According to Savills Vietnam, apartments priced below VND 3 billion per unit are currently considered affordable in Ho Chi Minh City. However, the supply of this segment is expected to account for less than 5% in the next three years.

Ms. Giang Huynh, Director of Research and Consultancy at Savills Vietnam, analyzed that the supply of new apartments priced below VND 3 billion per unit is becoming limited in Ho Chi Minh City, accounting for only 18% of the primary supply in the first half of 2024. Assuming that homebuyers accumulate savings for 10 years and can get support through mortgage or equity, purchasing a two-bedroom apartment priced below VND 3 billion is considered reasonable in the Ho Chi Minh City apartment market at this time.

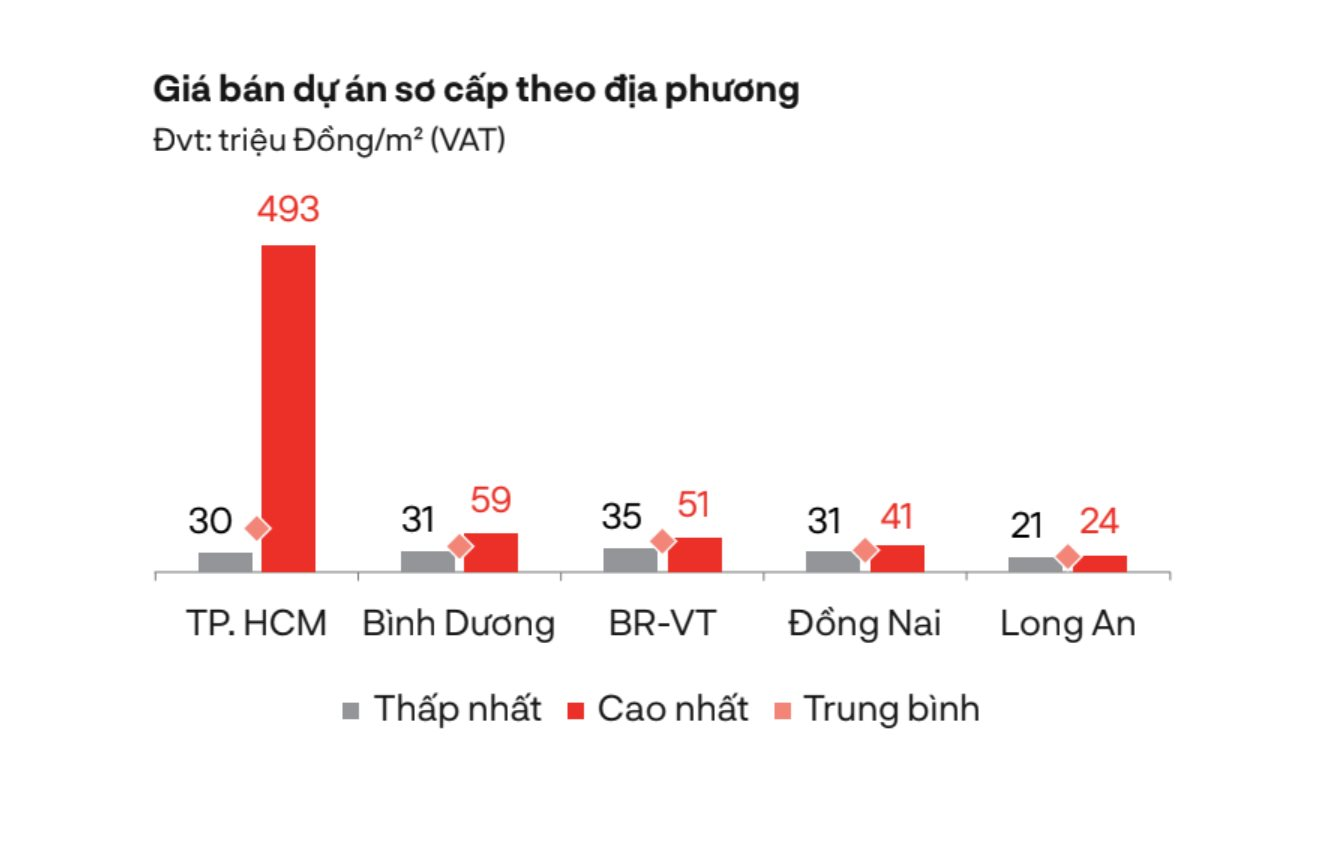

According to Ms. Giang, the prolonged upward trend in apartment prices has pushed the average primary apartment price in Ho Chi Minh City to VND 72 million per square meter of usable area in the second quarter of 2024.

