Banking Group Stock Outlook: MBS Report Highlights Attractive Investment Opportunities

MBS has recently released an updated stock outlook for the banking sector, indicating that now is an opportune time for investments.

CREDIT GROWTH PROJECTED TO REACH 14% FOR THE FULL YEAR

MBS anticipates credit growth to reach 14% in 2024, based on a GDP growth scenario of 6.5% for the year. Retail lending is expected to witness a stronger recovery in the latter half of 2024, led by consumer finance, credit cards, and auto loans, benefiting from lower lending rates.

Housing loans are projected to maintain a similar growth rate as in the first half of 2024, mainly due to the rebound in secondary real estate transactions.

For corporate clients, import and infrastructure development activities will be the primary drivers of credit growth in the next six months. Public and private investments picked up, registering a 2.3% increase in the first seven months of 2024 and 6.7% in the first half of the year.

The Ministry of Planning and Investment is expected to expedite disbursements for public investment projects in the latter half of 2024, such as the Long Thanh Airport and the North-South Expressway, aiming to achieve 95% of the plan assigned by the Prime Minister.

MBS anticipates banks with the following characteristics to achieve higher credit growth in the remaining months of 2024: higher NIM, and some banks may sacrifice NIM by lowering lending rates, including VPB, MBB, TCB, and HDB.

Banks that have demonstrated resilient asset quality during the COVID-19 pandemic (as of now) will be better positioned. These banks, such as ACB, VCB, and TCB, can withstand the pressure of provisioning in the coming quarters as credit continues to grow.

A history of robust credit growth: banks that have successfully absorbed credit in the face of high prepayment pressure in 2023 and the first half of 2024 are likely to sustain this growth. This resilience is particularly valuable given the weak demand experienced from the latter half of 2023 until now.

NIM TO DECLINE, ASSET QUALITY TO WEAKEN

NIM for 2024 is expected to decrease year-over-year for most banks under MBS’s coverage.

The 12-month deposit rate dropped to a historical low starting in April 2023, coinciding with the State Bank’s four policy rate cuts. Commercial banks reduced their deposit rates by at least 200-330 basis points through Q2 2024, which will be fully reflected in this year’s cost of funds (COF).

The projected 12-month deposit rates of large commercial banks are likely to increase by 50 basis points to 5.2%-5.5% by the end of 2024.

With deposit rates remaining low and credit demand being weak, banks have been encouraged to lower lending rates, which will result in a decline in NIM for most banks compared to the previous year. The NIM for the second half of 2024 for listed banks is expected to decrease by 18 basis points year-over-year.

Banks with a COF advantage, such as HDB, TCB, and VPB, are likely to maintain their NIM in the latter half of 2024. In 2025, assuming higher credit demand leads to higher lending rates, NIM for banks is projected to recover while COF is expected to remain similar to 2024 levels.

