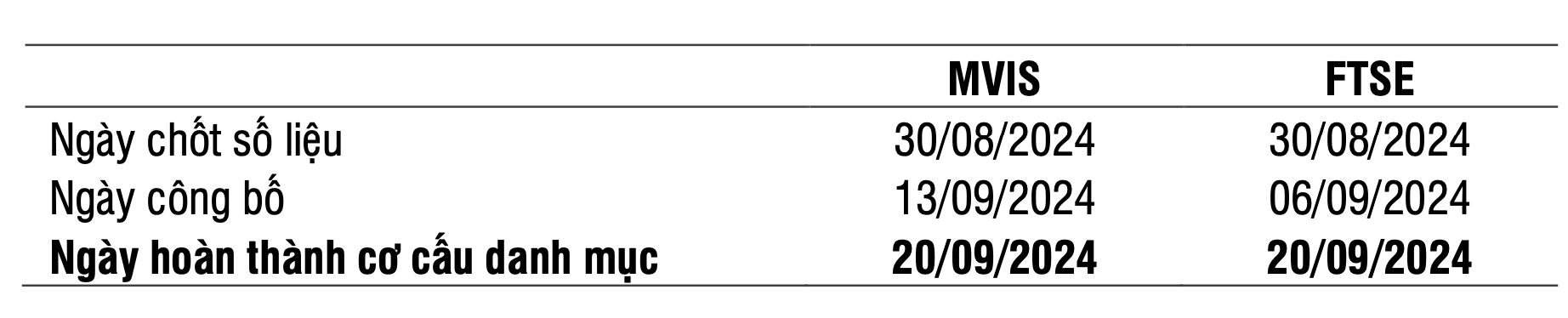

Q3 2024 Portfolio Restructuring Calendar

Based on data updated as of August 27, SSI Research predicts that the FTSE Vietnam Index could include KDH, FRT, and FTS. Specifically, among the FTSE criteria for market cap, liquidity, free float, and foreign ownership limit, KDH has met the final criterion after its foreign ownership limit increased to 11.9%. Additionally, FRT and FTS have met the liquidity criterion compared to the previous period.

On the other hand, EVF may be removed from the index for failing to meet the requirements for the free-float ratio and free-float market cap.

