East Asia Plastic Joint Stock Group (DAG-HOSE on the stock exchange) has been facing challenges with its stock being placed under special treatment due to violations of information disclosure regulations.

Recently, the Ho Chi Minh Stock Exchange (HOSE) announced the transfer of DAG stock from restricted trading to a trading suspension, effective August 15, as the company continued to violate information disclosure regulations after being placed under restricted trading.

As of August 15, the stock was also placed under warning status due to exceptions noted by the auditing organization regarding the audited 2023 financial statements.

Additionally, the stock faced another warning as of August 15 due to a negative post-tax profit distribution of VND -558,077,162,453 on the 2023 audited consolidated financial statements.

Prior to these developments, HOSE had removed the stock from the warning list on August 12 as the company successfully held its 2024 Annual General Meeting of Shareholders on July 31, 2024, addressing the reasons for the warning status.

However, DAG stock remained under control as the company continued to violate information disclosure regulations after being placed under warning by HOSE.

Furthermore, the stock remained under warning status per HOSE’s decision on September 14, 2024, due to the late submission of the 2023 semi-annual audited financial statements, exceeding the deadline by more than 15 days.

Notably, the stock faces the additional pressure of mandatory delisting, as East Asia Plastic’s accumulated losses have exceeded owner’s equity.

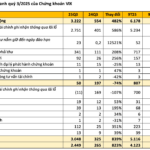

Specifically, for the first six months of 2024, DAG recorded a 94% decrease in revenue, from VND 959 billion to VND 55.34 billion. Financial expenses decreased by 12% to VND 36.47 billion, while selling expenses and management expenses decreased by 96%.

As a result, the company reported a loss of VND 66.6 billion, a 60% increase compared to the loss of nearly VND 116 billion in the second quarter of 2023. This pushed the accumulated loss from VND -588 billion to nearly VND -641 billion.

According to Clause 1, Article 120 of Decree 155/2020/ND-CP, one of the cases leading to the cancellation of stock listing is when the enterprise has been making losses for three consecutive years, or the total accumulated loss exceeds the chartered capital or the owner’s equity is negative in the audited financial statements of the previous year before the time of consideration.

According to the company’s explanation, the reduction in post-tax profit in the second quarter of 2024 compared to the same period in 2023 (a 60% decrease, equivalent to VND 99,077,927,607) was due to a significant drop in revenue in 2024 affected by the general market and the plastics industry. To mitigate losses, the company minimized selling and management expenses and focused on restoring production.

Additionally, as the company is in the process of restructuring to find a new direction for future development, non-essential expenses were cut to ensure simplicity and efficiency, aligning with the company’s goals and future model.

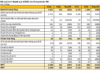

Specifically, in the second quarter of 2024 self-prepared consolidated financial statements, East Asia Plastic reported a post-tax profit of VND -641 billion, while the owner’s equity was VND 603 billion.

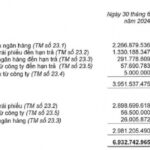

As of June 30, 2024, DAG had a total debt of VND 1,367.5 billion, a slight increase from the beginning of the year (VND 1,362 billion). This included short-term financial loans and leases of VND 733.6 billion and long-term financial loans and leases of VND 412 billion.

Moreover, East Asia Plastic had significant provisions for potential bad debts, totaling VND 118.5 billion in provisions for short-term difficult-to-recover receivables and VND 362 billion in provisions for inventory devaluation.

Notably, the company has long-term debt obligations to its leaders: a loan of VND 100 billion from Executive Board member Pham Ngoc Hinh, VND 40 billion from former Chairman Tran Viet Thang, nearly VND 184 billion from Executive Board member Nguyen Ba Hung, and over VND 36 billion from Nguyen Huu Quan.

It is worth mentioning that the company’s shareholders have approved a plan for private issuance to swap debt. According to the 2023 audited financial statements, the principal debt was VND 283,689,164,383, and the company will issue a maximum of 28,368,916 shares. As a result, Pham Ngoc Hinh will receive 10 million shares, and Nguyen Ba Hung will receive nearly 18.4 million shares. The transaction is expected to be completed in 2024, increasing the chartered capital to nearly VND 887 billion. Thus, Hinh and Hung will no longer be creditors but shareholders of DAG.

Additionally, DAG shareholders approved the 2024 business plan, targeting revenue of VND 642.2 billion and a post-tax profit of VND 9.5 billion.

The Unusual Story: Tan Tao Approaches 30 Audit Firms but Gets Rejected – What’s the Reason?

“According to Tan Tao, the entire auditing firm is afraid of working with them due to the potential suspension by the Securities Commission. This is a bold statement, and one that certainly captures attention. However, it is important to delve deeper and understand the intricacies of such a claim. The implication here is that the company’s operations are so complex and unique that they strike fear into the hearts of even the most seasoned auditors. This intriguing proposition piques the interest of potential investors and stakeholders, prompting them to want to learn more about this enigmatic company and the nature of its business.”