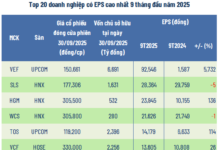

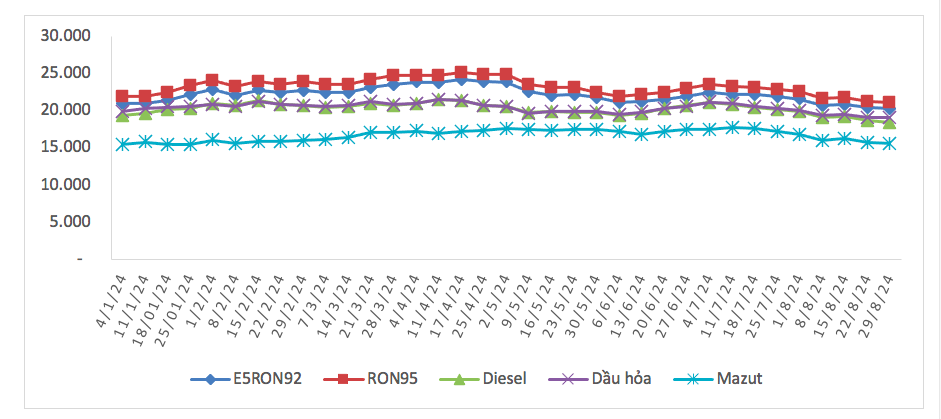

At the latest joint working session on August 29, the Ministry of Industry and Trade and the Ministry of Finance continued to decrease gasoline and oil prices by 84 – 299 VND/liter/kg, depending on the type.

Fluctuations in gasoline and oil prices since the beginning of the year

Specifically, RON95-III gasoline, the most popular type on the market, decreased by 208 VND/liter to 21,109 VND/liter, which is 807 VND/liter cheaper than at the beginning of the year. 0.05S diesel oil decreased by 299 VND/liter to 18,477 VND/liter, a reduction of 891 VND/liter…

Statistics show that since the beginning of the year, gasoline prices have decreased 18 times. This decrease goes against the predictions of many experts and international organizations, who previously warned that escalating geopolitical tensions would lead to higher crude oil prices.

However, according to the Ministry of Industry and Trade, the global gasoline and oil market continues to witness a downward trend due to new developments in the Middle East conflict, a decrease in US crude oil reserves, weak oil demand from China, and the ongoing military conflict between Russia and Ukraine.

While consumers rejoice at the drop in gasoline and oil prices, businesses, especially key traders, need to accurately forecast the situation to avoid incurring losses as they did in 2022, when they sold at a loss.

In an interview with Nguoi Lao Dong newspaper, Mr. Trinh Quang Khanh, Vice Chairman of the Vietnam Petroleum Association, attributed the sharp drop in domestic gasoline and oil prices to the influence of the global market.

According to Mr. Khanh, the significant decrease in global prices can cause losses for gasoline and oil importers if they do not proactively adapt to the situation. If they import at a cost of 10 VND and can only sell at 8 VND, they will incur losses.

Therefore, the Vice Chairman of the Vietnam Petroleum Association advised businesses to learn from the lessons of 2022, proactively respond to market fluctuations, ensure reserves as stipulated by regulations, and maintain a balance between cash flow and finances.

The Ministry of Industry and Trade forecasts that the total production and import volume for the last six months of 2024 (according to reports from traders) is estimated at 13.3 million m3/tons of various types of gasoline and oil. Nevertheless, domestic gasoline and oil prices will be significantly influenced by global market trends.

It is anticipated that the global economic and political landscape will remain complex and unpredictable, with heightened tensions in the Middle East, the Russia-Ukraine conflict showing no signs of abating, and OPEC+’s agreement to reduce output by 1.4 million barrels per day throughout 2024. Additionally, the US presidential election and the oil reserve purchase plans of major countries will impact the supply and prices of commodities, especially oil.

The Ultimate Guide to the Commodities Market: Oil, Gold, Natural Gas, and Aluminum Prices Take a Tumble, While Rubber Reaches an 8-Week High

As of August 21, oil, natural gas, gold, and aluminum prices took a hit, experiencing a downward trend. Meanwhile, palladium reached its highest point in over a month, lead peaked at a 3-week high, and rubber soared to an 8-week pinnacle, showcasing resilience and buoyancy in the face of the overall market downturn.

Is the Fuel Price Stabilization Fund Still Necessary for Market Regulation?

“There have been calls for a shift in the management of the gasoline and oil price stabilization fund. Bui Ngoc Bao, Chairman of the Vietnam Petroleum Association, suggested that if the fund is to be maintained, it should be managed by the state rather than the enterprises themselves, as is currently the practice.”