected to bring advantages in the future. The company shared that the utilization rate of alternative materials currently exceeds 20%, especially at the Kien Luong plant, where it is over 40%, resulting in expected material cost optimization of about 3-5%, equivalent to VND 150 billion per year.

Additionally, the BOT Phu Huu project is expected to commence operations in Q3/2024, with a concession period of 24 years, following the approval of the maximum toll fee by the HCMC People’s Committee.

At the 2024 Annual General Meeting of Shareholders, Vicem Ha Tien announced the bidding and construction of an automatic non-stop electronic toll collection system starting on March 20, 2024, with expected completion in May 2024. KBSV stated that if the project operates in the last two quarters of 2024, it will contribute about VND 24 billion to HT1’s consolidated profit for the year.

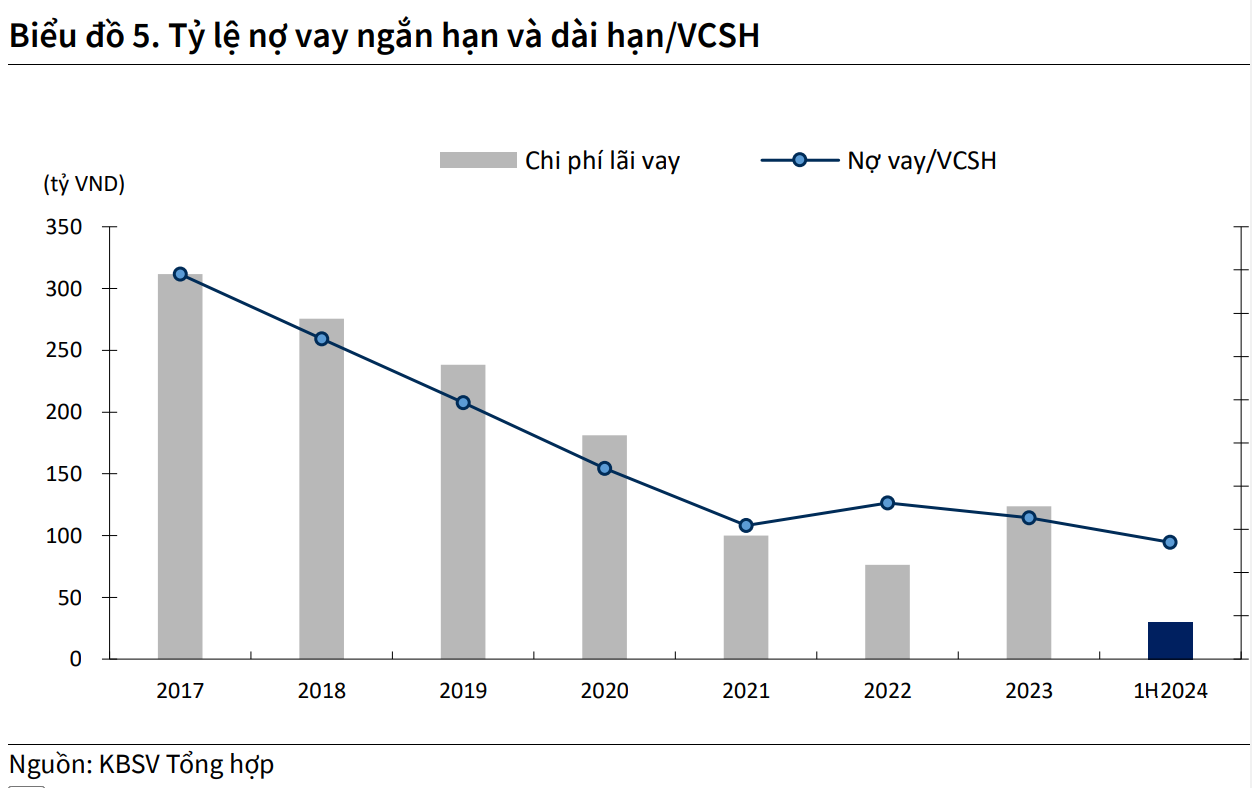

“We believe that HT1’s profit has bottomed out in 2023 and will show a more pronounced recovery in the last two quarters of 2024. Although consumption volume is not expected to improve significantly, KBSV assesses that the focus on cost optimization will enable HT1 to surpass its after-tax profit plan for 2024 (VND 23.2 billion), reaching approximately VND 107.9 billion (up 509%) with a gross profit margin of 9.4% (up 0.83ppt,” affirmed the securities company.