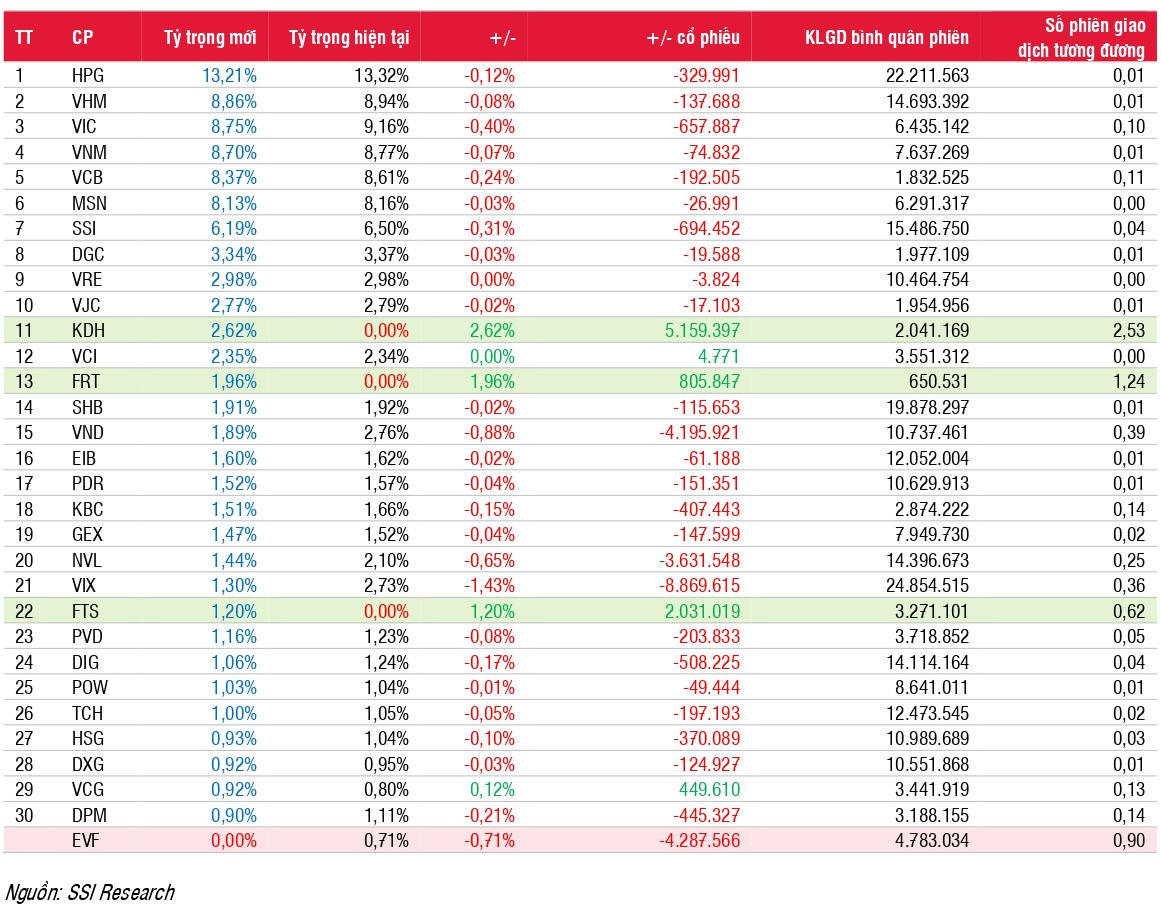

Estimated Changes in FTSE Vietnam Index Composition and FTSE Vietnam Swap UCITS ETF Weightings

Assuming the above changes, the index portfolio will comprise 30 stocks. The total assets of the FTSE Vietnam Swap UCITS ETF, which references the FTSE Vietnam Index, stood at VND 7,377 billion (USD 296.7 million) as of August 27. Specifically, the fund’s total assets decreased by 16% from the beginning of the year, NAV decreased by 4.1% from the beginning of the year, and net outflows reached VND 1,243 billion (USD 50 million).

SSI Research estimates that the FTSE Vietnam Swap UCITS ETF will purchase approximately 5.1 million KDH shares, 805,000 FRT shares, and 2 million FTS shares. Conversely, the fund is expected to sell approximately 4.29 million EVF shares.

Additionally, notably, the fund is also estimated to sell over 8.8 million VIX shares (reducing weight from 2.73% to 1.3%), 3.6 million NVL shares (reducing weight from 2.1% to 1.44%), and nearly 4.3 VND shares (reducing weight from 3.76% to 1.89%).

Meanwhile, the MarketVector Vietnam Local Index is expected to have no new additions, and EVF may be removed for failing to meet the free-float market cap requirement.

