Rising Expatriate Tenancy in Vietnam

Foreign investment in Vietnam has been on a steady rise, with figures from the Ministry of Planning and Investment showing that as of July 2024, total registered foreign investment reached over $18 billion, marking a 10.9% increase compared to the same period in 2023.

Ho Chi Minh City, a bustling metropolis, has attracted nearly $1.55 billion in registered investment, accounting for 8.6% of the country’s total investment. The city also boasts the highest number of new projects (over 39%) and equity contributions (over 70%) in the country.

Accompanying this influx of investment is a surge in international visitors. Ho Chi Minh City welcomed nearly 3.1 million international arrivals in the first seven months of the year, reflecting a significant increase of over 30% from the previous year. This combination of growing FDI and a booming tourism sector is fueling the development of the city’s serviced apartment rental market.

Serviced apartments in Ho Chi Minh City are benefiting from the surge in FDI and international tourism. (Photo: D.V)

Mr. Hoang Van Tuan, a resident of Thu Duc City, owns three two-bedroom apartments in Vinhomes Grand Park, which he rents out for 10 million VND per month each. His tenants are mostly expatriates, including experts and senior executives from foreign companies who work in Ho Chi Minh City and frequently travel to nearby provinces like Dong Nai and Binh Duong. The majority of his tenants hail from China, South Korea, and India.

“I’ve noticed a rapid increase in the demand for serviced apartments over the past two years,” Mr. Tuan says. His apartments are particularly sought-after due to their modern amenities, cleanliness, and competitive pricing. Vinhomes Grand Park has become a popular destination for Chinese entrepreneurs and experts, contributing to a vibrant expatriate community within the complex.

Ms. Nguyen Hanh Van, a resident of District 1, shares a similar experience. She owns two two-bedroom apartments on Ngo Tat To Street in Binh Thanh District, generating a monthly income of 30-32 million VND per apartment. Ms. Van rents out her apartments on a daily basis, charging 2-2.5 million VND per day. Her tenants include both Vietnamese tourists and expatriates on business or training trips to the city.

“I’ve had more inquiries from foreign tenants this year and the year before,” she says. “They usually stay for 2-10 days for market research, contract signing, or work engagements with local branches of their companies. Our apartments offer spacious, high-end accommodations that can comfortably host 4-6 people, and our location is very convenient, just a stone’s throw from the city center.”

High-end serviced apartments cater to the needs of foreign experts and provide a range of amenities. (Photo: D.V)

FDI Influx Attracts Tenants to Ho Chi Minh City

Mr. Troy Griffiths, Deputy Executive Director of Savills Vietnam, attributes the growing demand for high-quality serviced apartments to the strong performance of FDI in Vietnam in recent years. “While FDI has slowed down a bit this year, if we look at the data from the past three years, we see a consistent influx of around $2-4 billion in new FDI registrations in Vietnam, mainly in power plants, liquefied gas, and energy,” he says. “The FDI outlook remains positive.”

Vietnam’s attractiveness to foreign investors lies in its competitive costs across various sectors. FDI has now shifted towards server rental services and supply chain optimization, particularly in the electronics industry, bringing greater benefits to the economy. As Mr. Griffiths points out, “The more foreign managers we have working here, the greater the demand for serviced apartments.”

Savills experts highlight the diverse nature of the serviced apartment market in Ho Chi Minh City compared to other locations, with a range of projects in the B and C segments. The city attracts tenants from various income levels and professional backgrounds, creating a unique dynamic in the serviced apartment market when compared to Hanoi.

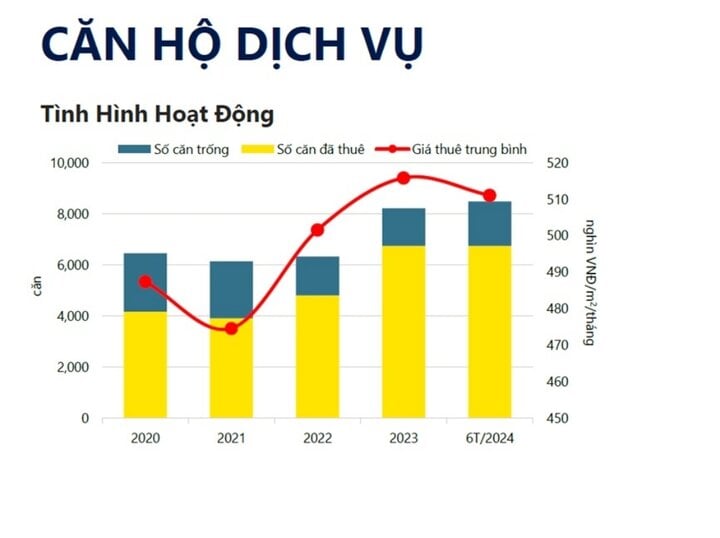

According to Mr. Griffiths, the COVID-19 pandemic and economic downturn led to a slight decrease in serviced apartment rental rates in Ho Chi Minh City, but the market is showing strong signs of recovery. This makes it an appealing real estate segment with stable operational performance.

Serviced apartments in Ho Chi Minh City are experiencing healthy occupancy rates with a steady upward trend over the years. (Photo: D.V)

Ms. Cao Thi Thanh Huong, Senior Manager of Research at Savills Ho Chi Minh City, notes that the primary tenants of serviced apartments are foreign experts working in industrial parks or companies in Ho Chi Minh City, Long An, Dong Nai, and Binh Duong. To optimize occupancy rates, projects offer a mix of long-term and short-term leases.

With a high demand for affordable accommodations, studios and one-bedroom apartments are the most popular choices. Over the past five years, Savills has recorded 1,849 apartments from 48 new B and C-class projects. Developers have focused on studios and one-bedroom apartments, accounting for 85% of the new supply.

According to Savills’ Q2 2024 market report, the supply reached 8,490 units, a 21% year-on-year increase. Future supply in Ho Chi Minh City is expected to be limited, with only five projects and approximately 500 units forecasted to enter the market by 2025. Of these, 63% will be located in District 1.

The Surprising Lending Speed of Ho Chi Minh City Banks

“Hanoi’s bank credit growth has yet to reach its expected breakthrough as businesses continue to face challenges. Despite this, there remains an air of cautious optimism within the city’s financial sector. With a resilient economy and a dynamic business landscape, the potential for a surge in credit growth is ever-present, and banks are poised to play a pivotal role in facilitating this anticipated upswing.”

The Ever-Changing Landscape of Ho Chi Minh City’s Ring Road 3: A Year of Transformation

After more than a year of construction, contractors are now mobilizing equipment, manpower, and resources to accelerate the progress of the Ring Road 3 project in Ho Chi Minh City.