The supply of affordable housing in Ho Chi Minh City is expected to remain very limited in the future. Source: Savills Vietnam

The scarce supply at present and the predicted limited availability in the future have led to a resurgence in demand. Most of the reasonably priced apartments in Ho Chi Minh City are selling well. This is especially true for completed projects that are nearing the handover phase and are priced between VND 3 and 4 billion per unit.

For example, in the western part of Ho Chi Minh City, the second phase of Nam Long’s Akari City project, which is nearing completion (fourth quarter of 2024), is receiving positive attention due to its affordable pricing (from VND 3.8 billion per unit for a two-bedroom apartment). This is also one of the rare completed projects in the city at the moment. Moreover, the developer is offering attractive sales policies to support homebuyers in owning their homes by the end of this year. Specifically, homebuyers can obtain a bank loan with a limit of 70% at a zero-interest rate for 18 months and a 24-month grace period on principal repayment. For customers who do not utilize the loan option, a discount of up to VND 700 million is offered.

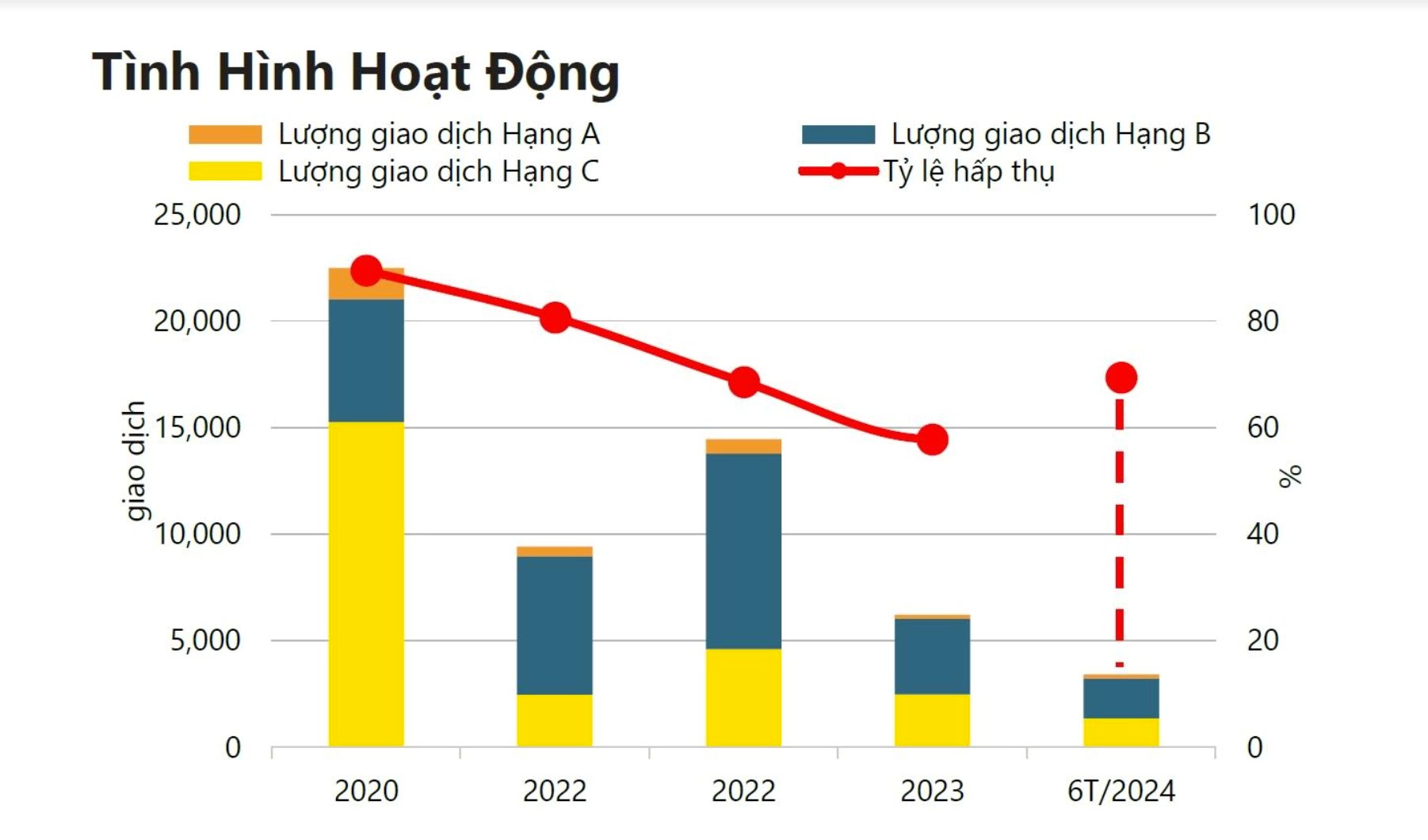

Ms. Giang Huynh stated that despite the limited choices due to scarce supply, the overall demand is returning to a recovery trajectory, with transaction volumes increasing by 655% compared to the same period last year, indicating improved market confidence. Buyers understand that if they wait, prices will continue to rise.

In the second quarter of 2024, Ho Chi Minh City recorded 2,288 successful transactions, accounting for 70% of the total sales in the first half of the year, thanks to reduced lending rates, clear product legal status, and effective sales policies.

The shortage of apartment supply in Ho Chi Minh City has reached its “peak,” considering the period after the Covid-19 pandemic up to now. Very few projects have been launched into the market.

Sharing a similar view, a representative of DKRA Group pointed out that the apartment market’s liquidity has shown some positive signs in recent months. The primary market absorption rate across the city increased significantly by 82% compared to the same period in 2023. Transactions were mainly focused on mid-range projects with prices ranging from VND 40-55 million per square meter in Ho Chi Minh City and VND 30-35 million per square meter in Binh Duong Province. Most of these transactions involved projects with completed legal procedures, rapid construction progress, and convenient connections to the city center.

Specifically, in Ho Chi Minh City, according to DKRA Group, new supply increased by 12% in the second quarter, but most of it came from luxury apartment projects in the eastern part of the city. The highest primary apartment price recorded in Ho Chi Minh City in the second quarter of 2024 reached nearly VND 500 million per square meter, while affordable housing continued to be absent. This shortage has persisted for more than three years, and the supply challenge is expected to continue in the future.

