Dong A Plastic Joint Stock Group (DAG: HoSE Ticker) recently sent a document to the Ho Chi Minh City Stock Exchange (HoSE) explaining and providing opinions on handling violations and suspending trading of DAG shares.

Specifically, on August 9, 2024, the company received documents from HoSE, including a decision to switch DAG shares from restricted trading to suspended trading, and a notice of violation handling and suspension of DAG share trading.

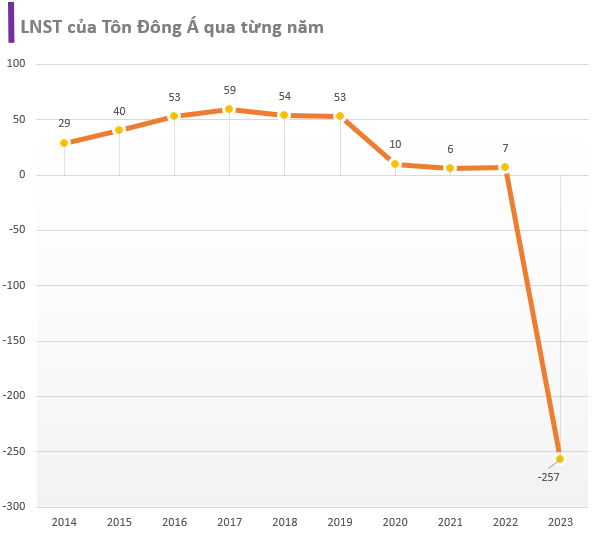

Dong A Plastic stated that 2023 was an exceptionally challenging year for the business operations of plastic companies in general and DAG and its subsidiaries in particular. Operations were disrupted, products could not be sold, Chinese competition was intense, and the company had to downsize. The company had to restructure to ensure business continuity, and the departure of key personnel in charge of business operations and accounting greatly affected the company’s performance.

As a result, in 2023, the company recorded revenue of VND 1,215 billion, a decrease of nearly 50% compared to 2022. The cost of goods sold was VND 1,587 billion, resulting in a gross loss of VND 371.9 billion. High financial expenses (interest expenses) of VND 90.6 billion and a significant increase in selling expenses of VND 148 billion led to a net loss of VND 606.75 billion for the company in 2023.

By the second quarter of 2024, the company’s business operations were impacted by the enforcement of invoice restrictions, affecting revenue and expense recognition. As of June 30, 2024, the company recorded a loss of VND 66.6 billion and reported an undistributed post-tax profit in the financial statements of negative VND 640.98 billion.

Additionally, the 2023 financial statements audited by UHY Audit and Consulting Co., Ltd. encountered delays due to the large volume of work, requiring time for understanding, reviewing, and compiling related documents and evidence. There were also staff changes in the company’s accounting department, and the new personnel needed time to get up to speed, causing delays in coordinating with the auditing firm and providing relevant information and documents.

Furthermore, frequent business trips undertaken by the company’s leadership and the auditing firm also impacted the timely exchange and agreement of reported figures.

Regarding the delay in publishing the audited 2023 financial statements, Dong A Plastic had previously sent a document to the State Securities Commission requesting an extension of the deadline for publishing the audited financial statements for 2023.

On July 24, 2024, the company finalized the financial statements in agreement with the auditing firm and published the audited financial statements, sending them to the relevant management agencies. The company has also been working diligently to complete the necessary procedures, including accounting software adjustments, to finalize the financial statements and disclose information as regulated.

Concerning the disclosure of information about events affecting production and business activities, the company has provided explanations and submitted additional documents and evidence related to the content mentioned by the Exchange in its notice.

The company’s management commits to fulfilling all relevant obligations of public and listed companies as regulated. However, the suspension of DAG share trading has significantly impacted investors, shareholders, and employees.

To protect the interests of shareholders and the company and to maintain stability for employees, Dong A Plastic requests HoSE to consider resuming trading of DAG shares as soon as possible.

On the stock market, DAG’s last trading session before the suspension was on August 14. The share price closed at VND 1,430 per share.

The Unusual Story: Tan Tao Approaches 30 Audit Firms but Gets Rejected – What’s the Reason?

“According to Tan Tao, the entire auditing firm is afraid of working with them due to the potential suspension by the Securities Commission. This is a bold statement, and one that certainly captures attention. However, it is important to delve deeper and understand the intricacies of such a claim. The implication here is that the company’s operations are so complex and unique that they strike fear into the hearts of even the most seasoned auditors. This intriguing proposition piques the interest of potential investors and stakeholders, prompting them to want to learn more about this enigmatic company and the nature of its business.”