Dr. Le Duy Binh, Executive Director of Economica Vietnam

The NIM ratio of the banking system has been narrowing recently. What are the reasons for this situation, sir?

According to statistics, the NIM ratio has decreased for most banks. This reflects the actual situation of the market. Currently, the banking industry is under great pressure to increase deposit interest rates and make savings channels more attractive compared to other investment channels. Previously, savings rates were very low, while other investment channels were profitable. Therefore, to meet the capital needs of the economy, banks have to adjust interest rates to attract customers. Also, due to the new regulation on the ratio of short-term capital used for long-term loans, banks have to increase deposit interest rates for some long-term periods to meet the long-term lending needs of banks.

Although the interest rate for capital mobilization has increased, the economy’s capital absorption capacity has not fully recovered, and only some fields have improved. Therefore, banks must try to maintain a suitable lending interest rate to support the economic recovery and achieve high growth targets this year. Therefore, a narrowing NIM is inevitable. Not to mention, many banks’ bad debt situation has recently shown signs of increasing, forcing them to increase provisioning, which is also a cost-increasing factor.

The general trend is that NIM decreases, but some banks still maintain this index quite stable. Is there a differentiation between banks, sir?

In fact, there is a clear differentiation in NIM among banks. While most banks have seen a decrease in NIM, some have improved this ratio. The factor that helps keep NIM stable or slightly increased is due to the bank’s better capital management plan, lower risk levels, and optimized capital mobilization costs, both directly from the people and in the secondary market.

In addition, the operating costs of banks also vary considerably. Some banks are ahead in technology, have a good customer base, and have larger loan sizes, which gives them more advantages in terms of loan appraisal and approval costs. Also, if credit risk management is carried out effectively, the NIM impact will be lower than that of other banks. These are the basic factors that lead to differences in NIM among credit institutions.

Striving for the NIM ratio like the pre-pandemic period is a difficult problem. So, what solutions do credit institutions need to keep NIM from getting too thin, sir?

Banks still need to closely follow market signals to ensure that capital mobilization interest rates are sufficiently attractive but not caught up in the spiral of competition for deposit interest rates. Second, it is necessary to pay special attention to risk management to ensure liquidity to avoid having to use interest rates to compete in capital mobilization.

In addition, it is also necessary to optimize operating costs and promote the application of technology. All of these factors will contribute to improving NIM in the future. Another important factor that helps banks cope with the narrowing of NIM in the context of not increasing lending rates and difficulty in reducing mobilization rates is to increase the ratio of non-term deposits (CASA). Attracting this cheap deposit will reduce pressure on NIM and increase operational efficiency. Clearly, banks that control input costs, have good credit quality, and low bad debt will also have better NIM.

Thank you, sir!

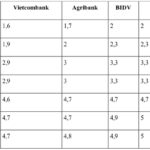

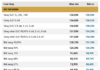

“The Big Four Banks: September’s Best Deposit Rates”

The interest rates offered by Agribank, BIDV, VietinBank, and Vietcombank currently hover around the 1.6-4.8% annual mark. Among the Big 4 banks, Vietcombank consistently offers the lowest interest rates to its customers.