According to DKRA Group’s data, the highest primary apartment price in Ho Chi Minh City reached nearly VND 500 million per square meter in the second quarter of 2024. This indicates that the criteria for product classification need to be adjusted.

Similarly, the Savills expert suggested that the lack of affordable housing and the constantly changing price thresholds pose significant affordability challenges for the Ho Chi Minh City apartment market.

The above figures indicate that the shortage of apartment supply in Ho Chi Minh City has reached its “peak.” Currently, apartment projects priced around VND 3-4 billion per unit are considered reasonable and suitable for the majority of buyers. This price range is expected to change in the future as the land fund and the supply of new apartment projects in Ho Chi Minh City show no signs of improvement. Moreover, in some projects, it is challenging to find apartments with an area of approximately 60 square meters and a price of VND 50 million per square meter, totaling about VND 3 billion, in the primary market.

In a recent sharing, an industry expert emphasized that the primary market prices can only “cool down” when the market focuses on developing a segment specifically for middle-income earners. However, at present, the supply of affordable housing is meager, legal issues have not been entirely resolved, and the new Law tightens investment conditions, making it more difficult for new projects to enter the market.

The Emergence of a Japanese Giant: Debuts in Vietnam with an Affordable Condo Project

Cosmos Intia, a member of the prestigious Daiwa House Group, has announced an exciting new venture in the vibrant city of Binh Duong. In a dynamic collaboration, Cosmos Intia is set to develop an affordable housing project, bringing their renowned expertise and commitment to quality to this thriving province.

The Great Property Conundrum: Unveiling the True Haven for Homebuyers in Binh Duong and Ho Chi Minh City

In a market saturated with luxury condominiums, Benhill Apartments stands out with its competitive pricing of just 26 million VND per square meter. This competitive pricing strategy quickly captured the attention of homebuyers seeking affordable mid-range housing options in the Southern region, offering a much-needed respite from the surplus of high-end residences.

“Waiting for Apartment Prices to Drop is Unrealistic, says OneHousing Director”

“It is unlikely that we will see a decrease in apartment prices, according to Mr. Tran Quang Trung, Director of Business Development at OneHousing. With input costs, such as land, design, construction, landscaping, and amenities, all on the rise, the prospect of more affordable housing seems distant. Mr. Trung highlights the escalating expenses involved in creating residential complexes, indicating that consumers should not anticipate any significant discounts in the near future.”