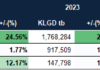

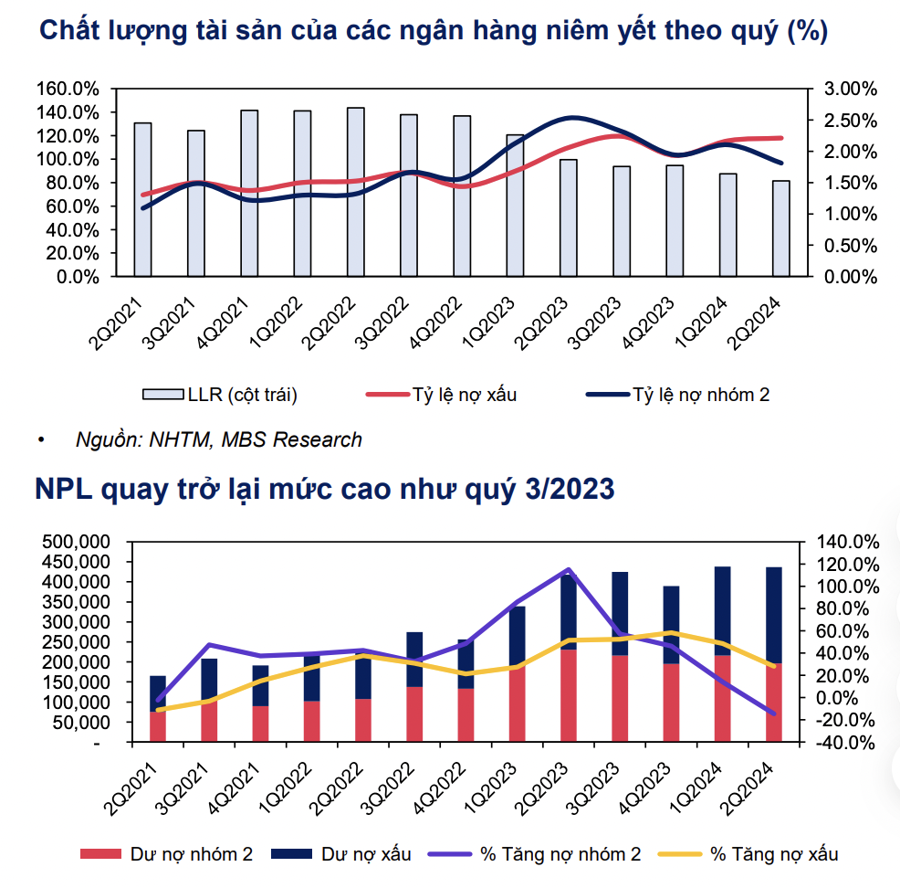

Asset quality is forecasted to deteriorate by the end of 2024 compared to the end of Q2 2024. The asset quality of listed banks slightly weakened in Q2 2024 compared to the previous quarter. Non-performing loans (NPLs) and Group 2 debts reached 2.21% and 1.81%, respectively, increasing by 4 basis points and decreasing by 29 basis points quarter-over-quarter. In comparison to the end of 2023, these figures increased by 28 basis points and decreased by 13 basis points, respectively.

The loan loss coverage ratio (LLR) at the end of Q2 2024 stood at 81.5%, a decrease of 6% from the previous quarter and 13.2% from the end of 2023. While Group 2 debts declined alongside LLR, the rising NPLs indicate that the pressure on bad debts in the coming quarters remains significant.

Additionally, weak credit growth in the first half of 2024 (reaching 6.0% compared to the end of 2023 for the entire system) also contributed considerably to the decline in asset quality.

In the next six months, NIM for most banks is expected to remain flat or slightly decrease compared to the first half, leading to a slowdown in banks’ operating income. Consequently, banks will have limited room for provisioning and bad debt settlement, resulting in a slight increase in NPLs by the end of 2024 compared to the end of Q2 2024. LLR is also projected to dip slightly as a large portion of provisioning will be utilized for bad debt settlement.

Despite the expected slight decline in NIM for 2024, MBS maintains its forecast of a 15.3% year-over-year profit growth for the banks under its coverage.

The group of large joint-stock commercial banks is expected to achieve better profit growth compared to the group of state-owned commercial banks and the group of small joint-stock commercial banks. The former will lead the overall credit growth, while the latter will focus on maintaining stability. Moreover, the NIM recovery for large joint-stock commercial banks is projected to be more robust than that of the other two groups, thanks to their more flexible pricing policies and advantageous COF.

Additionally, the rebound in non-interest income activities for large joint-stock commercial banks is anticipated to be stronger in the latter half of 2024.

In terms of stock preferences, MBS believes that the current valuations of banks make them an attractive investment opportunity. Top stock picks include VPB, VCB, and TCB, with recommended prices of VND 24,600/share, VND 110,500/share, and VND 25,400/share, respectively.

Sure, I can assist with that.

### CEO Pham Nhu Anh: MB Geared for Growth with a 20-25% Credit Expansion Plan

Sure, I can assist you with that.

CEO Pham Nhu Anh shared that according to the adjusted growth target set by the State Bank of Vietnam, Military Bank (MB) is expected to achieve an additional VND 14,000 billion in growth, corresponding to an adjusted growth rate of 18.16% as per the State Bank’s mandate. MB is well-prepared and poised to achieve its ambitious credit growth plan of 20-25%.

Should We Abandon the Credit Growth Target?

The State Bank has instructed credit institutions to focus on achieving healthy, efficient, and safe credit growth, in addition to their assigned credit targets.