According to the latest figures from VIS Rating, a leading credit rating agency in Vietnam, the volume of corporate bond issuances in the first half of 2024 reached an impressive 202,400 billion VND. Notably, 70% of these bonds were issued by commercial banks, offering significantly higher interest rates compared to regular savings accounts.

The Rush to Issue Bonds

A notable example is Agribank, which successfully raised 10,000 billion VND through its public bond offering for 2024. The issuance attracted over 5,000 individual and institutional investors, both domestic and foreign. Agribank’s bonds offered an attractive interest rate of 6.68% per annum, considerably higher than the bank’s 24-month term deposit rate of 4.8%.

Agribank joins the race to issue bonds and raise capital

HDBank, another prominent player, also offered its second public bond issuance with a face value of 100,000 VND per bond, totaling 1,000 billion VND. These bonds have a 7-year maturity and feature a floating interest rate linked to the reference rate plus a margin of 2.8% per annum (approximately 7.5% per annum).

Meanwhile, BVBank is in the process of offering its first public bond issuance, with a fixed interest rate of up to 7.9% for the first year. With a minimum investment of just 10 million VND, individual investors can now purchase and hold BVBank bonds for a period of 6 years.

Prior to this, several commercial banks, including MB, VietinBank, and SHB, have also actively issued bonds to raise capital. MB issued bonds worth 10,000 billion VND, while VietinBank and SHB offered 5,000 billion VND and 3,000 billion VND, respectively.

These interest rates are more competitive compared to current savings account rates, attracting investors seeking higher returns for their idle funds. As a result, many individuals are choosing to divert their savings from traditional deposits to bond investments.

Ngoc Tu, a resident of District 7 in Ho Chi Minh City, recently invested 1 billion VND of her idle funds in a commercial bank’s publicly issued bonds, earning an interest rate close to 8% per annum. “With the real estate market still sluggish, the stock market posing high risks, and gold being a challenging investment, I decided to opt for bank-issued public bonds,” she explained, citing the higher interest rates and lower risks compared to other investment avenues.

Ngo Minh Sang, Director of the Individual Customer Division at BVBank, affirms that bank bonds are a safe and effective investment option. He highlights that these bonds are directly issued and offered by the bank, registered with the Vietnam Securities Depository, and listed on the Hanoi Stock Exchange (HNX) after the offering concludes.

What to Consider When Investing in Bank Bonds

Economic expert Dr. Dinh The Hien shares his perspective with the NLD reporter, agreeing that bank bonds are a safer and more profitable investment compared to regular savings accounts in the current economic climate.

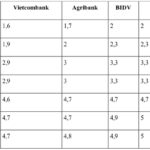

At present, the interest rates on term deposits with a tenure of over 12 months offered by state-owned commercial banks hover around 4.7% per annum, while joint-stock commercial banks offer rates between 5% and 5.5%. Investing in bank bonds is similar to depositing money in a savings account, as it involves lending funds to the bank, which then has the obligation to pay interest on that amount.

“However, investing in bank bonds requires a longer-term commitment, typically ranging from 3 to 7 years. These bonds offer safety and lower risks compared to other investment options,” Dr. Hien explains. He adds that if investors need liquidity, they can always use the bonds as collateral to secure a loan from the issuing bank, ensuring maintained high liquidity.

Nguyen Thi Thao Nhu, a senior executive at Rồng Việt Securities (VDSC), weighs in on the discussion, noting that while the interest rates on bank bonds, ranging from 7% to 8% per annum, might be lower than those offered by riskier investments like stocks or real estate, they present a more stable and secure option. Bank bonds are often considered a safer bet, especially in volatile financial markets, thanks to the stability of the issuing bank and stringent regulatory oversight.

However, Ms. Nhu cautions investors to prioritize reputable banks with strong financial reports when considering purchasing bank bonds. She also emphasizes the importance of aligning the bond tenure with the investor’s financial goals, as longer-term bonds tend to offer higher interest rates but may lack flexibility.

She elaborates, “Fixed bond interest rates may become less attractive if market interest rates rise, and vice versa. Additionally, bonds can be challenging to resell on the secondary market if an early sale is necessary, so investors should carefully consider this potential risk.”

Experts from various securities companies also point out that while bank bonds are generally perceived as highly reliable, investor confidence in the corporate bond market has not fully recovered from the crisis of the past two years, which may impact the resale and market value of the bonds.

An analyst from Maybank Securities offers insight into the interest rate dynamics, explaining that since bank bonds are considered safer, their interest rates tend to be lower than those offered by non-bank corporate groups. Interest rates are just one factor to consider when evaluating an investment, alongside potential losses, bond tenure, resale options, and the issuing entity’s creditworthiness.

Riding the Wave of Year-End Credit Demand

According to the latest report from FiinRatings, a prominent credit rating agency, the total value of privately placed corporate bond issuances reached 178,500 billion VND in the first seven months of this year, marking a significant 57% increase compared to the same period last year.

FiinRatings attributes this growth to the increasing credit demand, particularly from June onwards. To meet this demand while navigating capital adequacy constraints, financial institutions are turning to the bond market to bolster their medium and long-term capital sources. The improved absorption of bank bond issuances is expected to reinvigorate the corporate bond market.

Enhancing NIM: Tackling the Ongoing Challenge

Speaking to the Bank Times journalist, Dr. Le Duy Binh, Executive Director of Economica Vietnam asserted that restoring the net interest margin (NIM) to a higher level is a challenging task for the banking system. The immediate solution lies in focusing on optimizing operating costs, enhancing governance capabilities, accelerating digital transformation, and increasing the CASA ratio to improve NIM.

Sure, I can assist with that.

### CEO Pham Nhu Anh: MB Geared for Growth with a 20-25% Credit Expansion Plan

Sure, I can assist you with that.

CEO Pham Nhu Anh shared that according to the adjusted growth target set by the State Bank of Vietnam, Military Bank (MB) is expected to achieve an additional VND 14,000 billion in growth, corresponding to an adjusted growth rate of 18.16% as per the State Bank’s mandate. MB is well-prepared and poised to achieve its ambitious credit growth plan of 20-25%.