**American Real Estate Joint Stock Company’s Financial Performance in H1 2024**

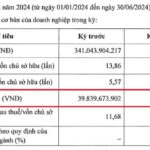

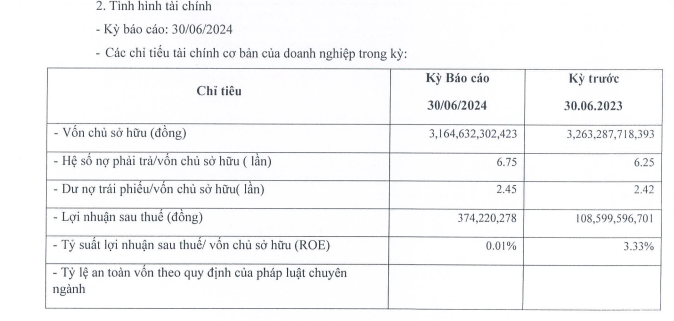

American Real Estate JSC has released its financial report for the first half of 2024, revealing impressive results. The company recorded a net profit of nearly VND 109 billion, a significant improvement compared to the same period last year when it posted a profit of just over VND 374 million.

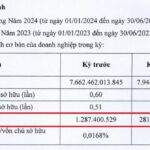

As of June 30, 2024, the company’s equity stood at over VND 3,263 billion. Its debt-to-equity ratio was 6.25, indicating total liabilities of over VND 20,395 billion. Of this, bond debt amounted to more than VND 7,896 billion.

American Real Estate JSC has numerous bond payments due in the coming years. The company is servicing interest payments on 89 bond lots, mostly issued in the first half of 2020 with a five-year maturity, indicating a maturity date in 2025. Only one lot in this group was issued in May 2021 and will mature in 2026.

Formerly known as VID Winter Real Estate JSC, American Real Estate JSC was established on September 28, 2007, and is headquartered at GoldSeason TNR, 47 Nguyen Tuan, Thanh Xuan Trung ward, Thanh Xuan district, Hanoi. As of April 2022, the company’s charter capital was VND 2,571 billion. The current Chairman of the Board and legal representative is Ms. Vu Thi Duyen (born in 1994).

In recent years, American Real Estate JSC has gained prominence in the real estate market by developing large-scale projects such as the Bao Ha New Urban Area in Lao Cai province (42 hectares, with a total investment of VND 708 billion), the Cuong Thinh New Urban Area (a total investment of VND 665 billion and a total area of 18.17 hectares), and the Canh Buom Urban Area in Ha Tinh province, among others.

The company has also actively participated in bidding for projects in various localities, often in partnership with other businesses. For instance, the consortium of Oleco – NQ Co., Ltd. and American Real Estate JSC was the sole investor registered for the new urban area project in the west of the administrative center of Giong Rieng district. This project covers an area of 99,485 m2 and has a total investment of nearly VND 400 billion.

Oleco – NQ and American Real Estate JSC are both part of the TNG Holdings Vietnam ecosystem, and this is not the first time they have collaborated. In Lam Dong province, the consortium is developing the Thanh Danh Hill Residential Area in Di Linh town, Di Linh district, spanning nearly 5 hectares with a total investment of VND 507 billion.

In Hau Giang province, on July 7, 2022, the Provincial People’s Committee approved the consortium as the investor for the Cai Tac – Thanh Hoa new urban area project in Phung Hiep district, with a total investment of over VND 407 billion.

In Thai Nguyen province, on April 24, 2024, the Provincial People’s Committee announced the list of investors meeting the preliminary requirements for the No. 1A Urban Area project in Ba Xuyen, Song Cong city. Once again, the Oleco – NQ and American Real Estate JSC consortium was the sole entity on the list. The project has a preliminary total cost of nearly VND 635 billion and covers an area of nearly 31 hectares.

Additionally, last year, the consortium of An Phuc Real Estate Development JSC and American Real Estate JSC was the only registered investor for the project to build a new urban area in Hoang Xa, Hai Phong city. This project covers an area of nearly 35 hectares and has a total investment of over VND 3,400 billion.

In Thanh Hoa province, the consortium of Duc Tri Investment and Development JSC and American Real Estate JSC registered for the Cao Nguyen Residential Area project in Ngoc Lac town, Ngoc Lac district, with a total investment of over VND 611 billion. The consortium successfully won the bid for this project.

The Real Estate Company in District 7 Reports a Surge in Half-Yearly Profits, a Whopping 100 Times More Than Last Year’s Annual Figures.

In a surprising turn of events, amidst a subdued real estate market, a real estate company in District 7, Ho Chi Minh City, has recorded extraordinary financial results. The company’s performance for the first half of the year far exceeded expectations, with profits soaring to over 100 times their full-year 2023 earnings. This remarkable achievement has caught the attention of industry experts and stakeholders alike, leaving many wondering about the strategies employed by this company to achieve such remarkable success during a period of market stagnation.