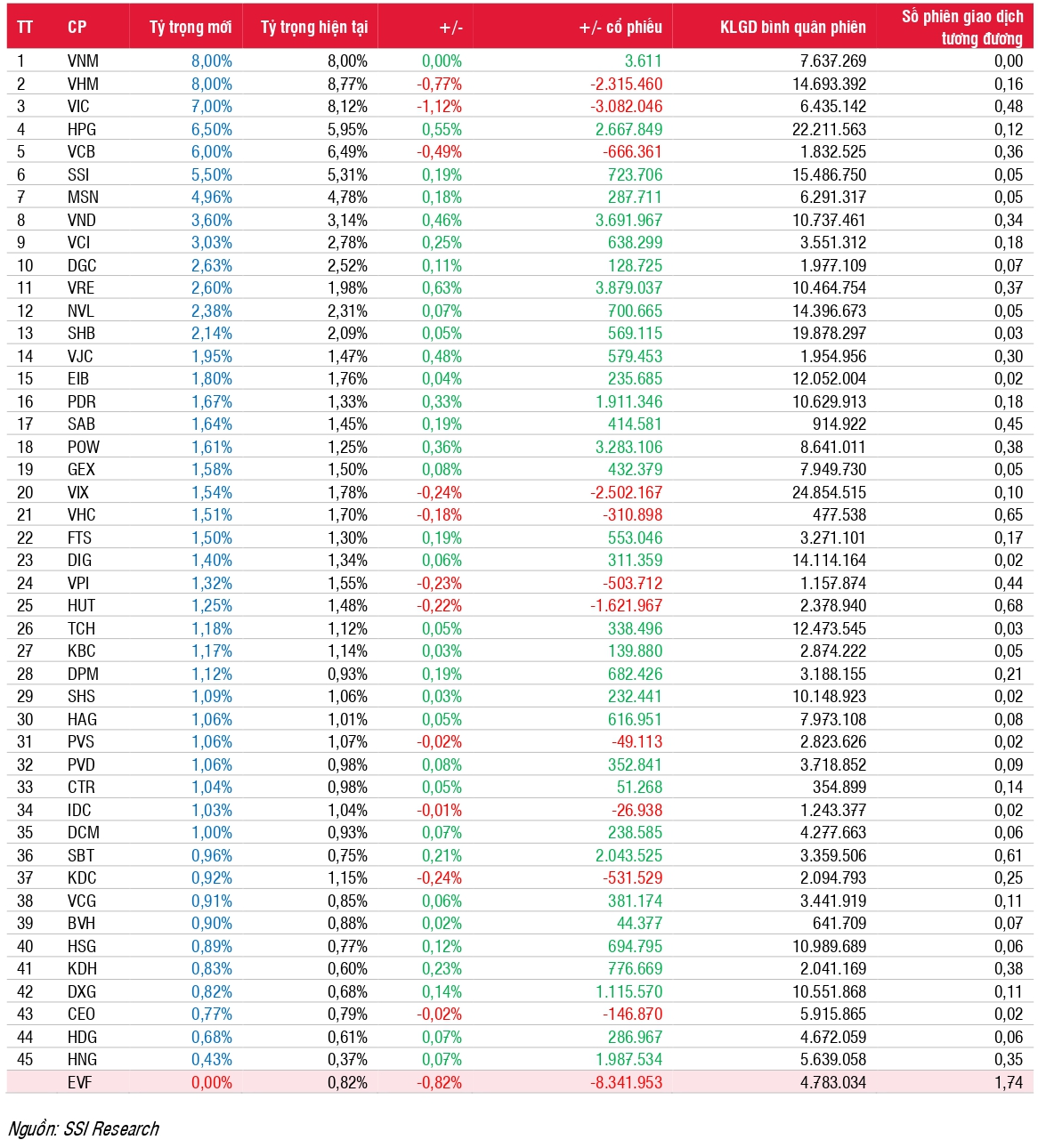

Estimated Changes in MarketVector Vietnam Local Index Composition and VanEck Vectors Vietnam ETF Weightings

Assuming the above changes, the index portfolio will comprise 45 stocks. The total assets of the VanEck Vectors Vietnam ETF, which references the MarketVector Vietnam Local Index, stood at VND 12,438 billion (USD 500 million) as of August 27. Specifically, the fund’s total assets decreased by 5.1% from the beginning of the year, NAV decreased by 2.7% from the start of the year, and net outflows reached VND 316 billion (USD 12.7 million).

During this review period, SSI Research estimates that the VanEck Vectors Vietnam ETF will sell approximately 8.3 million EVF shares.

Additionally, the fund is expected to sell over 3 million VIC shares (reducing weight from 8.12% to 7%), 2.3 million VHM shares (reducing weight from 8.77% to 8%). Conversely, the fund is expected to purchase nearly 3.9 million VRE shares (increasing weight from 1.98% to 2.60%) and 3.7 million VND shares (increasing weight from 3.14% to 3.60%).

What Are the Two FPT Family Stocks Likely to be Included in the $1 Billion Foreign ETF Basket in the Q3 Review?

The latest quarterly portfolio reshuffle witnessed a substantial accumulation of tens of millions of shares in the banking and securities sectors.